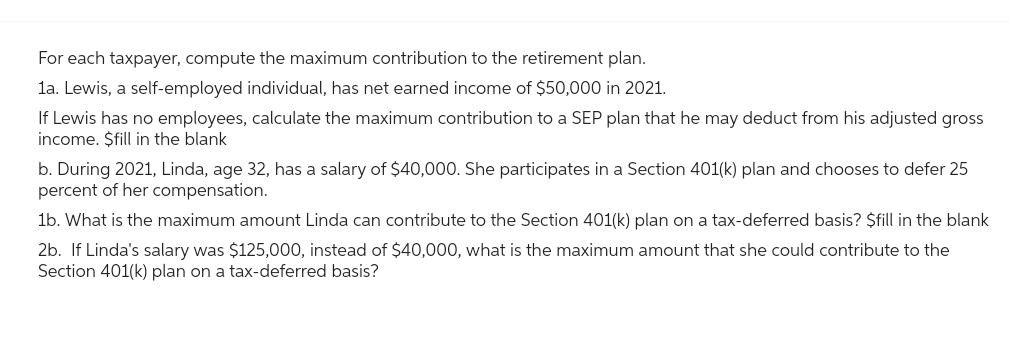

For each taxpayer, compute the maximum contribution to the retirement plan. 1a. Lewis, a self-employed individual, has net earned income of $50,000 in 2021. If Lewis has no employees, calculate the maximum contribution to a SEP plan that he may deduct from his adjusted gross income. $fill in the blank b. During 2021, Linda, age 32, has a salary of $40,000. She participates in a Section 401(k) plan and chooses to defer 25 percent of her compensation. 1b. What is the maximum amount Linda can contribute to the Section 401(k) plan on a tax-deferred basis? $fill in the blank 2b. If Linda's salary was $125,000, instead of $40,000, what is the maximum amount that she could contribute to the Section 401(k) plan on a tax-deferred basis?

For each taxpayer, compute the maximum contribution to the retirement plan. 1a. Lewis, a self-employed individual, has net earned income of $50,000 in 2021. If Lewis has no employees, calculate the maximum contribution to a SEP plan that he may deduct from his adjusted gross income. $fill in the blank b. During 2021, Linda, age 32, has a salary of $40,000. She participates in a Section 401(k) plan and chooses to defer 25 percent of her compensation. 1b. What is the maximum amount Linda can contribute to the Section 401(k) plan on a tax-deferred basis? $fill in the blank 2b. If Linda's salary was $125,000, instead of $40,000, what is the maximum amount that she could contribute to the Section 401(k) plan on a tax-deferred basis?

Chapter9: Deduct Ions: Employee And Self-employed - Related Expenses

Section: Chapter Questions

Problem 38P

Related questions

Question

Hh1.

Account

Transcribed Image Text:For each taxpayer, compute the maximum contribution to the retirement plan.

1a. Lewis, a self-employed individual, has net earned income of $50,000 in 2021.

If Lewis has no employees, calculate the maximum contribution to a SEP plan that he may deduct from his adjusted gross

income. $fill in the blank

b. During 2021, Linda, age 32, has a salary of $40,000. She participates in a Section 401(k) plan and chooses to defer 25

percent of her compensation.

1b. What is the maximum amount Linda can contribute to the Section 401(k) plan on a tax-deferred basis? $fill in the blank

2b. If Linda's salary was $125,000, instead of $40,000, what is the maximum amount that she could contribute to the

Section 401(k) plan on a tax-deferred basis?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT