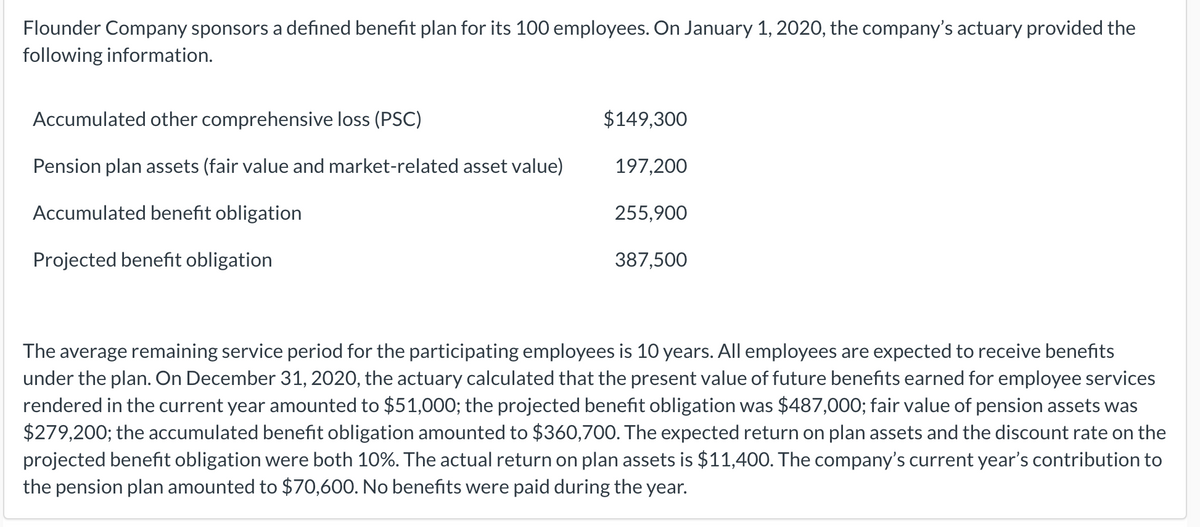

Flounder Company sponsors a defined benefit plan for its 100 employees. On January 1, 2020, the company's actuary provided the following information. Accumulated other comprehensive loss (PSC) $149,300 Pension plan assets (fair value and market-related asset value) 197,200 Accumulated benefit obligation 255,900 Projected benefit obligation 387,500 The average remaining service period for the participating employees is 10 years. All employees are expected to receive benefits under the plan. On December 31, 2020, the actuary calculated that the present value of future benefits earned for employee services rendered in the current year amounted to $51,000; the projected benefit obligation was $487,000; fair value of pension assets was $279,200; the accumulated benefit obligation amounted to $360,700. The expected return on plan assets and the discount rate on the projected benefit obligation were both 10%. The actual return on plan assets is $11,400. The company's current year's contribution to the pension plan amounted to $70,600. No benefits were paid during the year.

Flounder Company sponsors a defined benefit plan for its 100 employees. On January 1, 2020, the company's actuary provided the following information. Accumulated other comprehensive loss (PSC) $149,300 Pension plan assets (fair value and market-related asset value) 197,200 Accumulated benefit obligation 255,900 Projected benefit obligation 387,500 The average remaining service period for the participating employees is 10 years. All employees are expected to receive benefits under the plan. On December 31, 2020, the actuary calculated that the present value of future benefits earned for employee services rendered in the current year amounted to $51,000; the projected benefit obligation was $487,000; fair value of pension assets was $279,200; the accumulated benefit obligation amounted to $360,700. The expected return on plan assets and the discount rate on the projected benefit obligation were both 10%. The actual return on plan assets is $11,400. The company's current year's contribution to the pension plan amounted to $70,600. No benefits were paid during the year.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter19: Accounting For Post Retirement Benefits

Section: Chapter Questions

Problem 6RE

Related questions

Question

Transcribed Image Text:Flounder Company sponsors a defined benefit plan for its 100 employees. On January 1, 2020, the company's actuary provided the

following information.

Accumulated other comprehensive loss (PSC)

$149,300

Pension plan assets (fair value and market-related asset value)

197,200

Accumulated benefit obligation

255,900

Projected benefit obligation

387,500

The average remaining service period for the participating employees is 10 years. All employees are expected to receive benefits

under the plan. On December 31, 2020, the actuary calculated that the present value of future benefits earned for employee services

rendered in the current year amounted to $51,000; the projected benefit obligation was $487,000; fair value of pension assets was

$279,200; the accumulated benefit obligation amounted to $360,700. The expected return on plan assets and the discount rate on the

projected benefit obligation were both 10%. The actual return on plan assets is $11,400. The company's current year's contribution to

the pension plan amounted to $70,600. No benefits were paid during the year.

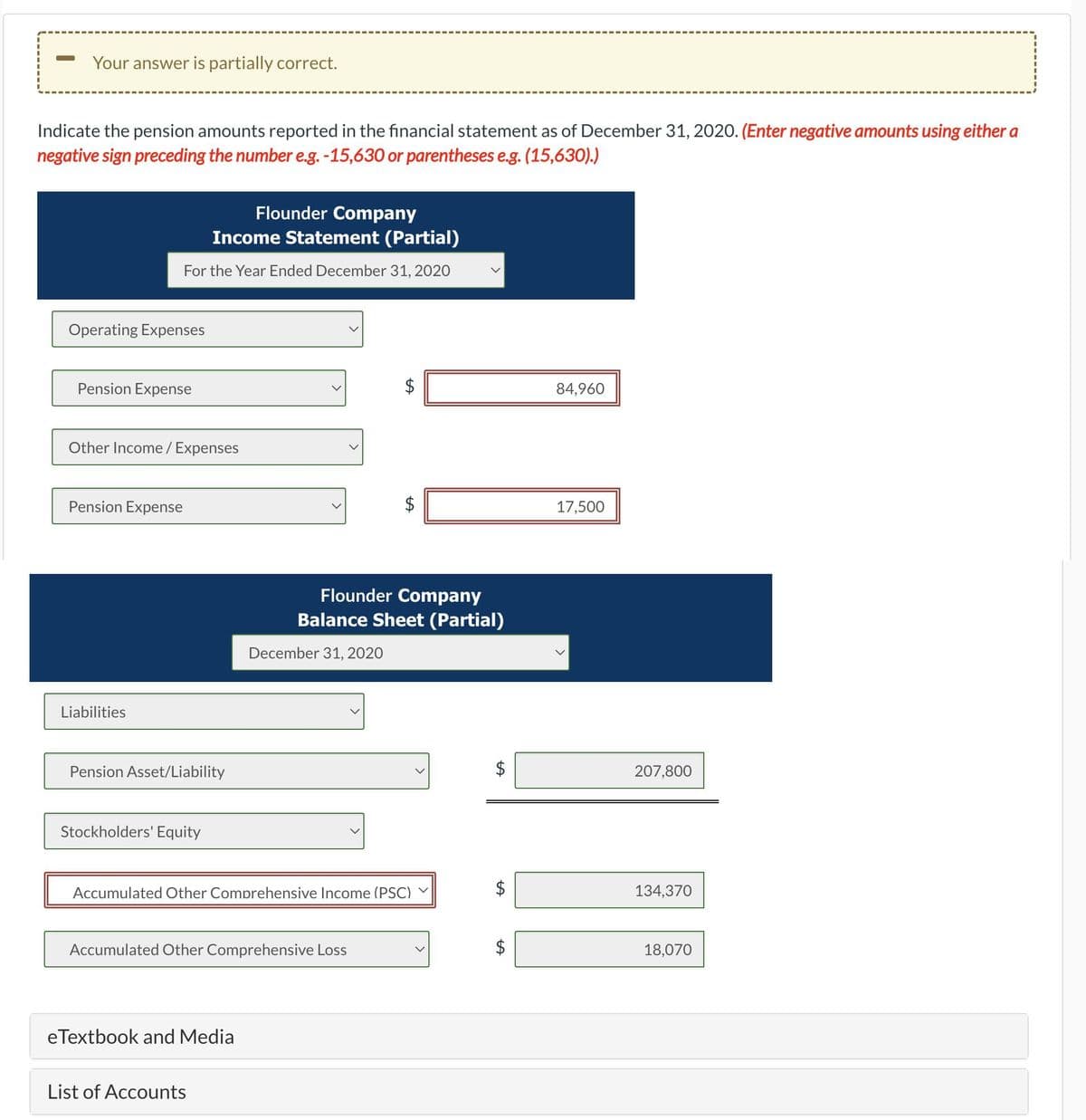

Transcribed Image Text:Your answer is partially correct.

Indicate the pension amounts reported in the financial statement as of December 31, 2020. (Enter negative amounts using either a

negative sign preceding the number e.g. -15,630 or parentheses e.g. (15,630).)

Flounder Company

Income Statement (Partial)

For the Year Ended December 31, 2020

Operating Expenses

Pension Expense

84,960

Other Income / Expenses

Pension Expense

17,500

Flounder Company

Balance Sheet (Partial)

December 31, 2020

Liabilities

Pension Asset/Liability

207,800

Stockholders' Equity

Accumulated Other Comprehensive Income (PSC) V

134,370

Accumulated Other Comprehensive Loss

18,070

eTextbook and Media

List of Accounts

%24

%24

%24

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT