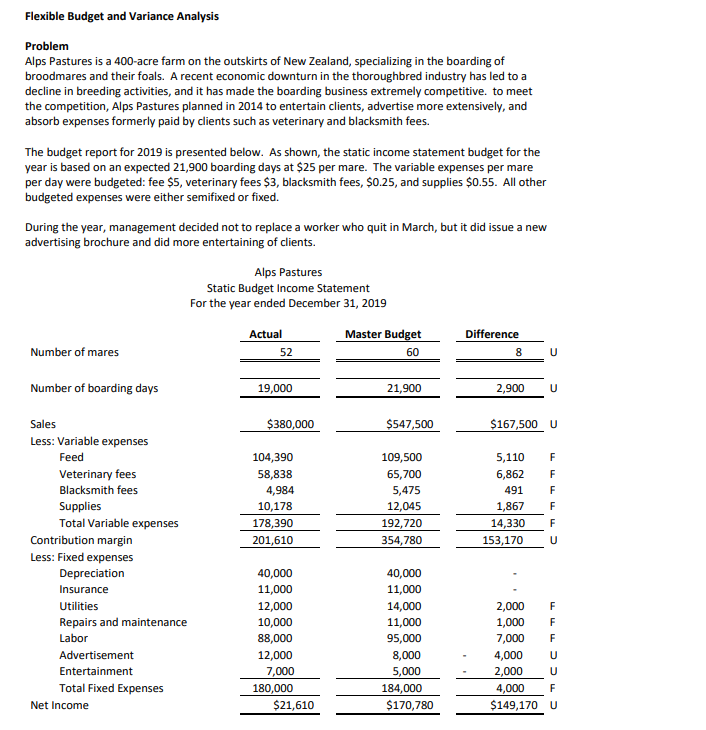

Flexible Budget and Variance Analysis Problem Alps Pastures is a 400-acre farm on the outskirts of New Zealand, specializing in the boarding of broodmares and their foals. A recent economic downturn in the thoroughbred industry has led to a decline in breeding activities, and it has made the boarding business extremely competitive. to meet the competition, Alps Pastures planned in 2014 to entertain clients, advertise more extensively, and absorb expenses formerly paid by clients such as veterinary and blacksmith fees. The budget report for 2019 is presented below. As shown, the static income statement budget for the year is based on an expected 21,900 boarding days at $25 per mare. The variable expenses per mare per day were budgeted: fee $5, veterinary fees $3, blacksmith fees, $0.25, and supplies $0.55. All other budgeted expenses were either semifixed or fixed. During the year, management decided not to replace a worker who quit in March, but it did issue a new advertising brochure and did more entertaining of clients. Alps Pastures Static Budget Income Statement For the year ended December 31, 2019 Actual Master Budget Difference Number of mares 52 60 Number of boarding days 19,000 21,900 2,900 U Sales $380,000 $547,500 $167,500 U Less: Variable expenses Feed 104,390 109,500 5,110 F Veterinary fees 58,838 65,700 5,475 12,045 192,720 354,780 6,862 F Blacksmith fees 4,984 491 F 10,178 178,390 201,610 Supplies 1,867 F Total Variable expenses 14,330 F Contribution margin 153,170 Less: Fixed expenses Depreciation 40,000 40,000 Insurance 11,000 11,000 2,000 1,000 7,000 Utilities 12,000 14,000 F 11,000 95,000 Repairs and maintenance 10,000 F Labor 88,000 F 12,000 7,000 Advertisement 8,000 5,000 4,000 2,000 Entertainment Total Fixed Expenses 180,000 184,000 4,000 F Net Income $21,610 $170,780 $149,170 U

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Prepare a flexible budget report for the year

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images