ble for a monthly bank reconciliation dated September 30 is given below. For each item 1 through 12, indicate whether the item uld be added to or subtracted from the book or bank balance, and whether it should or should not appear on the reconciliation. lect the answers in the appropriate cells. Leave no cells blank. Be certain to select "NA" in fields which are not applicable.) Debit or Bank Balance Book Balance Credit to Cash Account Shown or Not Item Shown on Reconciliation NSF check from a customer is shown on the bank statement but not yet recorded by the company. NA Subtract Cr. Shown Checks written by another depositor but mistakenly charged against this company's account. Outstanding checks to suppliers existed at the end of September. Check written against the company's account and cleared by the bank eroneously not recorded by ne company's recordkeeper. Bank service charge for September is not yet recorded by the company. . The company made a month-end accrual for wages earned but not yet paid. 7. Checks outstanding on August 31 that cleared the bank in September. B. The bank received an electronic funds transfer (EFT) and deposited the amount in the company's account on September 30. The company has not yet recorded this EFT. 9. The company made a month-end accrual for expired insurance coverage. 10. Deposits mailed to the bank on September 30 had not been recorded by the bank until October 2. 11. The company had outstanding checks to employees on September 30. 12. The company hired a new treasurer. < Prev 2 of 23 Next > i......

ble for a monthly bank reconciliation dated September 30 is given below. For each item 1 through 12, indicate whether the item uld be added to or subtracted from the book or bank balance, and whether it should or should not appear on the reconciliation. lect the answers in the appropriate cells. Leave no cells blank. Be certain to select "NA" in fields which are not applicable.) Debit or Bank Balance Book Balance Credit to Cash Account Shown or Not Item Shown on Reconciliation NSF check from a customer is shown on the bank statement but not yet recorded by the company. NA Subtract Cr. Shown Checks written by another depositor but mistakenly charged against this company's account. Outstanding checks to suppliers existed at the end of September. Check written against the company's account and cleared by the bank eroneously not recorded by ne company's recordkeeper. Bank service charge for September is not yet recorded by the company. . The company made a month-end accrual for wages earned but not yet paid. 7. Checks outstanding on August 31 that cleared the bank in September. B. The bank received an electronic funds transfer (EFT) and deposited the amount in the company's account on September 30. The company has not yet recorded this EFT. 9. The company made a month-end accrual for expired insurance coverage. 10. Deposits mailed to the bank on September 30 had not been recorded by the bank until October 2. 11. The company had outstanding checks to employees on September 30. 12. The company hired a new treasurer. < Prev 2 of 23 Next > i......

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter6: Cash And Internal Control

Section: Chapter Questions

Problem 6.3E

Related questions

Question

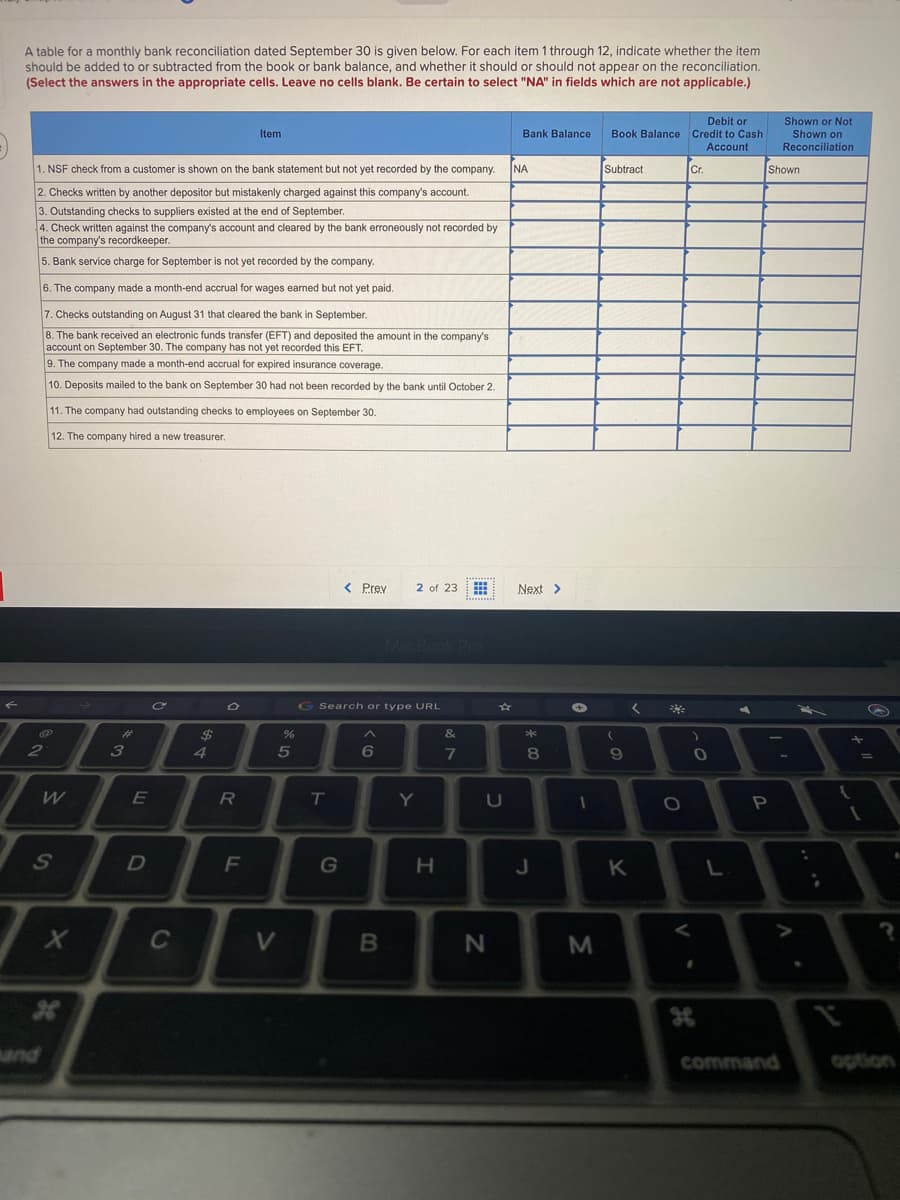

Transcribed Image Text:A table for a monthly bank reconciliation dated September 30 is given below. For each item 1 through 12, indicate whether the item

should be added to or subtracted from the book or bank balance, and whether it should or should not appear on the reconciliation.

(Select the answers in the appropriate cells. Leave no cells blank. Be certain to select "NA" in fields which are not applicable.)

Debit or

Shown or Not

Item

Bank Balance

Book Balance Credit to Cash

Shown on

Account

Reconciliation

1. NSF check from a customer is shown on the bank statement but not yet recorded by the company.

NA

Subtract

Cr.

Shown

2. Checks written by another depositor but mistakenly charged against this company's account.

3. Outstanding checks to suppliers existed at the end of September.

4. Check written against the company's account and cleared by the bank erroneously not recorded by

the company's recordkeeper.

5. Bank service charge for September is not yet recorded by the company.

6. The company made a month-end accrual for wages earned but not yet paid.

7. Checks outstanding on August 31 that cleared the bank in September.

8. The bank received an electronic funds transfer (EFT) and deposited the amount in the company's

account on September 30. The company has not yet recorded this EFT.

9. The company made a month-end accrual for expired insurance coverage.

10. Deposits mailed to the bank on September 30 had not been recorded by the bank until October 2.

11. The company had outstanding checks to employees on September 30.

12. The company hired a new treasurer.

< Prev

2 of 23

Next >

G Search or type URL

く

%23

2$

&

2

3

4

5

6

7

E

R

T

Y

U

S

G

K

L

C

und

command

option

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,