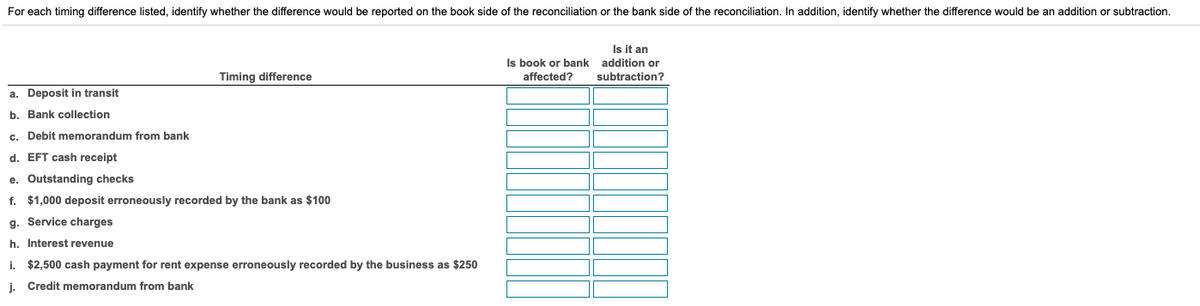

For each timing difference listed, identify whether the difference would be reported on the book side of the reconciliation or the bank side of the reconciliation. In addition, identify whether the difference would be an addition or subtraction. Is it an Is book or bank addition or affected? Timing difference subtraction? a. Deposit in transit b. Bank collection c. Debit memorandum from bank d. EFT cash receipt e. Outstanding checks f. $1,000 deposit erroneously recorded by the bank as $100 g. Service charges h. Interest revenue i. $2,500 cash payment for rent expense erroneously recorded by the business as $250 j. Credit memorandum from bank

For each timing difference listed, identify whether the difference would be reported on the book side of the reconciliation or the bank side of the reconciliation. In addition, identify whether the difference would be an addition or subtraction. Is it an Is book or bank addition or affected? Timing difference subtraction? a. Deposit in transit b. Bank collection c. Debit memorandum from bank d. EFT cash receipt e. Outstanding checks f. $1,000 deposit erroneously recorded by the bank as $100 g. Service charges h. Interest revenue i. $2,500 cash payment for rent expense erroneously recorded by the business as $250 j. Credit memorandum from bank

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter6: Bank Accounts, Cash Funds, And Internal Controls

Section: Chapter Questions

Problem 5DQ

Related questions

Question

Transcribed Image Text:For each timing difference listed, identify whether the difference would be reported on the book side of the reconciliation or the bank side of the reconciliation. In addition, identify whether the difference would be an addition or subtraction.

Is it an

Is book or bank addition or

Timing difference

affected?

subtraction?

a. Deposit in transit

b. Bank collection

c. Debit memorandum from bank

d. EFT cash receipt

e. Outstanding checks

f. $1,000 deposit erroneously recorded by the bank as $100

g. Service charges

h. Interest revenue

i. $2,500 cash payment for rent expense erroneously recorded by the business as $250

j. Credit memorandum from bank

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning