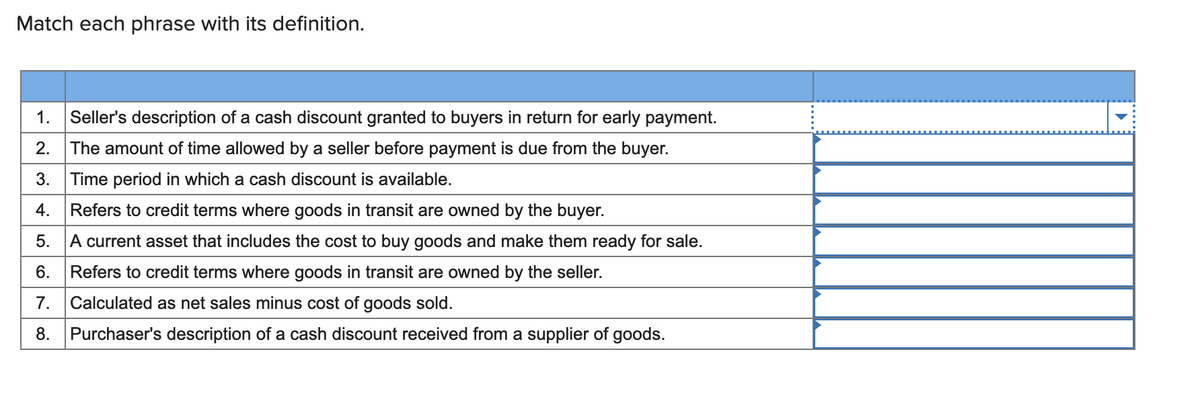

Match each phrase with its definition. 1. Seller's description of a cash discount granted to buyers in return for early payment. 2. The amount of time allowed by a seller before payment is due from the buyer. 3. Time period in which a cash discount is available. 4. Refers to credit terms where goods in transit are owned by the buyer. 5. A current asset that includes the cost to buy goods and make them ready for sale. 6. Refers to credit terms where goods in transit are owned by the seller. 7. Calculated as net sales minus cost of goods sold. 8. Purchaser's description of a cash discount received from a supplier of goods.

Match each phrase with its definition. 1. Seller's description of a cash discount granted to buyers in return for early payment. 2. The amount of time allowed by a seller before payment is due from the buyer. 3. Time period in which a cash discount is available. 4. Refers to credit terms where goods in transit are owned by the buyer. 5. A current asset that includes the cost to buy goods and make them ready for sale. 6. Refers to credit terms where goods in transit are owned by the seller. 7. Calculated as net sales minus cost of goods sold. 8. Purchaser's description of a cash discount received from a supplier of goods.

Chapter4: The Adjustment Process

Section: Chapter Questions

Problem 1EA: Identify whether each of the following transactions, which are related to revenue recognition, are...

Related questions

Topic Video

Question

Availabe Options Are:

Sales Discount

Credit Period

Discount Period

FOB Shipping Point

FOB Destination

Merchandise Inventory

Gross Profit

Purchases Discount

Transcribed Image Text:Match each phrase with its definition.

1.

Seller's description of a cash discount granted to buyers in return for early payment.

2.

The amount of time allowed by a seller before payment is due from the buyer.

3.

Time period in which a cash discount is available.

4. Refers to credit terms where goods in transit are owned by the buyer.

5. A current asset that includes the cost to buy goods and make them ready for sale.

6.

Refers to credit terms where goods in transit are owned by the seller.

7.

Calculated as net sales minus cost of goods sold.

8.

Purchaser's description of a cash discount received from a supplier of goods.

Expert Solution

Discount:

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,