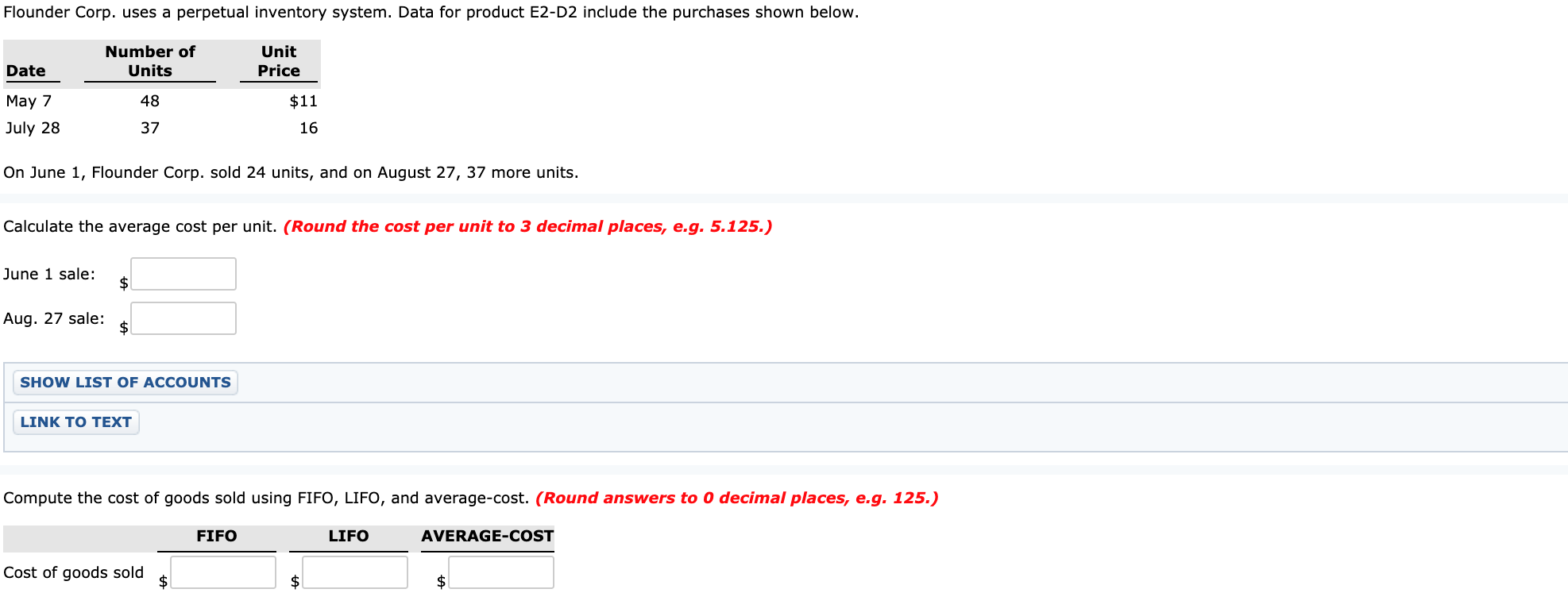

Flounder Corp. uses a perpetual inventory system. Data for product E2-D2 include the purchases shown below. Number of Unit Date Units Price May 7 48 $11 July 28 37 16 On June 1, Flounder Corp. sold 24 units, and on August 27, 37 more units. Calculate the average cost per unit. (Round the cost per unit to 3 decimal places, e.g. 5.125.) June 1 sale: $ Aug. 27 sale: $4 SHOW LIST OF ACCOUNTS LINK TO TEXT Compute the cost of goods sold using FIFO, LIFO, and average-cost. (Round answers to 0 decimal places, e.g. 125.) FIFO LIFO AVERAGE-COST Cost of goods sold $ $4 $1

Flounder Corp. uses a perpetual inventory system. Data for product E2-D2 include the purchases shown below. Number of Unit Date Units Price May 7 48 $11 July 28 37 16 On June 1, Flounder Corp. sold 24 units, and on August 27, 37 more units. Calculate the average cost per unit. (Round the cost per unit to 3 decimal places, e.g. 5.125.) June 1 sale: $ Aug. 27 sale: $4 SHOW LIST OF ACCOUNTS LINK TO TEXT Compute the cost of goods sold using FIFO, LIFO, and average-cost. (Round answers to 0 decimal places, e.g. 125.) FIFO LIFO AVERAGE-COST Cost of goods sold $ $4 $1

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 12RE: Carla Company uses the perpetual inventory system. The following information is available for...

Related questions

Question

Practice Pack

Transcribed Image Text:Flounder Corp. uses a perpetual inventory system. Data for product E2-D2 include the purchases shown below.

Number of

Unit

Date

Units

Price

May 7

48

$11

July 28

37

16

On June 1, Flounder Corp. sold 24 units, and on August 27, 37 more units.

Calculate the average cost per unit. (Round the cost per unit to 3 decimal places, e.g. 5.125.)

June 1 sale:

$

Aug. 27 sale:

$4

SHOW LIST OF ACCOUNTS

LINK TO TEXT

Compute the cost of goods sold using FIFO, LIFO, and average-cost. (Round answers to 0 decimal places, e.g. 125.)

FIFO

LIFO

AVERAGE-COST

Cost of goods sold

$

$4

$1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Includes step-by-step video

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub