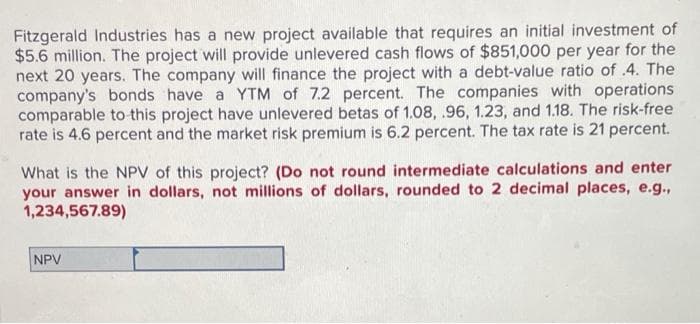

Fitzgerald Industries has a new project available that requires an initial investment of $5.6 million. The project will provide unlevered cash flows of $851,000 per year for the next 20 years. The company will finance the project with a debt-value ratio of 4. The company's bonds have a YTM of 7.2 percent. The companies with operations comparable to this project have unlevered betas of 1.08, .96, 1.23, and 1.18. The risk-free rate is 4.6 percent and the market risk premium is 6.2 percent. The tax rate is 21 percent. What is the NPV of this project? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89) NPV

Fitzgerald Industries has a new project available that requires an initial investment of $5.6 million. The project will provide unlevered cash flows of $851,000 per year for the next 20 years. The company will finance the project with a debt-value ratio of 4. The company's bonds have a YTM of 7.2 percent. The companies with operations comparable to this project have unlevered betas of 1.08, .96, 1.23, and 1.18. The risk-free rate is 4.6 percent and the market risk premium is 6.2 percent. The tax rate is 21 percent. What is the NPV of this project? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89) NPV

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter17: Long-term Investment Analysis

Section: Chapter Questions

Problem 2E

Related questions

Question

4

Transcribed Image Text:Fitzgerald Industries has a new project available that requires an initial investment of

$5.6 million. The project will provide unlevered cash flows of $851,000 per year for the

next 20 years. The company will finance the project with a debt-value ratio of .4. The

company's bonds have a YTM of 7.2 percent. The companies with operations

comparable to this project have unlevered betas of 1.08, .96, 1.23, and 1.18. The risk-free

rate is 4.6 percent and the market risk premium is 6.2 percent. The tax rate is 21 percent.

What is the NPV of this project? (Do not round intermediate calculations and enter

your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g.,

1,234,567.89)

NPV

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning