For each purchasing option, compute • the required monthly payment, • the total amount you will have paid for your car, and for the first loan payment, how much money will go towards interest and how much money will go towards the outstanding balance?

For each purchasing option, compute • the required monthly payment, • the total amount you will have paid for your car, and for the first loan payment, how much money will go towards interest and how much money will go towards the outstanding balance?

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter7: Using Consumer Loans

Section: Chapter Questions

Problem 3FPE: Evaluating financing packages. Assume that you’ve been shopping for a new car and intend to finance...

Related questions

Question

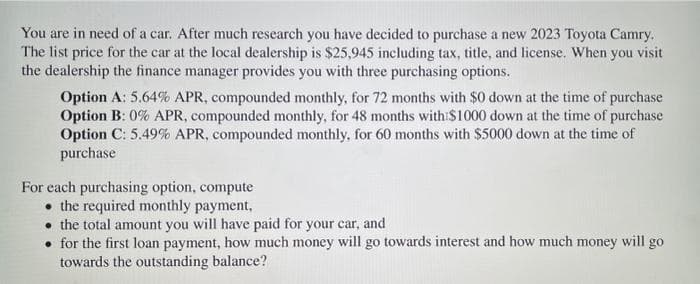

Transcribed Image Text:You are in need of a car. After much research you have decided to purchase a new 2023 Toyota Camry.

The list price for the car at the local dealership is $25,945 including tax, title, and license. When you visit

the dealership the finance manager provides you with three purchasing options.

Option A: 5.64% APR, compounded monthly, for 72 months with $0 down at the time of purchase

Option B: 0% APR, compounded monthly, for 48 months with $1000 down at the time of purchase

Option C: 5.49% APR, compounded monthly, for 60 months with $5000 down at the time of

purchase

For each purchasing option, compute

the required monthly payment,

the total amount you will have paid for your car, and

• for the first loan payment, how much money will go towards interest and how much money will go

towards the outstanding balance?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,