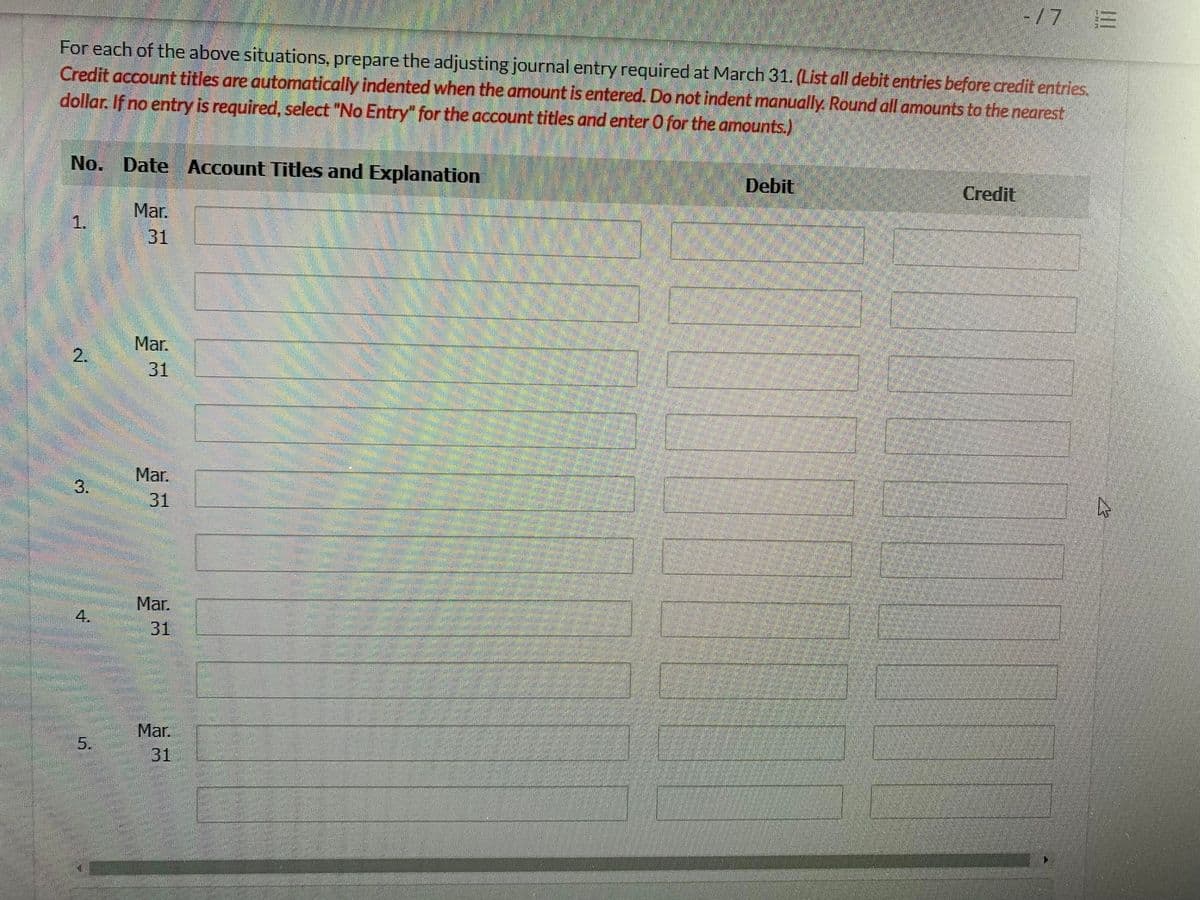

For each of the above situations, prepare the adjusting journal entry required at March 31. (List all debit entries before Credit account titles are automatically indented when the amount is entered. Do not indent manually. Round all amounts to dollar. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) No. Date Account Titles and Explanation Debit Cre Mar. 1. 31 Mar. 2.

For each of the above situations, prepare the adjusting journal entry required at March 31. (List all debit entries before Credit account titles are automatically indented when the amount is entered. Do not indent manually. Round all amounts to dollar. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) No. Date Account Titles and Explanation Debit Cre Mar. 1. 31 Mar. 2.

Corporate Financial Accounting

15th Edition

ISBN:9781337398169

Author:Carl Warren, Jeff Jones

Publisher:Carl Warren, Jeff Jones

Chapter7: Internal Control And Cash

Section: Chapter Questions

Problem 7.2MAD: Analyze and compare J. C. Penney and Macys J. C. Penney Company, Inc. (JCP) and Macys, Inc. (M) are...

Related questions

Question

100%

Transcribed Image Text:-7

For each of the above situations, prepare the adjusting journal entry required at March 31. (List all debit entries before credit entries.

Credit account titles are automatically indented when the amount is entered. Do not indent manually. Round all amounts to the nearest

dollar. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)

No. Date Account Titles and Explanation

Debit

Credit

Mar.

1.

31

Mar.

31

Mar.

3.

31

Mar.

4.

31

Mar.

31

II

2.

5.

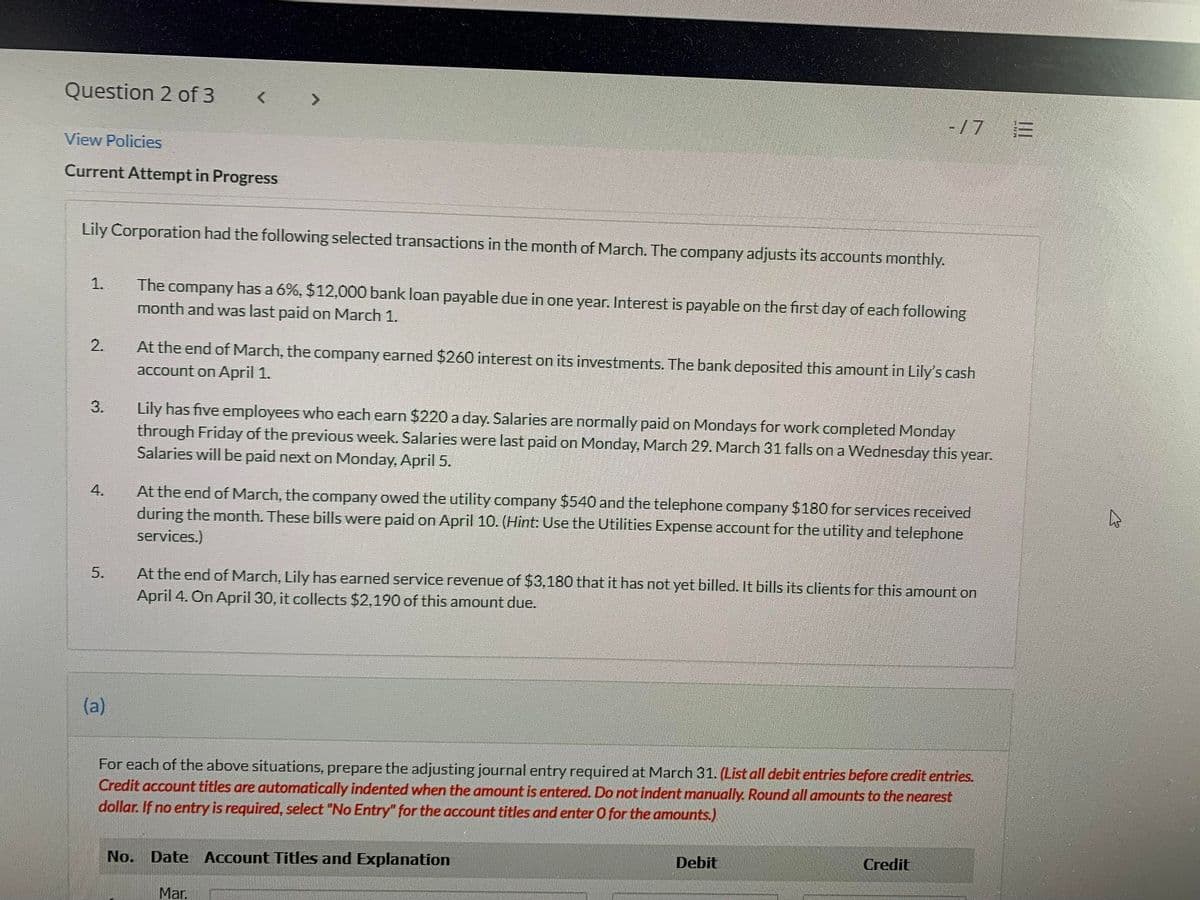

Transcribed Image Text:Question 2 of 3

-/7

View Policies

Current Attempt in Progress

Lily Corporation had the following selected transactions in the month of March. The company adjusts its accounts monthly.

The company has a 6%, $12,000 bank loan payable due in one year. Interest is payable on the first day of each following

month and was last paid on March 1.

1.

At the end of March, the company earned $260 interest on its investments. The bank deposited this amount in Lily's cash

account on April 1.

2.

Lily has five employees who each earn $220 a day. Salaries are normally paid on Mondays for work completed Monday

through Friday of the previous week. Salaries were last paid on Monday, March 29. March 31 falls on a Wednesday this year.

Salaries will be paid next on Monday, April 5.

At the end of March, the company owed the utility company $540 and the telephone company $180 for services received

during the month. These bills were paid on April 10. (Hint: Use the Utilities Expense account for the utility and telephone

services.)

4.

At the end of March, Lily has earned service revenue of $3,180 that it has not yet billed. It bills its clients for this amount on

April 4. On April 30, it collects $2,190 of this amount due.

5.

(a)

For each of the above situations, prepare the adjusting journal entry required at March 31. (List all debit entries before credit entries.

Credit account titles are automatically indented when the amount is entered. Do not indent manually. Round all amounts to the nearest

dollar. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)

No.

Date Account Titles and Explanation

Debit

Credit

Mar.

II

3.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,