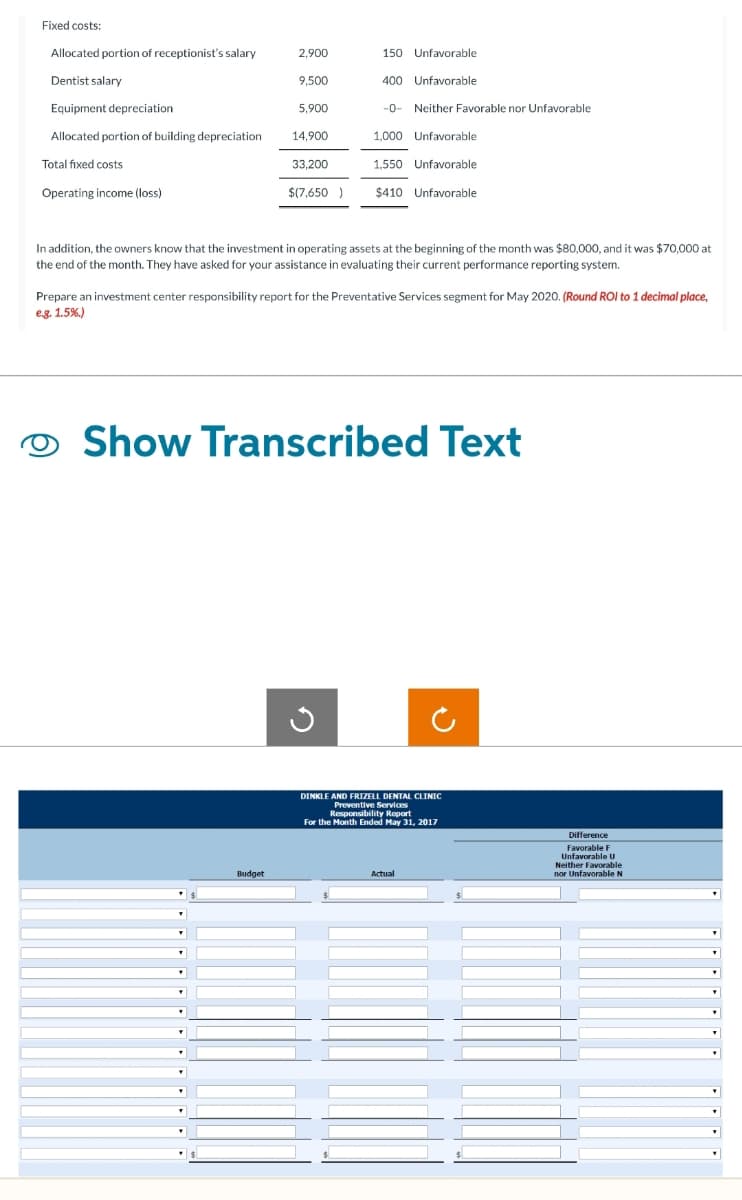

Fixed costs: Allocated portion of receptionist's salary Dentist salary Equipment depreciation. Allocated portion of building depreciation Total fixed costs Operating income (loss). T ▼ 2,900 T 9,500 ▾ 5,900 Budget 14,900 In addition, the owners know that the investment in operating assets at the beginning of the month was $80,000, and it was $70,000 at the end of the month. They have asked for your assistance in evaluating their current performance reporting system. 33,200 Prepare an investment center responsibility report for the Preventative Services segment for May 2020. (Round ROI to 1 decimal place, e.g. 1.5%.) $(7,650) Show Transcribed Text 150 Unfavorable 400 Unfavorable -0- Neither Favorable nor Unfavorable 1,000 Unfavorable 1.550 Unfavorable $410 Unfavorable G C DINKLE AND FRIZELL DENTAL CLINIC Preventive Services Responsibility Report For the Month Ended May 31, 2017 Actual Difference Favorable F Unfavorable U Neither Favorable. nor Unfavorable N ▼ ▾

Fixed costs: Allocated portion of receptionist's salary Dentist salary Equipment depreciation. Allocated portion of building depreciation Total fixed costs Operating income (loss). T ▼ 2,900 T 9,500 ▾ 5,900 Budget 14,900 In addition, the owners know that the investment in operating assets at the beginning of the month was $80,000, and it was $70,000 at the end of the month. They have asked for your assistance in evaluating their current performance reporting system. 33,200 Prepare an investment center responsibility report for the Preventative Services segment for May 2020. (Round ROI to 1 decimal place, e.g. 1.5%.) $(7,650) Show Transcribed Text 150 Unfavorable 400 Unfavorable -0- Neither Favorable nor Unfavorable 1,000 Unfavorable 1.550 Unfavorable $410 Unfavorable G C DINKLE AND FRIZELL DENTAL CLINIC Preventive Services Responsibility Report For the Month Ended May 31, 2017 Actual Difference Favorable F Unfavorable U Neither Favorable. nor Unfavorable N ▼ ▾

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter17: Activity Resource Usage Model And Tactical Decision Making

Section: Chapter Questions

Problem 6E: Elliott, Inc., has four salaried clerks to process purchase orders. Each clerk is paid a salary of...

Related questions

Question

Please do not give image format

Transcribed Image Text:Fixed costs:

Allocated portion of receptionist's salary

Dentist salary

Equipment depreciation

Allocated portion of building depreciation

Total fixed costs

Operating income (loss)

▼

▾

2,900

In addition, the owners know that the investment in operating assets at the beginning of the month was $80,000, and it was $70,000 at

the end of the month. They have asked for your assistance in evaluating their current performance reporting system.

T

9,500

Prepare an investment center responsibility report for the Preventative Services segment for May 2020. (Round ROI to 1 decimal place,

e.g. 1.5%.)

▾

5,900

Show Transcribed Text

Budget

14,900

33,200

$(7,650)

150 Unfavorable

400 Unfavorable

-0- Neither Favorable nor Unfavorable

1,000 Unfavorable

1.550 Unfavorable

$410 Unfavorable

G

DINKLE AND FRIZELL DENTAL CLINIC

Preventive Services

Responsibility Report

For the Month Ended May 31, 2017

Actual

Difference

Favorable F

Unfavorable U

Neither Favorable

nor Unfavorable N

▼

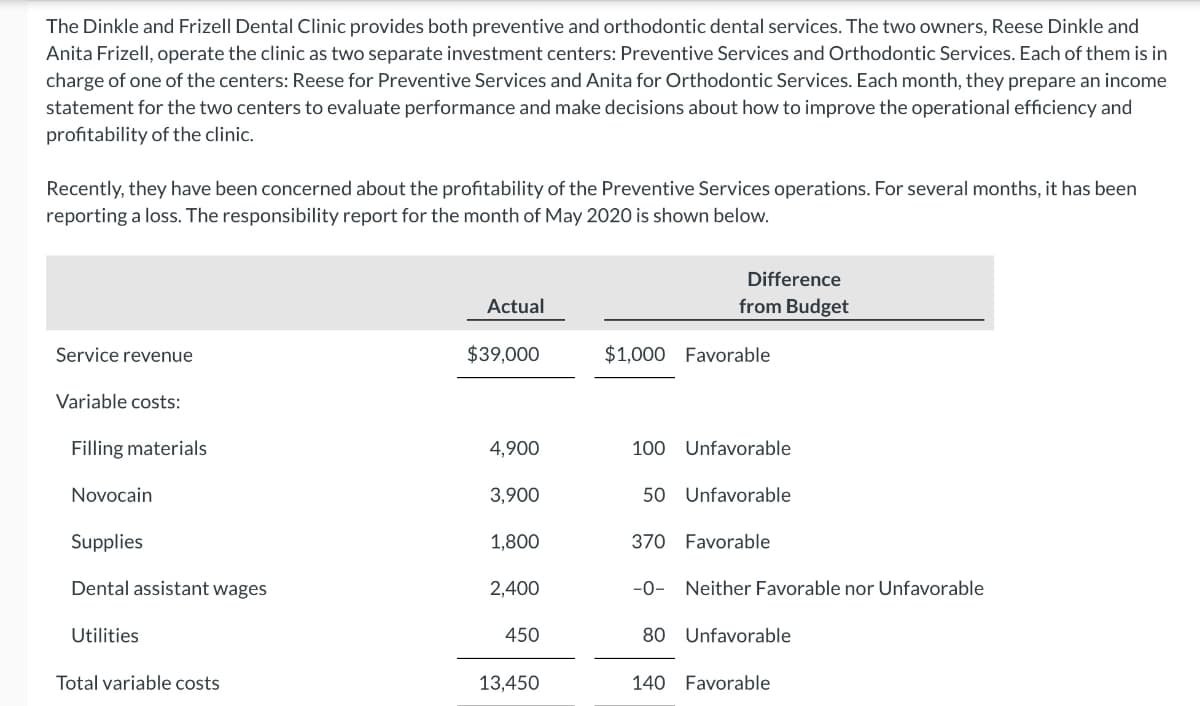

Transcribed Image Text:The Dinkle and Frizell Dental Clinic provides both preventive and orthodontic dental services. The two owners, Reese Dinkle and

Anita Frizell, operate the clinic as two separate investment centers: Preventive Services and Orthodontic Services. Each of them is in

charge of one of the centers: Reese for Preventive Services and Anita for Orthodontic Services. Each month, they prepare an income

statement for the two centers to evaluate performance and make decisions about how to improve the operational efficiency and

profitability of the clinic.

Recently, they have been concerned about the profitability of the Preventive Services operations. For several months, it has been

reporting a loss. The responsibility report for the month of May 2020 is shown below.

Service revenue

Variable costs:

Filling materials

Novocain

Supplies

Dental assistant wages

Utilities

Total variable costs

Actual

$39,000

4,900

3,900

1,800

2,400

450

13,450

Difference

from Budget

$1,000 Favorable

100 Unfavorable

50 Unfavorable

370 Favorable

-0- Neither Favorable nor Unfavorable

80 Unfavorable

140 Favorable

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning