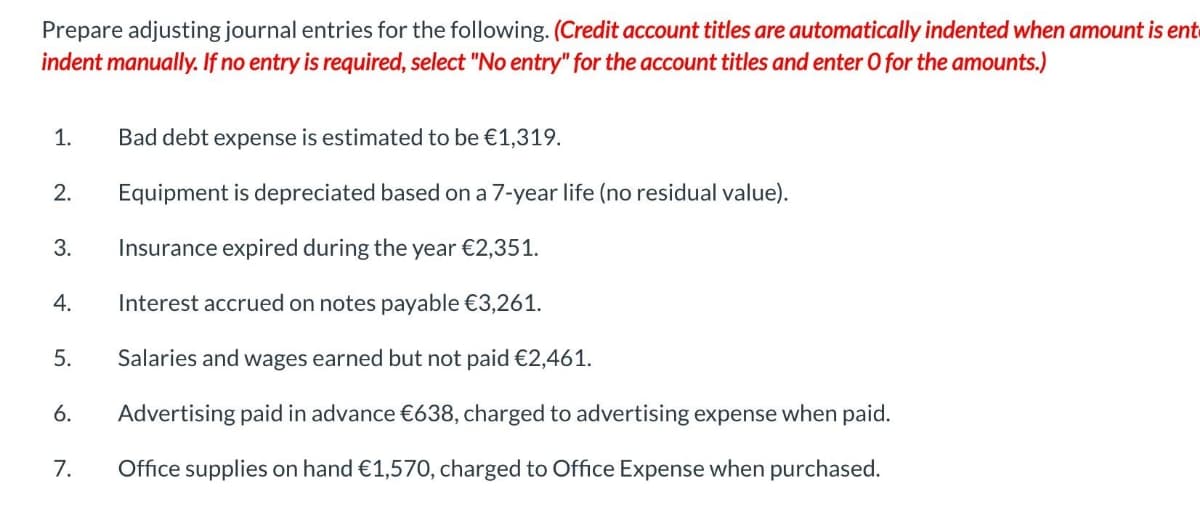

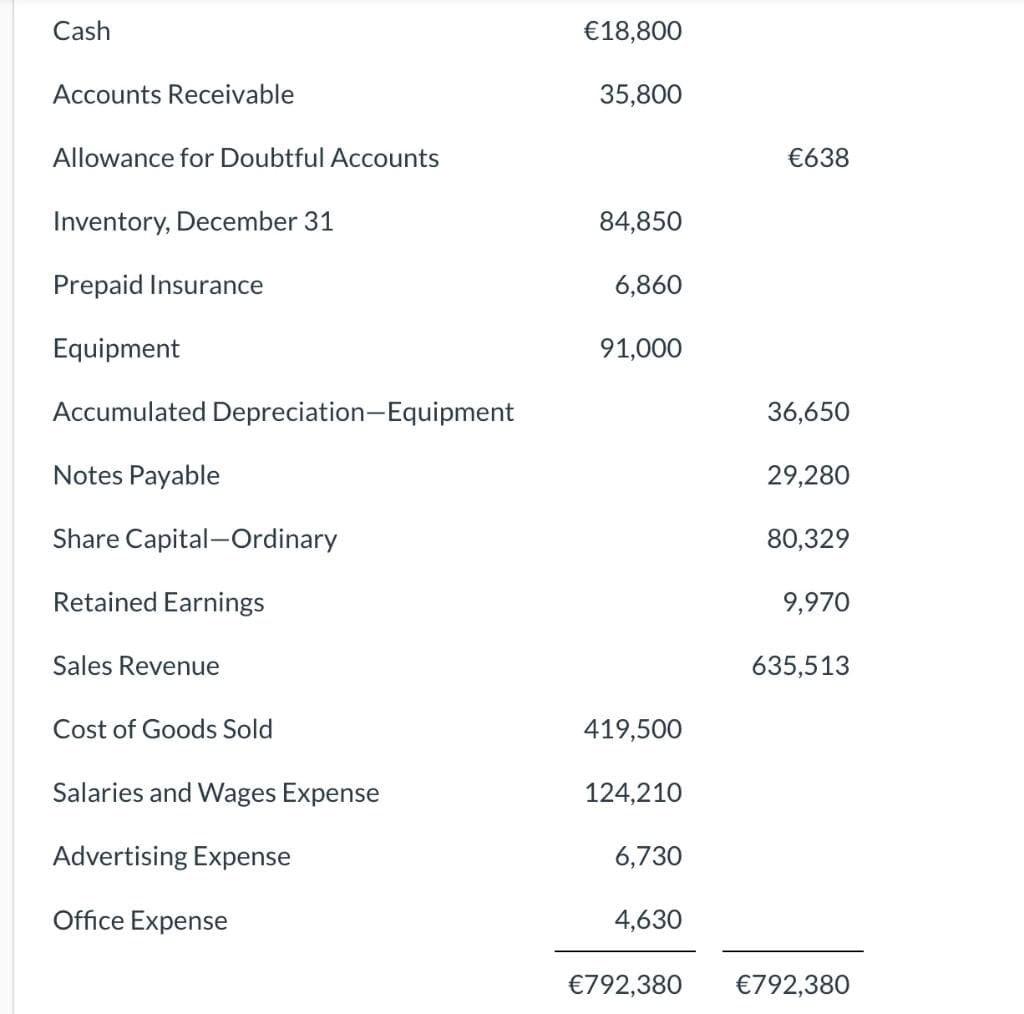

föllowing. repare adjus unof au

Q: 17. Lynx Oil Company, a successful efforts company, had the following costs as of December 31, 2018 ...

A: Here asked about he abandonment of lease of property which are involved in the oil company and its d...

Q: The use of standard costs in pricing and budgeting is quite valuable since decisions in the fields ...

A: Standard cost is the cost which is predetermined and which is expected to be incurred during the yea...

Q: P company bought 60% of common stock of S company on January 1, 20x4. On January 1 20x5, there was a...

A: Net income is also referred to as net earnings. Net income means deducting all the expenses (Costs) ...

Q: On January 1, 2020, Shell Corporation acquired the net assets of Petron Inc. The acquirer transferre...

A: 1. Value of contingent consideration shall be the additional pay of P 1500000 which would be paid if...

Q: 18. How much is the income of Tours4fun after taking into account all transactions? O 14,800 O 15,80...

A: Journal means the book of prime entry where all entries are recorded in different pages. Ledger mean...

Q: Cullumber Bikes could sell its bicycles to retailers either assembled or unassembled. The cost of an...

A: Net Income per unit = Sales per unit - Total cost per unit Total cost per unit includes : Direct ma...

Q: to conduct a marg inal cos nefits of the proposed ne

A: Answers a,b and c:

Q: The Dec. 31, 2016, statement of financial position of Leon Company showed Accounts Receivable of P50...

A: Bad debts are also known as doubtful debts. The bad debts expenses estimated for a particular period...

Q: a. Calculate the firm's tax liability.

A: A firm's tax liability refers to the total amount of tax debt owed by corporation to a government. U...

Q: n 2021, the Westgate Construction Company entered into a contract to construct a road for Santa Clar...

A: As per the guidelines we can solve the 3 parts of any question (first 3 ). so answer for remaining p...

Q: On December 31, 20--, Karmansky Company needed to record its accrued wages for year-end. If December...

A: Accrued salaries expense = Gross pay x no. of days accrued / 5 day week Accrued salaries payable = ...

Q: Manny hired his brothers firm to provide accounting services to his business. During the $83,000 for...

A: Ordinary business expenses are not for personal use they are only incurred for business use. These e...

Q: In financial analysis there is a possibility that business opportunities for growth will be uncovere...

A: Financial analysis is the analysis of the business in order to assess the profitability, stability o...

Q: Frito-Lay, Inc., manufactures snack foods. Production of Doritos occurs in four steps: cleaning, mix...

A: The question is based on the Cost Accounting.

Q: QUESTION 5 French Confection, Inc., allocates overhead using direct labor hours as the allocation ac...

A: Lets understand the basics. In traditional costing basis, overhead is allocated using the labor hour...

Q: A resident citizen taxpayer sold share of stock of a domestic corporation directly to the buyer at i...

A: Capital gain = Sales amount of shares - Cost of shares sold Capital gain tax = Capital gain * Tax r...

Q: Case 2: Non-Controlling Interest measured at fair value Inahan Co. elects the option to measure the ...

A: 1. Inahan Co. acquires 75% interest in Bunso, Inc and holds no previous interest in Bunso, Inc , So,...

Q: TABLE 13-2 Present value of an annuity of $1 Period 2% 3% 5% 6% 7% 8% 9% 10% 11% 12% 13% 1. 0.9804 0...

A: Value of different alternate offers is examined on basis of concept of time value of money and annui...

Q: Interest versus dividend expense Derwent Ltd., has announced that the eamings before income and taxe...

A: Income statement means the statement which show the cost of goods sold and selling price and give ou...

Q: Chapter 3 Activity – Taxes Individual Income Tax Brackets (2021) Marginal Tax Rate Single, t...

A: Introduction: Individual gross income (sometimes known as gross pay on a paycheck) is a person's ent...

Q: A Company plans on an expansion project that would initially cost $750,000 and a salvage value of $1...

A: A) Yearly Total Cash flows Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Cos...

Q: Cozy Corporation purchased supplies at a cost of S24,000 during the current year. At January 1, supp...

A: Supplies expense= Opening supplies + purchases- closing supplies

Q: The Intra-company basis compares data ______ that are often useful to detect changes in financial re...

A: Solution Intra company transactions involves different subsidiaries within a single legal entity , s...

Q: Peters operated at 80% of capacity during the year but applied factory overhead based on the 90% cap...

A: Overhead amount of cost is the cost which is incurred by the company in order to make the product wh...

Q: A. What are the total expected cash collections for the year under revised budget ? B. What is the ...

A: The expected cash collection for a quarter shall consist of 75% of current quarter sales and 25% of ...

Q: Treasury bills are currently paying 4.6 percent and the inflation rate is 1.9 percent. What is the r...

A: Bonds are priced by discounting future cash flows. Future cash flows include coupons and par value o...

Q: Bonita Clothiers is a small company that manufactures tall-men's suits. The company has used a stand...

A:

Q: Case Study– Requirements. Speedy Burger is a small regional hamburger chain that has 10 stores in Or...

A: A cost-benefit analysis would be performed when a firm owner, a management consultant, or a person p...

Q: 1. When posting all transactions to the ledgers, the cash account will show a total amount in the cr...

A: Transaction- A business transaction is a monetary exchange of products or services. Purchase of item...

Q: P company bought 60% of common stock of S company on January 1, 20x4. On January 1 20x5, there was a...

A: It is an intercompany transaction, in which the flow of transaction will be from parent to subsidiar...

Q: Case 3: Non-Controlling Interest measured at proportionate share in net assets Inahan Co. elects the...

A: 1. Transaction cost incurred fair value of land - book value of land = P1000000 - P 7500000 = P 250...

Q: On July 1, 2021, Whiskey Company had an equipment with cost of P5,000,000 and accumulated depreciati...

A: The correct answer for the above mentioned question is given in the following steps for your referen...

Q: Explain the auditor legal liability, this includes what law that procure such liability?

A: An auditor is expected to complete their tasks in good faith and with integrity and should operate e...

Q: Grand Canyon Toy Company manufactures talking toy Christmas kitten in four sequential processes. Th...

A: The question is based on the concept of Cost Accounting.

Q: Prepare the cash flows from operating activities section of Sarasota’s 2020 statement of cash flows ...

A: 1. Increase in Accounts Receivables of $13000 will be subtracted from Cash Flow from Operating Activ...

Q: On January 1, Year 5, Pic Company acquired 7,500 ordinary shares of Sic Company for $726,000. On Jan...

A: Consolidated profit is the combined profits of either all the divisions of the firm or all the subsi...

Q: At the start of the current year, Violet Company held 30% of ABC Company’s 150,000 outstanding share...

A: From ABC Company DEF Company No of share held by Violet 45,000 10,000 ...

Q: ABC Corporation’s liability account balances at June 30, 2018, included a 10% notes payable in the a...

A: What amount should be recorded as accrued interest for this note:- Accrued interest:- = outsta...

Q: Russia Company provided the following information on December 31, 2021: Jan. 15, 2022 - P3,000,000 o...

A: A company prepares its financial statements showing profitability...

Q: Naomi uses the filing status of Single for 2021. Her taxable income is $612.353, which includes $25,...

A: Question 1 For 2021 When single tax payers As total taxalable income is Then qualified dividend ta...

Q: Activity 1- ACCHT 221 - RECORDING TRANSACTIONS ; POSTING TO LEDGER AND PREPARATION OF TRIAL BALANCI ...

A: Solution Ledger is an account or record used to store bookkeeping entries for balance sheet and inco...

Q: On April 5, 2019, Janeen Camoct took out an 7.75% loan for $22,000. The loan is due March 9, 2020. U...

A: Interest refers to the amount of return that is received by the lender by borrowing a sum to the bor...

Q: Freedom Corporation acquired a fixed asset for $100,000. Its estimated life at time of purchase was ...

A: Part 1 Incremental present value of the tax benefits resulting from calculating depreciation using...

Q: Sako Company’s Audio Division produces a speaker that is used by manufacturers of various audio prod...

A: Transfer price means the price at which goods are transfer from one division to another Minimum Tran...

Q: Dibiasky Corporation is a trading company based in Laguna. The auditor in charge for 2020 audit is e...

A: Question No.1 states that the balance in the company’s accounts payable account as of December 31, 2...

Q: before-tax yearly income of $203,000 and has no debt outstanding. Expanding Hemingway Corporation is...

A: The formula to calculate tax liability is - Tax liability = EBT * Tax rate where, EBT is Earning bef...

Q: Feather Friends, Incorporated, distributes a high-quality wooden birdhouse that sells for $20 per un...

A: Formula: Contribution Margin ratio = Contribution margin / sales

Q: Frank Moran manages the cutting department of Greene Timber Company. He purchased a tree-cutting mac...

A: Income statement refers to the financial statement which shows the financial performance for an acco...

Q: n's net profit for the past year using the accrual basis of accounting. 's net cash flow for the pas...

A: Net Profit = Sales Revenue - Cost of goods sold.

Q: The total assets and the total liabilities of Paragon Services are shown below. During the year, no ...

A: Lets understand the basics. For calculate the drawings, we need to use below formula. Drawings = (Be...

Step by step

Solved in 2 steps

- 1. Compute the current assets.Cash Php 25,867.00Barney’s drawing 50,485.00Accounts Payable 78,584.00Notes Receivable 45,051.00Building 1,500,125.00Inventory 33,669.002. Compute the Net Income.Service Income Php 356,867.00Prepaid Rent 16,800.00Interest Expense 1,523.00Barney’s drawing 21,786.00Taxes 4,544.00Utilities Expense 3,651.003. The liabilities of Bb Barn are equal to 1/3 of thetotal assets. The owner's equity is P 6,300,500. Whatis the amount of the liabilities?4. Prepare journal entries to the following transactionsfor the year 2020.Sept. 1 V Barney invested Php 150,000 in Barney repair ShopSept 3 Purchased equipment worth Php 80,000 on account.Sept. 12 Paid Php 25, 000 for the equipmentpurchased dated Sept. 3, 2020.Sept. 15 Rendered service amounting toPhp 45,000.Sept. 17 Paid salaries to employees, Php16,000ShafNita Sdn. Bhd. Statement of Financial Position as at 31 December2019 2020RM RM RM RM Non Current AssetsBuilding 100,000 100,000Fixtures less accumulated depreciation 3,600 4,000Van less accumulated depreciation 7,840 14,800111,440 118,800 Current AssetInventory 11,200 24,800Trade account receivable 12,800 16,400Bank 1,800 -Cash 440 400 26,240 41,600Total assets 137,680 160,400Finance by:Capital account:Balance at 1 January 74,080 105,080Add: Net profit for the year 70,400 42,320Cash introduced - 20,000144,480 167,400Less: Drawings (39,400) (43,200)105,080 124,200 Non Current LiabilitiesLoan (repayable in 10 years time) 20,000 30,000Current LiablitiesAccount Payable 12,600 6,012Bank overdraft - 188Retained earnings 32,600 36,200Total liabilities and equity 137,680 160,400 Additional information at 31 December 2020: Fixtures bought in 2020 cost RM800. Van bought in 2020 cost RM11,000. Required: Prepare statement of cash flow for ShafNita Sdn. Bhd. for the year ended 31 December…is: Dec. 31, 20Y9 Dec. 31, 20Y8 Assets Cash $70,720 $47,940 Accounts receivable (net) 207,230 188,190 Inventories 298,520 289,850 Investments 0 102,000 Land 295,800 0 Equipment 438,600 358,020 Accumulated depreciation—equipment (99,110) (84,320) Total assets $1,211,760 $901,680 Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) $205,700 $194,140 Accrued expenses payable (operating expenses) 30,600 26,860 Dividends payable 25,500 20,400 Common stock, $1 par 202,000 102,000 Paid-in capital: Excess of issue price over par—common stock 354,000 204,000 Retained earnings 393,960 354,280 Total liabilities and stockholders' equity $1,211,760 $901,680 The income statement for the year ended December 31, 20Y9, is as follows: Sales $2,023,898 Cost of goods sold 1,245,476 Gross profit $778,422 Operating…

- Determine the missing amount: cash$239,186;short term investment$353,700;acct receiv$504,944;inventory? Prepaid exp$83,259;total current asset$1,594927; property&equipment? what is the inventory amount and property& equipment amount?Metal tech Cash Account 31.12.2020 RS RS Balance B/D50Payment to suppliers2000 Equity share300Purchase of fixed asset200 Receipts from customer2800Overhead expenses200 Sale of fixed asset100Wages & Salaries100 Tax250 Dividend50 Repayment of loan300 Balance C/D150 3250 3250 Prepare a cash flow account for metal tech ending on 31.12.2020.21.. Your answer is incorrect. Riverbed Corp. uses the direct method to prepare its statement of cash flows. Riverbed trial balances at December 31, 2020 and 2019, are as follows. December 31 Debits 2020 2019 Cash $34,800 $32,300 Accounts receivable 32,800 29,800 Inventory 30,900 47,000 Property, plant, & equipment 100,800 95,900 Unamortized bond discount 4,600 5,100 Cost of goods sold 252,100 378,200 Selling expenses 142,700 172,900 General and administrative expenses 136,800 152,300 Interest expense 4,300 2,600 Income tax expense 20,400 60,600 $760,200 $976,700 Credits Allowance for doubtful accounts $1,300 $1,100 Accumulated depreciation—plant assets 16,600 15,100 Accounts payable 25,300 15,600 Income taxes payable 21,000 29,000 Deferred tax liability 5,200 4,500 8%…

- Use the below information to answer the following questions: 20202021Sales$11,573$12,936Depreciation 1661 1736Cost of goods sold 3979 4707Other Expenses 846 924Interest Expense 776 926Cash 6067 6466Accounts Receivables 8034 9427Short-term Notes Payable 1171 1147Long-term debt 20,320 24,696Net fixed assets 50,888 54,273Accounts Payable 4384 4644Tax rate 26% 34%Inventory 14,283 15,288Payout ratio 33% 30% A. Create the Balance Sheets for 2020 & 2021.Use the below information to answer the following questions: 20202021Sales$11,573$12,936Depreciation 1661 1736Cost of goods sold 3979 4707Other Expenses 846 924Interest Expense 776 926Cash 6067 6466Accounts Receivables 8034 9427Short-term Notes Payable 1171 1147Long-term debt 20,320 24,696Net fixed assets 50,888 54,273Accounts Payable 4384 4644Tax rate 26% 34%Inventory 14,283 15,288Payout ratio 33% 30% A. Create the Income Statements for 2020 and 2021 (including dividends paid and retained earnings).Assets Cash $ 58,900 $ 79,500 Accounts receivable 74,830 56,625 Inventory 284,656 257,800 Prepaid expenses 1,270 2,015 Total current assets 419,656 395,940 Equipment 151,500 114,000 Accum. depreciation—Equipment (39,625 ) (49,000 ) Total assets $ 531,531 $ 460,940 Liabilities and Equity Accounts payable $ 59,141 $ 123,675 Short-term notes payable 11,800 7,200 Total current liabilities 70,941 130,875 Long-term notes payable 62,000 54,750 Total liabilities 132,941 185,625 Equity Common stock, $5 par value 171,750 156,250 Paid-in capital in excess of par, common stock 46,500 0 Retained earnings 180,340 119,065 Total…

- Assets Cash $ 58,900 $ 79,500 Accounts receivable 74,830 56,625 Inventory 284,656 257,800 Prepaid expenses 1,270 2,015 Total current assets 419,656 395,940 Equipment 151,500 114,000 Accum. depreciation—Equipment (39,625 ) (49,000 ) Total assets $ 531,531 $ 460,940 Liabilities and Equity Accounts payable $ 59,141 $ 123,675 Short-term notes payable 11,800 7,200 Total current liabilities 70,941 130,875 Long-term notes payable 62,000 54,750 Total liabilities 132,941 185,625 Equity Common stock, $5 par value 171,750 156,250 Paid-in capital in excess of par, common stock 46,500 0 Retained earnings 180,340 119,065 Total…What are the spontaneous liabilities on this balance sheet? Cash $ 174.90 $ 201.14 Accounts receivable $ 741.80 $ 853.07 Inventory $ 1,366.40 $ 1,571.36 Other current assets $ 174.10 $ 200.22 Total current assets $ 2,457.20 $ 2,825.78 Net plant and equipment $ 1,266.40 $ 1,456.36 Other long-term assets $ 76.30 $ 87.75 Total assets $ 3,799.90 $ 4,369.89 Accounts payable $ 192.80 $ 221.72 Accrued expenses $ 348.90 $ 401.24 Short-term debt $…Eastwood CompanyAdjusted Trial BalanceDecember 31, 2020 Debit Credit Cash $ 41,000 Accounts Receivable 163,500 Allowance for Doubtful Accounts $ 8,700 Prepaid Insurance 5,900 Inventory 208,500 Equity Investments (long-term) 339,000 Land 85,000 Construction in Process (building) 124,000 Patents 36,000 Equipment 400,000 Accumulated Depreciation—Equipment 240,000 Discount on Bonds Payable 20,000 Accounts Payable 148,000 Accrued Liabilities 49,200 Notes Payable 94,000 Bonds Payable 200,000 Common Stock 500,000 Paid-in Capital in Excess of Par—Common Stock 45,000 Retained Earnings 138,000 $1,422,900 $1,422,900 Additional information: 1. The LIFO method of inventory value is used. 2. The cost and fair value of the long-term investments that consist of stocks (with ownership less than 20% of total shares) are the same. 3. The amount of the Construction in Progress…