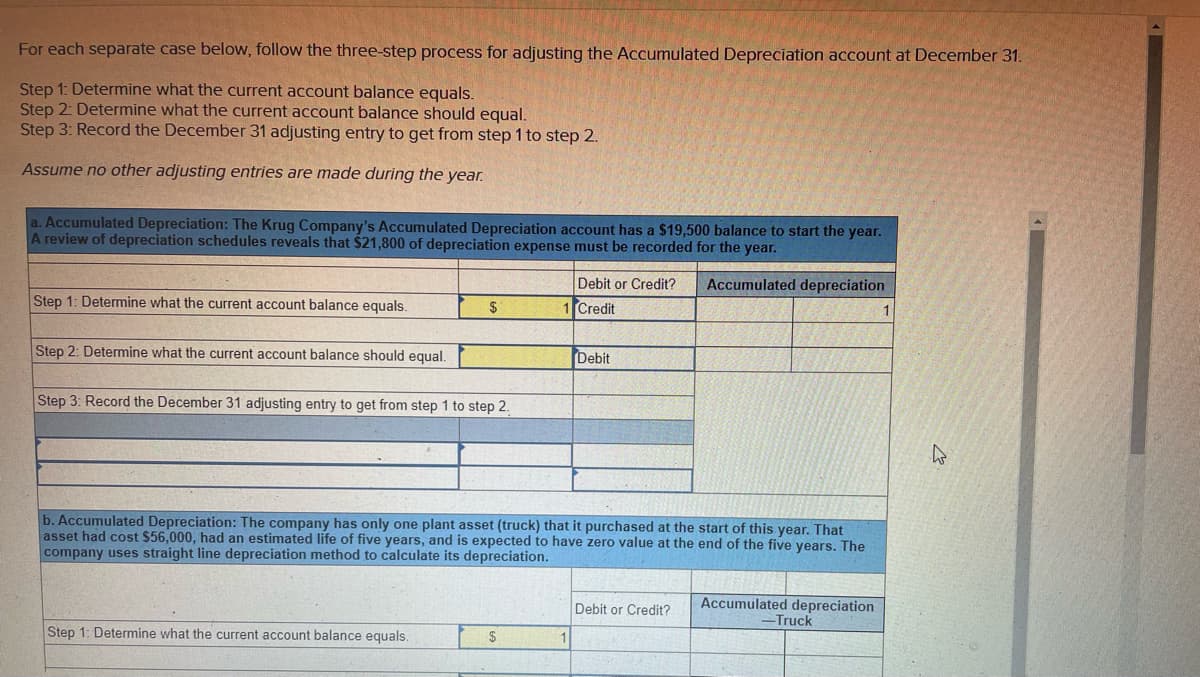

For each separate case below, follow the three-step process for adjusting the Accumulated Depreciation account at December 31. Step 1: Determine what the current account balance equals. Step 2: Determine what the current account balance should equal. Step 3: Record the December 31 adjusting entry to get from step 1 to step 2. Assume no other adjusting entries are made during the year. a. Accumulated Depreciation: The Krug Company's Accumulated Depreciation account has a $19,500 balance to start the year. A review of depreciation schedules reveals that $21,800 of depreciation expense must be recorded for the year. Debit or Credit? Accumulated depreciation Step 1: Determine what the current account balance equals. 1 Credit 1 Step 2: Determine what the current account balance should equal. Debit Step 3: Record the December 31 adjusting entry to get from step 1 to step 2.

For each separate case below, follow the three-step process for adjusting the Accumulated Depreciation account at December 31. Step 1: Determine what the current account balance equals. Step 2: Determine what the current account balance should equal. Step 3: Record the December 31 adjusting entry to get from step 1 to step 2. Assume no other adjusting entries are made during the year. a. Accumulated Depreciation: The Krug Company's Accumulated Depreciation account has a $19,500 balance to start the year. A review of depreciation schedules reveals that $21,800 of depreciation expense must be recorded for the year. Debit or Credit? Accumulated depreciation Step 1: Determine what the current account balance equals. 1 Credit 1 Step 2: Determine what the current account balance should equal. Debit Step 3: Record the December 31 adjusting entry to get from step 1 to step 2.

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter11: Work Sheet And Adjusting Entries

Section: Chapter Questions

Problem 2PA: The balances of the ledger accounts of Beldren Home Center as of December 31, the end of its fiscal...

Related questions

Question

Transcribed Image Text:For each separate case below, follow the three-step process for adjusting the Accumulated Depreciation account at December 31.

Step 1: Determine what the current account balance equals.

Step 2: Determine what the current account balance should equal.

Step 3: Record the December 31 adjusting entry to get from step 1 to step 2.

Assume no other adjusting entries are made during the year.

a. Accumulated Depreciation: The Krug Company's Accumulated Depreciation account has a $19,500 balance to start the year.

A review of depreciation schedules reveals that $21,800 of depreciation expense must be recorded for the year.

Debit or Credit?

Accumulated depreciation

Step 1: Determine what the current account balance equals.

$

1 Credit

1

Step 2: Determine what the current account balance should equal.

Debit

Step 3: Record the December 31 adjusting entry to get from step 1 to step 2.

b. Accumulated Depreciation: The company has only one plant asset (truck) that it purchased at the start of this year. That

asset had cost $56,000, had an estimated life of five years, and is expected to have zero value at the end of the five years. The

company uses straight line depreciation method to calculate its depreciation.

Accumulated depreciation

-Truck

Debit or Credit?

Step 1: Determine what the current account balance equals.

1

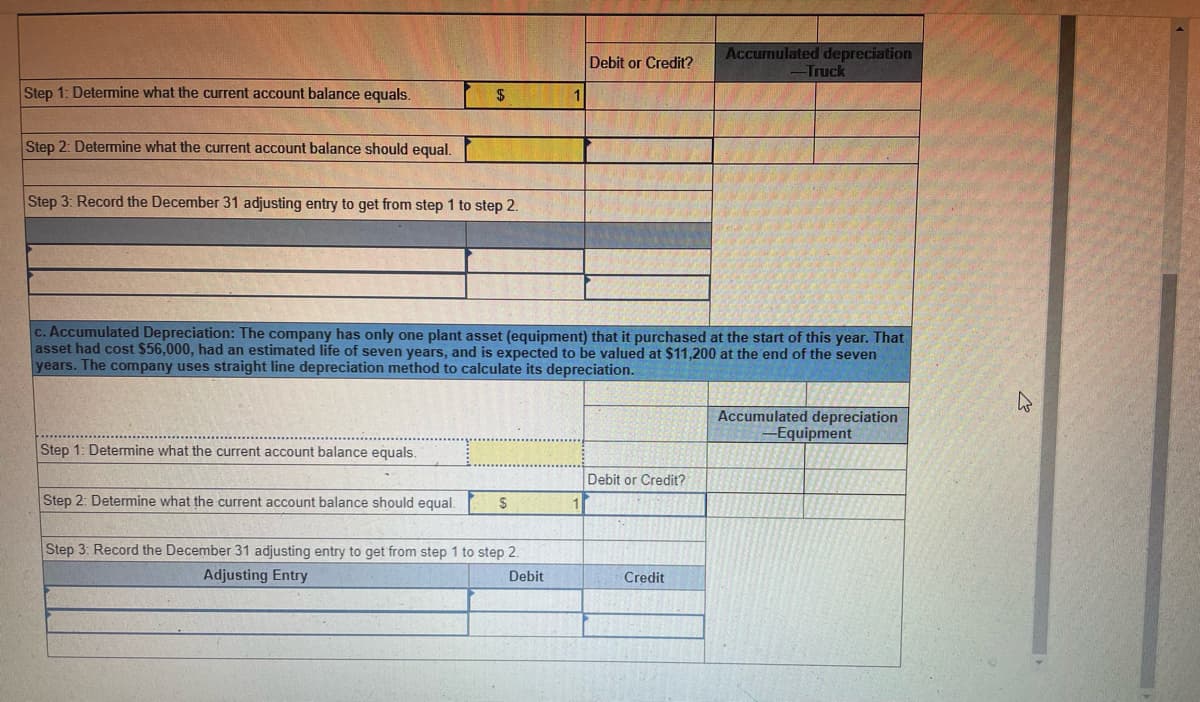

Transcribed Image Text:Accurnulated depreciation

-Truck

Debit or Credit?

Step 1: Determine what the current account balance equals.

Step 2: Determine what the current account balance should equal.

Step 3: Record the December 31 adjusting entry to get from step 1 to step 2.

c. Accumulated Depreciation: The company has only one plant asset (equipment) that it purchased at the start of this year. That

asset had cost $56,000, had an estimated life of seven years, and is expected to be valued at $11,200 at the end of the seven

years. The company uses straight line depreciation method to calculate its depreciation.

Accumulated depreciation

-Equipment

Step 1: Determine what the current account balance equals.

Debit or Credit?

Step 2: Determine what the current account balance should equal.

1

Step 3: Record the December 31 adjusting entry to get from step 1 to step 2.

Adjusting Entry

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning