Assets Cash $ 58,900 $ 79,500 Accounts receivable 74,830 56,625 Inventory 284,656 257,800 Prepaid expenses 1,270 2,015 Total current assets 419,656 395,940 Equipment 151,500 114,000 Accum. depreciation—Equipment (39,625 ) (49,000 ) Total assets $ 531,531 $ 460,940 Liabilities and Equity Accounts payable $ 59,141 $ 123,675 Short-term notes payable 11,800 7,200 Total current liabilities 70,941 130,875 Long-term notes payable 62,000 54,750 Total liabilities 132,941 185,625 Equity Common stock, $5 par value 171,750 156,250 Paid-in capital in excess of par, common stock 46,500 0 Retained earnings 180,340 119,065 Total liabilities and equity $ 531,531 $ 460,940 FORTEN COMPANY Income Statement For Current Year Ended December 31 Sales $ 612,500 Cost of goods sold 291,000 Gross profit 321,500 Operating expenses Depreciation expense $ 26,750 Other expenses 138,400 165,150 Other gains (losses) Loss on sale of equipment (11,125 ) Income before taxes 145,225 Income taxes expense 32,650 Net income $ 112,575 Additional Information on Current Year Transactions The loss on the cash sale of equipment was $11,125 (details in b). Sold equipment costing $64,875, with accumulated depreciation of $36,125, for $17,625 cash. Purchased equipment costing $102,375 by paying $42,000 cash and signing a long-term note payable for the balance. Borrowed $4,600 cash by signing a short-term note payable. Paid $53,125 cash to reduce the long-term notes payable. Issued 3,100 shares of common stock for $20 cash per share. Declared and paid cash dividends of $51,300.

Assets Cash $ 58,900 $ 79,500 Accounts receivable 74,830 56,625 Inventory 284,656 257,800 Prepaid expenses 1,270 2,015 Total current assets 419,656 395,940 Equipment 151,500 114,000 Accum. depreciation—Equipment (39,625 ) (49,000 ) Total assets $ 531,531 $ 460,940 Liabilities and Equity Accounts payable $ 59,141 $ 123,675 Short-term notes payable 11,800 7,200 Total current liabilities 70,941 130,875 Long-term notes payable 62,000 54,750 Total liabilities 132,941 185,625 Equity Common stock, $5 par value 171,750 156,250 Paid-in capital in excess of par, common stock 46,500 0 Retained earnings 180,340 119,065 Total liabilities and equity $ 531,531 $ 460,940 FORTEN COMPANY Income Statement For Current Year Ended December 31 Sales $ 612,500 Cost of goods sold 291,000 Gross profit 321,500 Operating expenses Depreciation expense $ 26,750 Other expenses 138,400 165,150 Other gains (losses) Loss on sale of equipment (11,125 ) Income before taxes 145,225 Income taxes expense 32,650 Net income $ 112,575 Additional Information on Current Year Transactions The loss on the cash sale of equipment was $11,125 (details in b). Sold equipment costing $64,875, with accumulated depreciation of $36,125, for $17,625 cash. Purchased equipment costing $102,375 by paying $42,000 cash and signing a long-term note payable for the balance. Borrowed $4,600 cash by signing a short-term note payable. Paid $53,125 cash to reduce the long-term notes payable. Issued 3,100 shares of common stock for $20 cash per share. Declared and paid cash dividends of $51,300.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter15: Statement Of Cash Flows

Section: Chapter Questions

Problem 21E

Related questions

Question

| Assets | |||||||||||

| Cash | $ | 58,900 | $ | 79,500 | |||||||

| Accounts receivable | 74,830 | 56,625 | |||||||||

| Inventory | 284,656 | 257,800 | |||||||||

| Prepaid expenses | 1,270 | 2,015 | |||||||||

| Total current assets | 419,656 | 395,940 | |||||||||

| Equipment | 151,500 | 114,000 | |||||||||

| Accum. |

(39,625 | ) | (49,000 | ) | |||||||

| Total assets | $ | 531,531 | $ | 460,940 | |||||||

| Liabilities and Equity | |||||||||||

| Accounts payable | $ | 59,141 | $ | 123,675 | |||||||

| Short-term notes payable | 11,800 | 7,200 | |||||||||

| Total current liabilities | 70,941 | 130,875 | |||||||||

| Long-term notes payable | 62,000 | 54,750 | |||||||||

| Total liabilities | 132,941 | 185,625 | |||||||||

| Equity | |||||||||||

| Common stock, $5 par value | 171,750 | 156,250 | |||||||||

| Paid-in capital in excess of par, common stock | 46,500 | 0 | |||||||||

| 180,340 | 119,065 | ||||||||||

| Total liabilities and equity | $ | 531,531 | $ | 460,940 | |||||||

| FORTEN COMPANY Income Statement For Current Year Ended December 31 |

|||||||

| Sales | $ | 612,500 | |||||

| Cost of goods sold | 291,000 | ||||||

| Gross profit | 321,500 | ||||||

| Operating expenses | |||||||

| Depreciation expense | $ | 26,750 | |||||

| Other expenses | 138,400 | 165,150 | |||||

| Other gains (losses) | |||||||

| Loss on sale of equipment | (11,125 | ) | |||||

| Income before taxes | 145,225 | ||||||

| Income taxes expense | 32,650 | ||||||

| Net income | $ | 112,575 | |||||

Additional Information on Current Year Transactions

- The loss on the cash sale of equipment was $11,125 (details in b).

- Sold equipment costing $64,875, with accumulated depreciation of $36,125, for $17,625 cash.

- Purchased equipment costing $102,375 by paying $42,000 cash and signing a long-term note payable for the balance.

- Borrowed $4,600 cash by signing a short-term note payable.

- Paid $53,125 cash to reduce the long-term notes payable.

- Issued 3,100 shares of common stock for $20 cash per share.

- Declared and paid cash dividends of $51,300.

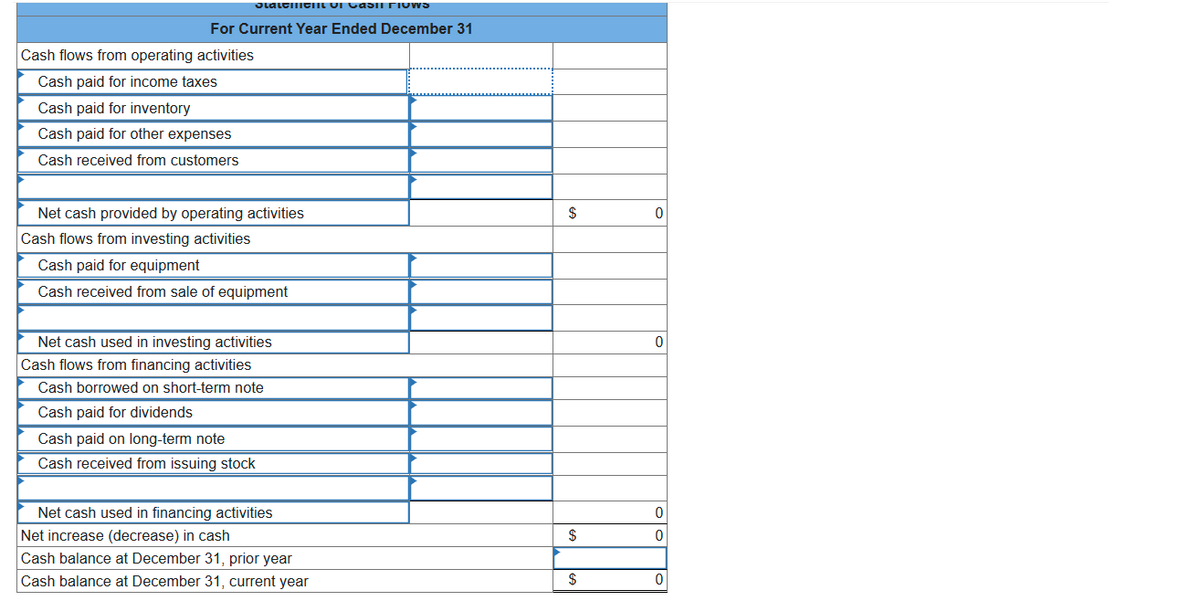

Transcribed Image Text:For Current Year Ended December 31

Cash flows from operating activities

Cash paid for income taxes

Cash paid for inventory

Cash paid for other expenses

Cash received from customers

Net cash provided by operating activities

$

Cash flows from investing activities

Cash paid for equipment

Cash received from sale of equipment

Net cash used in investing activities

Cash flows from financing activities

Cash borrowed on short-term note

Cash paid for dividends

Cash paid on long-term note

Cash received from issuing stock

Net cash used in financing activities

Net increase (decrease) in cash

$

Cash balance at December 31, prior year

Cash balance at December 31, current year

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,