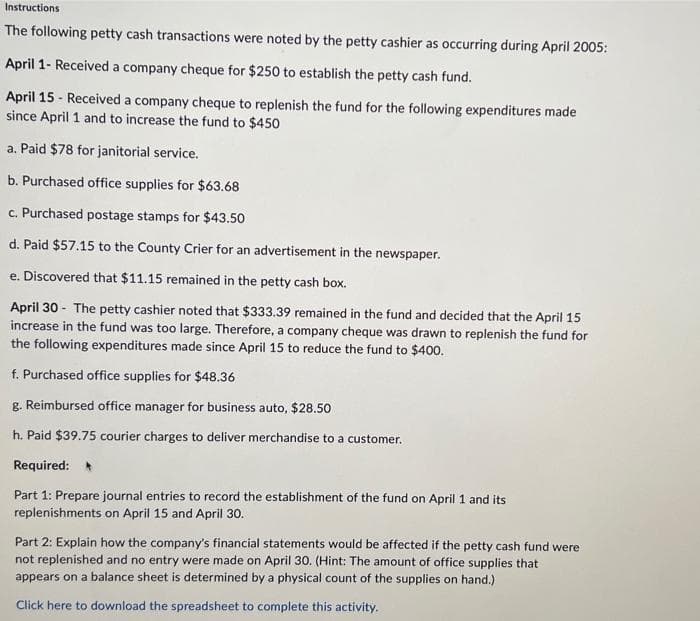

Part 1: Prepare journal entries to record the establishment of the fund on April 1 and its replenishments on April 15 and April 30. Part 2: Explain how the company's financial statements would be affected if the petty cash fund were not replenished and no entry were made on April 30. (Hint: The amount of office supplies that appears on a balance sheet is determined by a physical count of the supplies on hand.)

Instructions The following petty cash transactions were noted by the petty cashier as occurring during April 2005: April 1- Received a company cheque for $250 to establish the petty cash fund. April 15- Received a company cheque to replenish the fund for the following expenditures made since April 1 and to increase the fund to $450 a. Paid $78 for janitorial service. b. Purchased office supplies for $63.68 c. Purchased postage stamps for $43.50 d. Paid $57.15 to the County Crier for an advertisement in the newspaper. e. Discovered that $11.15 remained in the petty cash box. April 30- The petty cashier noted that $333.39 remained in the fund and decided that the April 15 increase in the fund was too large. Therefore, a company cheque was drawn to replenish the fund for the following expenditures made since April 15 to reduce the fund to $400. f. Purchased office supplies for $48.36 g. Reimbursed office manager for business auto, $28.50 h. Paid $39.75 courier charges to deliver merchandise to a customer. Required: Part 1: Prepare

Step by step

Solved in 3 steps