GO has a security service business and completed the following transactions ing October 2021: ober 1 DOGGO Inc. transferred cash from a personal account to an account to be used for the business, P243,000. 3 DOGGO Inc. invested in the business personal weapons having a fair market value of P34,000. 4 Bought communication equipment on account from Pesa Electronics, P13,740. 5 Paid rent for the month, P7,650. 6 Bought a used service vehicle car for P93,000, paying P45,000 down, with the balance due in thirty days. 9 Received invoice and paid insurance premium to Cacawa Fidelity Company for bonding employees, P7,710. 12 Performed security services for Loreta Galleries. Billed Loreta for services rendered, P8,250. 16 Received bill from Marcos Printers for office stationery, P1,757 17 Billed Pascua Construction for services rendered, P14,790.

GO has a security service business and completed the following transactions ing October 2021: ober 1 DOGGO Inc. transferred cash from a personal account to an account to be used for the business, P243,000. 3 DOGGO Inc. invested in the business personal weapons having a fair market value of P34,000. 4 Bought communication equipment on account from Pesa Electronics, P13,740. 5 Paid rent for the month, P7,650. 6 Bought a used service vehicle car for P93,000, paying P45,000 down, with the balance due in thirty days. 9 Received invoice and paid insurance premium to Cacawa Fidelity Company for bonding employees, P7,710. 12 Performed security services for Loreta Galleries. Billed Loreta for services rendered, P8,250. 16 Received bill from Marcos Printers for office stationery, P1,757 17 Billed Pascua Construction for services rendered, P14,790.

Chapter8: Fraud, Internal Controls, And Cash

Section: Chapter Questions

Problem 3PA: Domingo Company started its business on January 1, 2019. The following transactions occurred during...

Related questions

Question

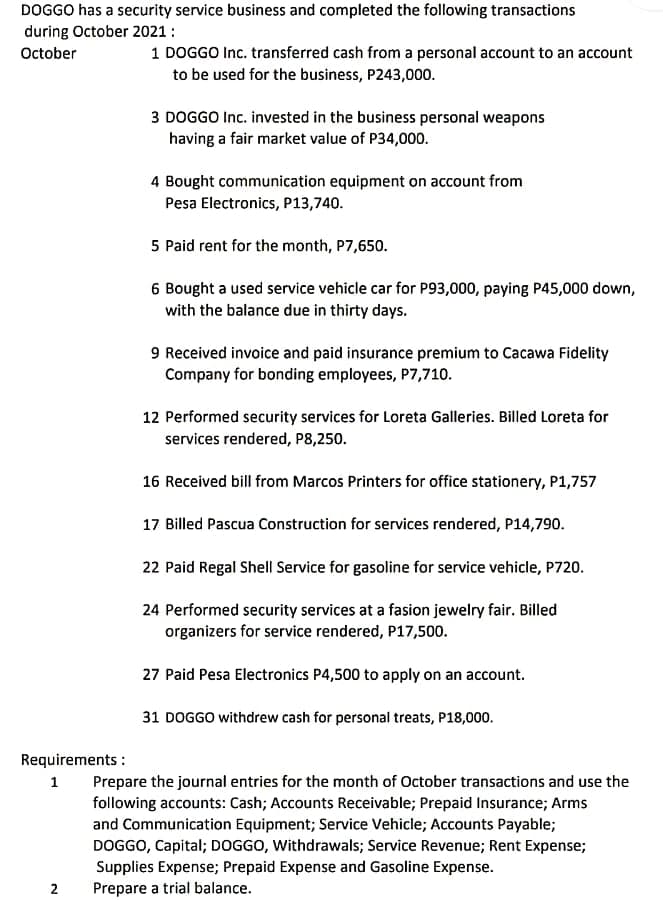

Transcribed Image Text:DOGGO has a security service business and completed the following transactions

during October 2021 :

October

1 DOGGO Inc. transferred cash from a personal account to an account

to be used for the business, P243,000.

3 DOGGO Inc. invested in the business personal weapons

having a fair market value of P34,000.

4 Bought communication equipment on account from

Pesa Electronics, P13,740.

5 Paid rent for the month, P7,650.

6 Bought a used service vehicle car for P93,000, paying P45,000 down,

with the balance due in thirty days.

9 Received invoice and paid insurance premium to Cacawa Fidelity

Company for bonding employees, P7,710.

12 Performed security services for Loreta Galleries. Billed Loreta for

services rendered, P8,250.

16 Received bill from Marcos Printers for office stationery, P1,757

17 Billed Pascua Construction for services rendered, P14,790.

22 Paid Regal Shell Service for gasoline for service vehicle, P720.

24 Performed security services at a fasion jewelry fair. Billed

organizers for service rendered, P17,500.

27 Paid Pesa Electronics P4,500 to apply on an account.

31 DOGGO withdrew cash for personal treats, P18,000.

Requirements :

Prepare the journal entries for the month of October transactions and use the

following accounts: Cash; Accounts Receivable; Prepaid Insurance; Arms

and Communication Equipment; Service Vehicle; Accounts Payable;

DOGGO, Capital; DOGGO, Withdrawals; Service Revenue; Rent Expense;

1

Supplies Expense; Prepaid Expense and Gasoline Expense.

2

Prepare a trial balance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub