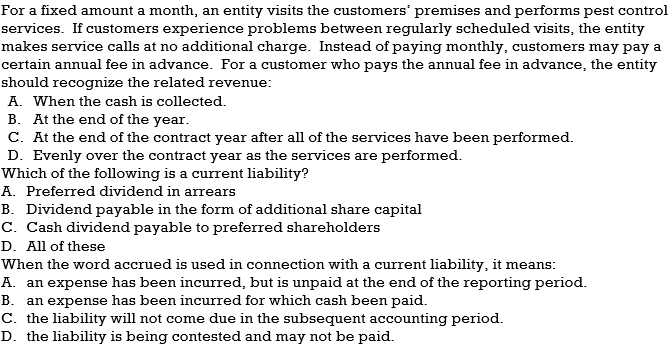

For a fixed amount a month, an entity visits the customers' premises and performs pest control services. If customers experience problems between regularly scheduled visits, the entity makes service calls at no additional charge. Instead of paying monthly, customers may pay a certain annual fee in advance. For a customer who pays the annual fee in advance, the entity should recognize the related revenue: A. When the cash is collected. B. At the end of the year. C. At the end of the contract year after all of the services have been performed. D. Evenly over the contract year as the services are performed.

For a fixed amount a month, an entity visits the customers' premises and performs pest control services. If customers experience problems between regularly scheduled visits, the entity makes service calls at no additional charge. Instead of paying monthly, customers may pay a certain annual fee in advance. For a customer who pays the annual fee in advance, the entity should recognize the related revenue: A. When the cash is collected. B. At the end of the year. C. At the end of the contract year after all of the services have been performed. D. Evenly over the contract year as the services are performed.

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 5PB: Review the following transactions and prepare any necessary journal entries. A. On January 5, Bunnet...

Related questions

Question

Transcribed Image Text:For a fixed amount a month, an entity visits the customers' premises and performs pest control

services. If customers experience problems between regularly scheduled visits, the entity

makes service calls at no additional charge. Instead of paying monthly, customers may pay a

certain annual fee in advance. For a customer who pays the annual fee in advance, the entity

should recognize the related revenue:

A. When the cash is collected.

B. At the end of the year.

C. At the end of the contract year after all of the services have been performed.

D. Evenly over the contract year as the services are performed.

Which of the following is a current liability?

A. Preferred dividend in arrears

B. Dividend payable in the form of additional share capital

C. Cash dividend payable to preferred shareholders

D. All of these

When the word accrued is used in connection with a current liability, it means:

A. an expense has been incurred, but is unpaid at the end of the reporting period.

B. an expense has been incurred for which cash been paid.

C. the liability will not come due in the subsequent accounting period.

D. the liability is being contested and may not be paid.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub