a. Prepare a bank reconciliation at June 30. b. Prepare the necessary journal entries to bring the general ledger Cash account into agreement with the adjusted balance on the bank reconciliation

a. Prepare a bank reconciliation at June 30. b. Prepare the necessary journal entries to bring the general ledger Cash account into agreement with the adjusted balance on the bank reconciliation

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter7: Internal Control And Cash

Section: Chapter Questions

Problem 7.21EX

Related questions

Question

Required

a. Prepare a bank reconciliation at June 30.

b. Prepare the necessary journal entries to bring the general ledger Cash account into agreement with the adjusted balance on the bank reconciliation.

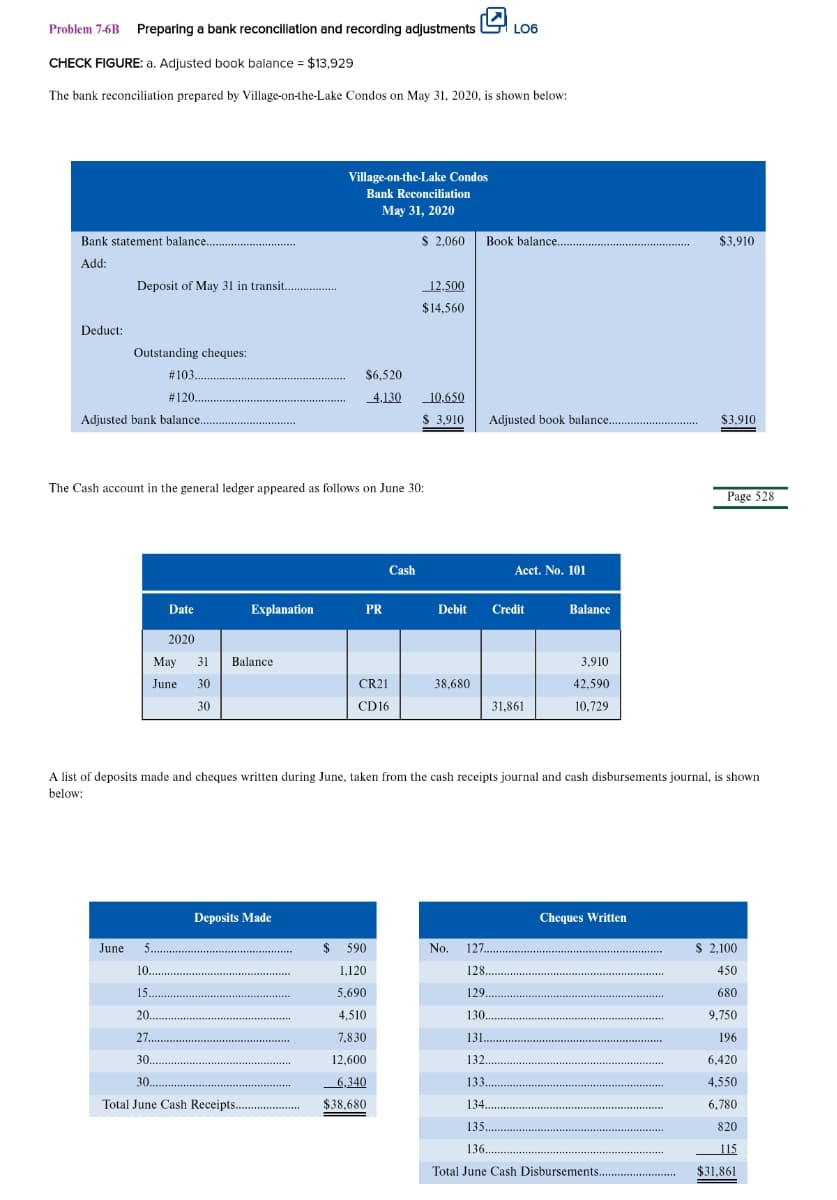

Transcribed Image Text:Problem 7-6B Preparing a bank reconcillation and recording adjustments

LO6

CHECK FIGURE: a. Adjusted book balance = $13,929

The bank reconciliation prepared by Village-on-the-Lake Condos on May 31, 2020, is shown below:

Village-on-the-Lake Condos

Bank Reconciliation

Мay 31, 2020

Bank statement balance..

$ 2,060

Book balance.

$3,910

Add:

Deposit of May 31 in transit.

12.500

$14,560

Deduct:

Outstanding cheques:

# 103.

$6,520

#120.

4,130

10.650

Adjusted bank balance..

$ 3,910

Adjusted book balance.

$3,910

...................

The Cash account in the general ledger appeared as follows on June 30:

Page 528

Cash

Acct. No. 101

Date

Explanation

PR

Debit

Credit

Balance

2020

May

31

Balance

3,910

June

30

CR21

38,680

42,590

30

CD16

31,861

10,729

A list of deposits made and cheques written during June, taken from the cash receipts journal and cash disbursements journal, is shown

below:

Deposits Made

Cheques Written

June 5..

$ 590

No.

127.

$ 2,100

10..

1,120

128.

450

15.

5,690

129

680

20

4,510

130,

9,750

27.

7,830

131.

196

30.

12,600

132,

6,420

30.

6,340

133.

4,550

Total June Cash Receipts. .

$38,680

6,780

134.

135.

820

136.

115

Total June Cash Disbursements.

$31,861

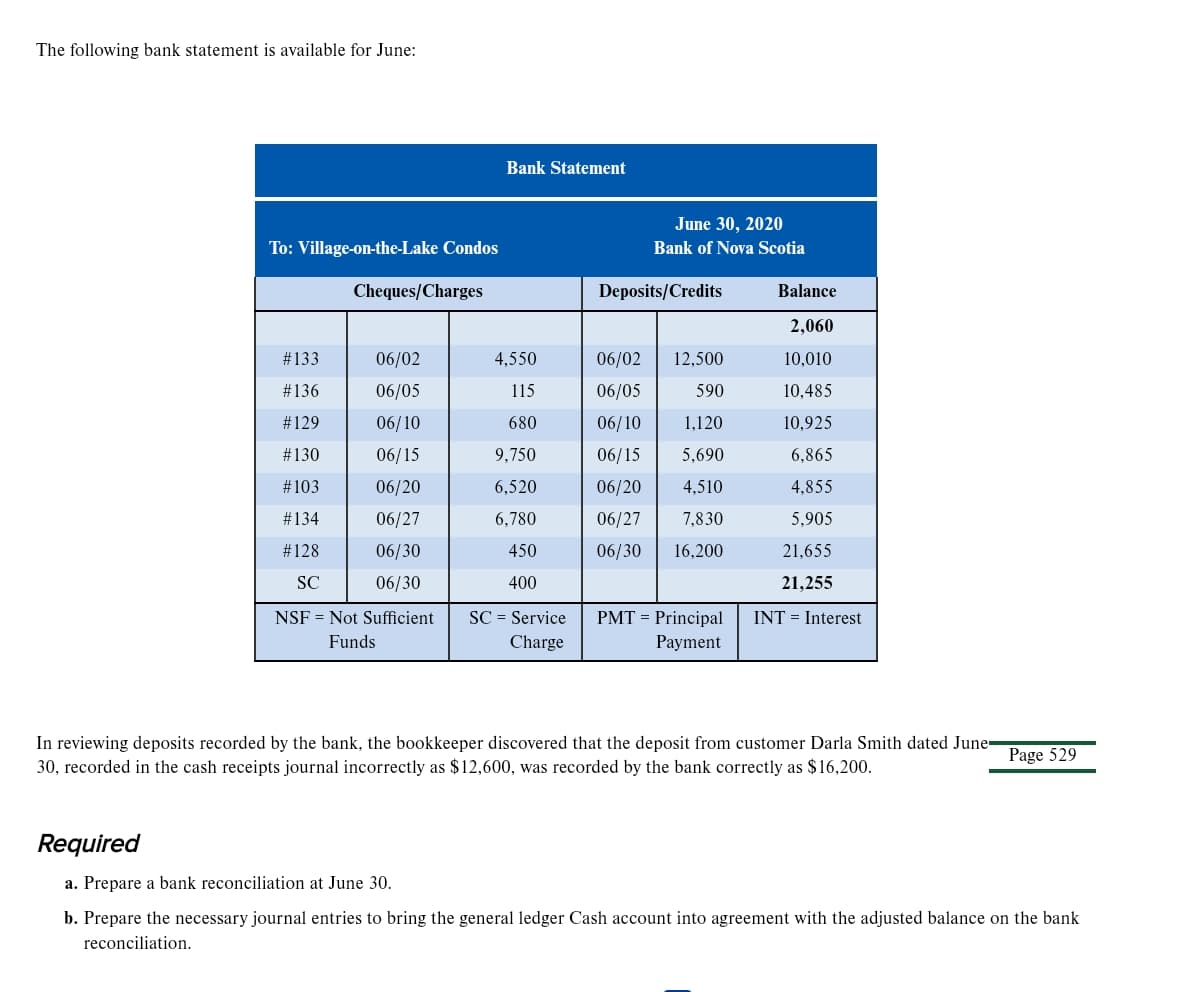

Transcribed Image Text:The following bank statement is available for June:

Bank Statement

June 30, 2020

To: Village-on-the-Lake Condos

Bank of Nova Scotia

Cheques/Charges

Deposits/Credits

Balance

2,060

#133

06/02

4,550

06/02

12,500

10,010

#136

06/05

115

06/05

590

10,485

#129

06/10

680

06/10

1,120

10,925

#130

06/15

9,750

06/15

5,690

6,865

#103

06/20

6,520

06/20

4,510

4,855

#134

06/27

6,780

06/27

7,830

5,905

#128

06/30

450

06/30

16,200

21,655

SC

06/30

400

21,255

NSF = Not Sufficient

SC = Service

PMT = Principal

INT = Interest

Funds

Charge

Payment

In reviewing deposits recorded by the bank, the bookkeeper discovered that the deposit from customer Darla Smith dated June=

30, recorded in the cash receipts journal incorrectly as $12,600, was recorded by the bank correctly as $16,200.

Page 529

Required

a. Prepare a bank reconciliation at June 30.

b. Prepare the necessary journal entries to bring the general ledger Cash account into agreement with the adjusted balance on the bank

reconciliation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning