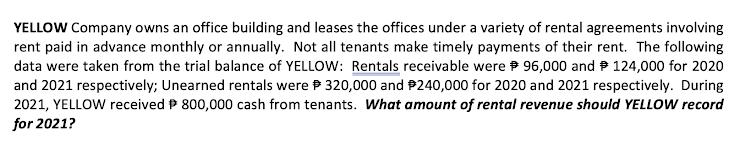

YELLOW Company owns an office building and leases the offices under a variety of rental agreements involving rent paid in advance monthly or annually. Not all tenants make timely payments of their rent. The following data were taken from the trial balance of YELLOW: Rentals receivable were P 96,000 and P 124,000 for 2020 and 2021 respectively; Unearned rentals were P 320,000 and P240,000 for 2020 and 2021 respectively. During 2021, YELLOW received P 800,000 cash from tenants. What amount of rental revenue should YELLOW record for 2021?

YELLOW Company owns an office building and leases the offices under a variety of rental agreements involving rent paid in advance monthly or annually. Not all tenants make timely payments of their rent. The following data were taken from the trial balance of YELLOW: Rentals receivable were P 96,000 and P 124,000 for 2020 and 2021 respectively; Unearned rentals were P 320,000 and P240,000 for 2020 and 2021 respectively. During 2021, YELLOW received P 800,000 cash from tenants. What amount of rental revenue should YELLOW record for 2021?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter17: Advanced Issues In Revenue Recognition

Section: Chapter Questions

Problem 19E: Rix Company sells home appliances and provides installation and service for its customers. On April...

Related questions

Question

What amount of rental revenue should YELLOW record for 2021?

Transcribed Image Text:YELLOW Company owns an office building and leases the offices under a variety of rental agreements involving

rent paid in advance monthly or annually. Not all tenants make timely payments of their rent. The following

data were taken from the trial balance of YELLOW: Rentals receivable were 96,000 and P 124,000 for 2020

and 2021 respectively; Unearned rentals were P 320,000 and P240,000 for 2020 and 2021 respectively. During

2021, YELLOW received P 800,000 cash from tenants. What amount of rental revenue should YELLOW record

for 2021?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT