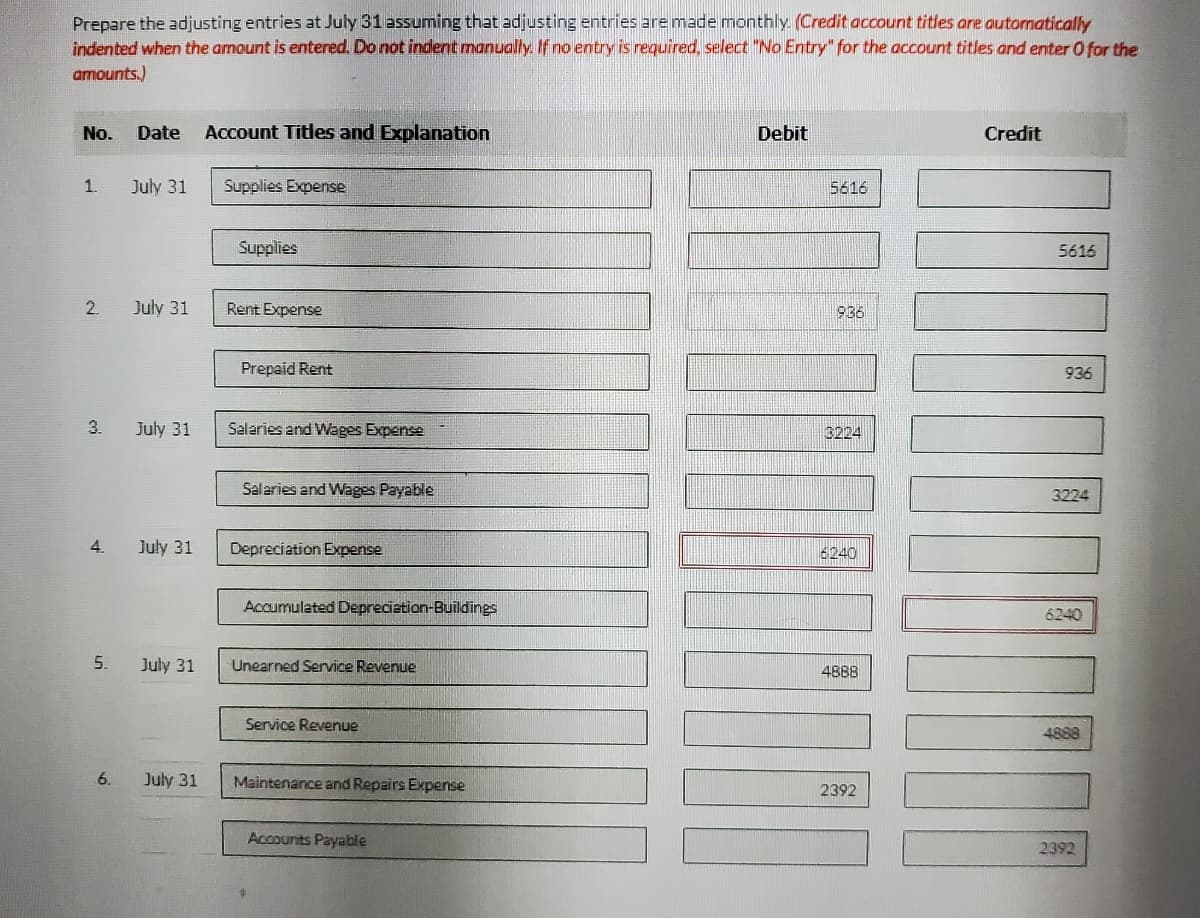

Prepare the adjusting entries at July 31 assuming that adjusting entries are made monthly (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) No. Date Account Titles and Explanation Debit Credit 1. July 31 Supplies Expense 5616 Supplies 5616 July 31 Rent Expense 936 Prepaid Rent 936 3. July 31 Salaries and Wages Expense 0224 Salaries and Wages Payable 3224 4. July 31 Depreciation Expense 6240 Accumulated Depreciation-Buildings 6240 5. July 31 Unearned Service Revenue 4888 Service Revenue 4888 6. July 31 Maintenance and Repairs Expense 2392 Accounts Payable 2392 2.

Prepare the adjusting entries at July 31 assuming that adjusting entries are made monthly (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) No. Date Account Titles and Explanation Debit Credit 1. July 31 Supplies Expense 5616 Supplies 5616 July 31 Rent Expense 936 Prepaid Rent 936 3. July 31 Salaries and Wages Expense 0224 Salaries and Wages Payable 3224 4. July 31 Depreciation Expense 6240 Accumulated Depreciation-Buildings 6240 5. July 31 Unearned Service Revenue 4888 Service Revenue 4888 6. July 31 Maintenance and Repairs Expense 2392 Accounts Payable 2392 2.

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter21: Accounting For Accruals, Deferrals, And Reversing Entries

Section: Chapter Questions

Problem 2AP

Related questions

Question

I need help with number 4, I dint know why it was marked wrong.

Transcribed Image Text:Prepare the adjusting entries at July 31 assuming that adjusting entries aremade monthly. (Credit account titles are automatically

indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the

amounts.)

No.

Date

Account Titles and Explanation

Debit

Credit

1.

July 31

Supplies Expense

5616

Supplies

5616

2.

July 31

Rent Expense

936

Prepaid Rent

936

3.

July 31

Salaries and Wages Expense

0224

Salaries and Wages Payable

3224

4.

July 31

Depreciation Expense

6240

Accumulated Depreciation-Buildings

6240

5.

July 31

Unearned Service Revenue

4888

Service Revenue

4888

6.

July 31

Maintenance and Repairs Expense

2392

Accounts Payable

2392

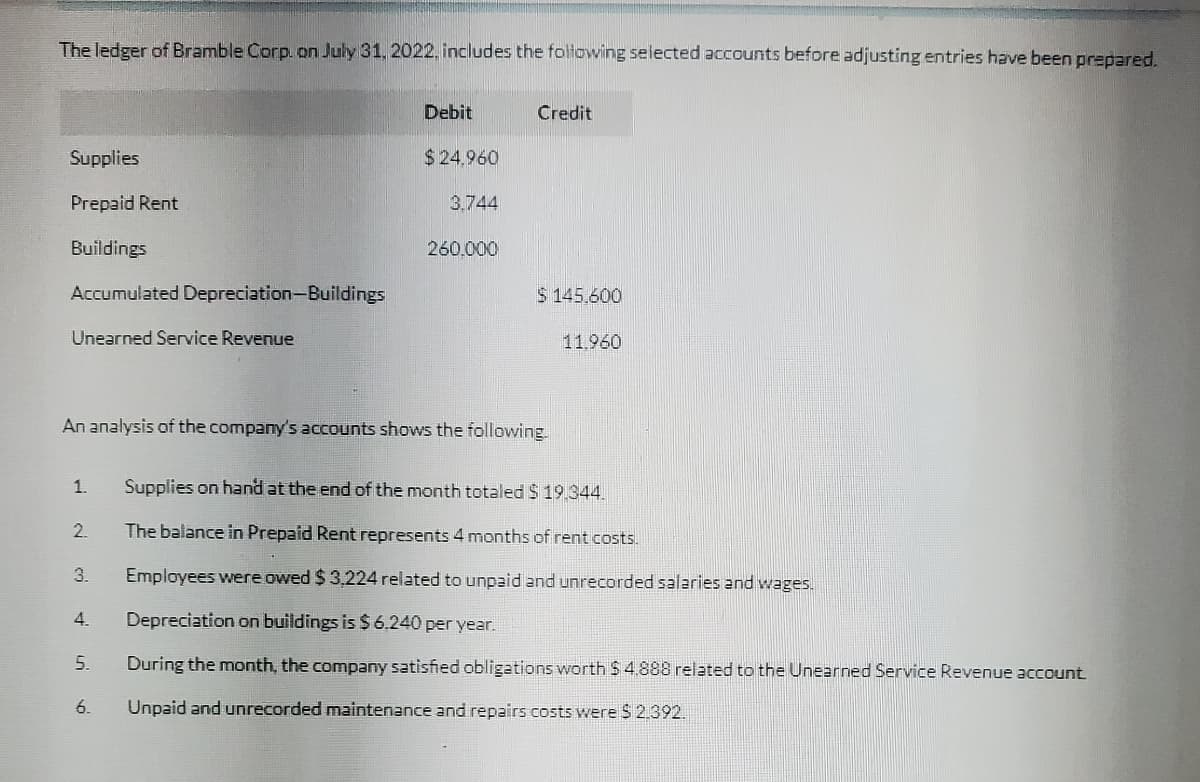

Transcribed Image Text:The ledger of Bramble Corp. on July 31, 2022, includes the foltowing selected accounts before adjusting entries have been prepared.

Debit

Credit

Supplies

$24.960

Prepaid Rent

3.744

Buildings

260.000

Accumulated Depreciation-Buildings

$ 145.600

Unearned Service Revenue

11.960

An analysis of the company's accounts shows the following.

1.

Supplies on hand at the end of the month totaled $ 19.344.

2.

The balance in Prepaid Rent represents 4 months of rent costs.

3.

Employees were owed $ 3,224 related to unpaid and unrecorded salaries and wages.

4.

Depreciation on buildings is $6.240 per year.

5.

During the month, the company satisfied obligations worth $ 4.888 related to the Unearned Service Revenue account

6.

Unpaid and unrecorded maintenance and repairs costs were $ 2.392.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning