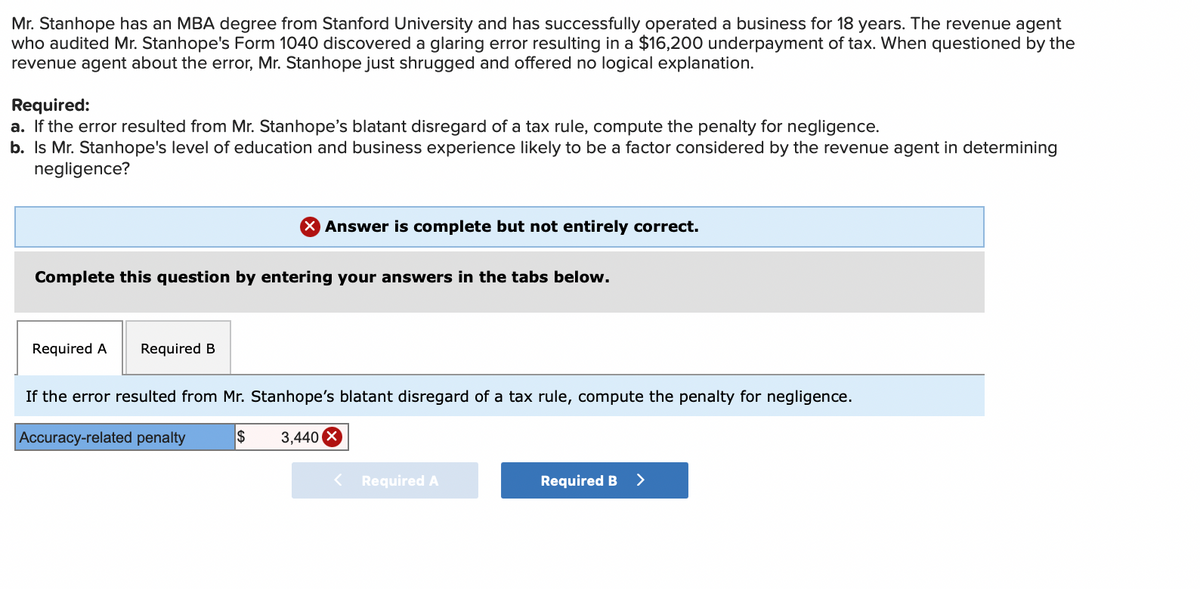

Mr. Stanhope has an MBA degree from Stanford University and has successfully operated a business for 18 years. The revenue agent who audited Mr. Stanhope's Form 1040 discovered a glaring error resulting in a $16,200 underpayment of tax. When questioned by the revenue agent about the error, Mr. Stanhope just shrugged and offered no logical explanation. Required: a. If the error resulted from Mr. Stanhope's blatant disregard of a tax rule, compute the penalty for negligence. b. Is Mr. Stanhope's level of education and business experience likely to be a factor considered by the revenue agent in determining negligence? X Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required A Required B If the error resulted from Mr. Stanhope's blatant disregard of a tax rule, compute the penalty for negligence. $ 3,440 X Accuracy-related penalty

Mr. Stanhope has an MBA degree from Stanford University and has successfully operated a business for 18 years. The revenue agent who audited Mr. Stanhope's Form 1040 discovered a glaring error resulting in a $16,200 underpayment of tax. When questioned by the revenue agent about the error, Mr. Stanhope just shrugged and offered no logical explanation. Required: a. If the error resulted from Mr. Stanhope's blatant disregard of a tax rule, compute the penalty for negligence. b. Is Mr. Stanhope's level of education and business experience likely to be a factor considered by the revenue agent in determining negligence? X Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required A Required B If the error resulted from Mr. Stanhope's blatant disregard of a tax rule, compute the penalty for negligence. $ 3,440 X Accuracy-related penalty

Chapter12: Tax Administration And Tax Planning

Section: Chapter Questions

Problem 7P

Related questions

Question

Transcribed Image Text:Mr. Stanhope has an MBA degree from Stanford University and has successfully operated a business for 18 years. The revenue agent

who audited Mr. Stanhope's Form 1040 discovered a glaring error resulting in a $16,200 underpayment of tax. When questioned by the

revenue agent about the error, Mr. Stanhope just shrugged and offered no logical explanation.

Required:

a. If the error resulted from Mr. Stanhope's blatant disregard of a tax rule, compute the penalty for negligence.

b. Is Mr. Stanhope's level of education and business experience likely to be a factor considered by the revenue agent in determining

negligence?

Complete this question by entering your answers in the tabs below.

Required A Required B

X Answer is complete but not entirely correct.

If the error resulted from Mr. Stanhope's blatant disregard of a tax rule, compute the penalty for negligence.

Accuracy-related penalty

$

3,440 X

Required A

Required B

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you