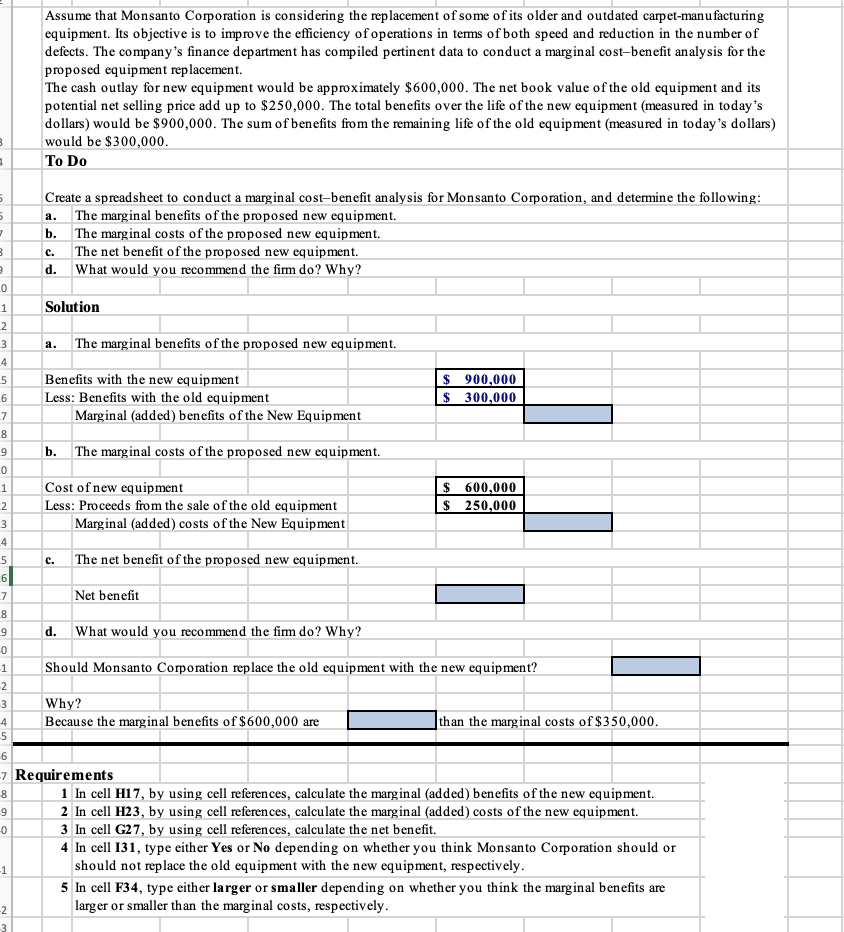

Assume that Monsanto Corporation is considering the replacement of some of its older and outdated carpet-manu facturing equipment. Its objective is to improve the efficiency of operations in tems of both speed and reduction in the number of defects. The company's finance department has compiled pertinent data to conduct a marginal cost-benefit analysis for the proposed equipment replacement. The cash outlay for new equipment would be approximately $600,000. The net book value of the old equipment and its potential net selling price add up to $250,000. The total benefits over the life of the new equipment (measured in today's dollars) would be $900,000. The sum of benefits from the remaining life of the old equipment (measured in today's dollars) would be $300,000. To Do Create a spreadsheet to conduct a marginal cost-benefit analysis for Monsanto Coporation, and detemine the following: The marginal benefits of the proposed new equipment. b. The marginal costs of the proposed new equipment. The net benefit of the proposed new equipment. d. What would you recommend the fim do? Why? a. с. Solution a. The marginal benefits of the proposed new equipment. Benefits with the new equipment Less: Benefits with the old equipment $ 900,000 $ 300,000 Marginal (added) benefits of the New Equipment b. The marginal costs of the proposed new equipment. Cost of new equipment Less: Proceeds from the sale of the old equipment Marginal (added) costs of the New Equipment $ 600,000 $ 250,000 c. The net benefit of the proposed new equipment. Net benefit d. What would you recommend the fim do? Why? Should Monsanto Coporation replace the old equipment with the new equipment? Why? Because the marg inal benefits of $600,000 are Jthan the marg inal costs of $350,000. Requirements 1 In cell H17, by using cell references, calculate the marginal (added) benefits of the new equipment. 2 In cell H23, by using cell references, calculate the marginal (added) costs of the new equipment. 3 In cell G27, by using cell references, calculate the net benefit. 4 In cell 131, type either Yes or No depending on whether you think Monsanto Corporation should or should not replace the old equipment with the new equipment, respectively. 5 In cell F34, type either larger or smaller depending on whether you think the marginal benefits are larger or smaller than the marginal costs, respectively.

Assume that Monsanto Corporation is considering the replacement of some of its older and outdated carpet-manu facturing equipment. Its objective is to improve the efficiency of operations in tems of both speed and reduction in the number of defects. The company's finance department has compiled pertinent data to conduct a marginal cost-benefit analysis for the proposed equipment replacement. The cash outlay for new equipment would be approximately $600,000. The net book value of the old equipment and its potential net selling price add up to $250,000. The total benefits over the life of the new equipment (measured in today's dollars) would be $900,000. The sum of benefits from the remaining life of the old equipment (measured in today's dollars) would be $300,000. To Do Create a spreadsheet to conduct a marginal cost-benefit analysis for Monsanto Coporation, and detemine the following: The marginal benefits of the proposed new equipment. b. The marginal costs of the proposed new equipment. The net benefit of the proposed new equipment. d. What would you recommend the fim do? Why? a. с. Solution a. The marginal benefits of the proposed new equipment. Benefits with the new equipment Less: Benefits with the old equipment $ 900,000 $ 300,000 Marginal (added) benefits of the New Equipment b. The marginal costs of the proposed new equipment. Cost of new equipment Less: Proceeds from the sale of the old equipment Marginal (added) costs of the New Equipment $ 600,000 $ 250,000 c. The net benefit of the proposed new equipment. Net benefit d. What would you recommend the fim do? Why? Should Monsanto Coporation replace the old equipment with the new equipment? Why? Because the marg inal benefits of $600,000 are Jthan the marg inal costs of $350,000. Requirements 1 In cell H17, by using cell references, calculate the marginal (added) benefits of the new equipment. 2 In cell H23, by using cell references, calculate the marginal (added) costs of the new equipment. 3 In cell G27, by using cell references, calculate the net benefit. 4 In cell 131, type either Yes or No depending on whether you think Monsanto Corporation should or should not replace the old equipment with the new equipment, respectively. 5 In cell F34, type either larger or smaller depending on whether you think the marginal benefits are larger or smaller than the marginal costs, respectively.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter12: Capital Investment Analysis

Section: Chapter Questions

Problem 1MAD: San Lucas Corporation is considering investment in robotic machinery based upon the following...

Related questions

Question

Transcribed Image Text:Assume that Monsanto Corporation is considering the replacement of some ofits older and outdated carpet-manu facturing

equipment. Its objective is to improve the efficiency of operations in terms of both speed and reduction in the number of

defects. The company's finance department has compiled pertinent data to conduct a marginal cost-benefit analysis for the

proposed equipment replacement.

The cash outlay for new equipment would be approximately $600,000. The net book value of the old equipment and its

potential net selling price add up to $250,000. The total benefits over the life of the new equipment (measured in today's

dollars) would be $900,000. The sum of benefits from the remaining life of the old equipment (measured in today's dollars)

would be $300,000.

To Do

Create a spreadsheet to conduct a marginal cost-benefit analysis for Monsanto Corporation, and determine the following:

a. The marginal benefits of the proposed new equipment.

b. The marg inal costs of the proposed new equipment.

The net benefit of the proposed new equipment.

d. What would you recommend the firm do? Why?

с.

Solution

2

3

a. The marg inal benefits of the proposed new equipment.

4

Benefits with the new equipment

Less: Benefits with the old equipment

$ 900,000

$300,000

6

L7

Marginal (added) benefits of the New Equipment

b. The marginal costs of the proposed new equipment.

Cost of new equipment

Less: Proceeds from the sale of the old equipment

Marginal (added) costs of the New Equipment

$ 600,000

$ 250,000

1

2

3

4

с.

The net benefit of the proposed new equipment.

L7

Net benefit

8

d. What would you recommend the firm do? Why?

1

Should Monsanto Corporation replace the old equipment with the new equipment?

2

Why?

Because the marginal benefits of $600,000 are

3

4

5

|than the marginal costs of $350,000.

6

7 Requirements

1 In cell H17, by using cell references, calculate the marg inal (added) benefits of the new equipment.

2 In cell H23, by using cell references, calculate the marginal (added) costs of the new equipment.

3 In cell G27, by using cell references, calculate the net benefit.

4 In cell 131, type either Yes or No depending on whether you think Monsanto Corporation should or

should not replace the old equipment with the new equipment, respectively.

-9

-0

-1

5 In cell F34, type either larger or smaller depending on whether you think the marginal benefits are

larger or smaller than the marginal costs, respectively.

-2

3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning