For its fiscal year ending October 31, 2022, Sarasota Corp. reports the following partial data shown below. Income before income taxes $507,600 Income tax expense (20% × $394,800) 78,960 Income from continuing operations 428,640 Loss on discontinued operations 112,800 Net income $315,840 The loss on discontinued operations was comprised of a $47,000 loss from operations and a $65,800 loss from disposal. The income tax rate is 20% on all items. Prepare a correct statement of comprehensive income, beginning with income before income taxes.

For its fiscal year ending October 31, 2022, Sarasota Corp. reports the following partial data shown below. Income before income taxes $507,600 Income tax expense (20% × $394,800) 78,960 Income from continuing operations 428,640 Loss on discontinued operations 112,800 Net income $315,840 The loss on discontinued operations was comprised of a $47,000 loss from operations and a $65,800 loss from disposal. The income tax rate is 20% on all items. Prepare a correct statement of comprehensive income, beginning with income before income taxes.

Chapter17: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 1BCRQ

Related questions

Question

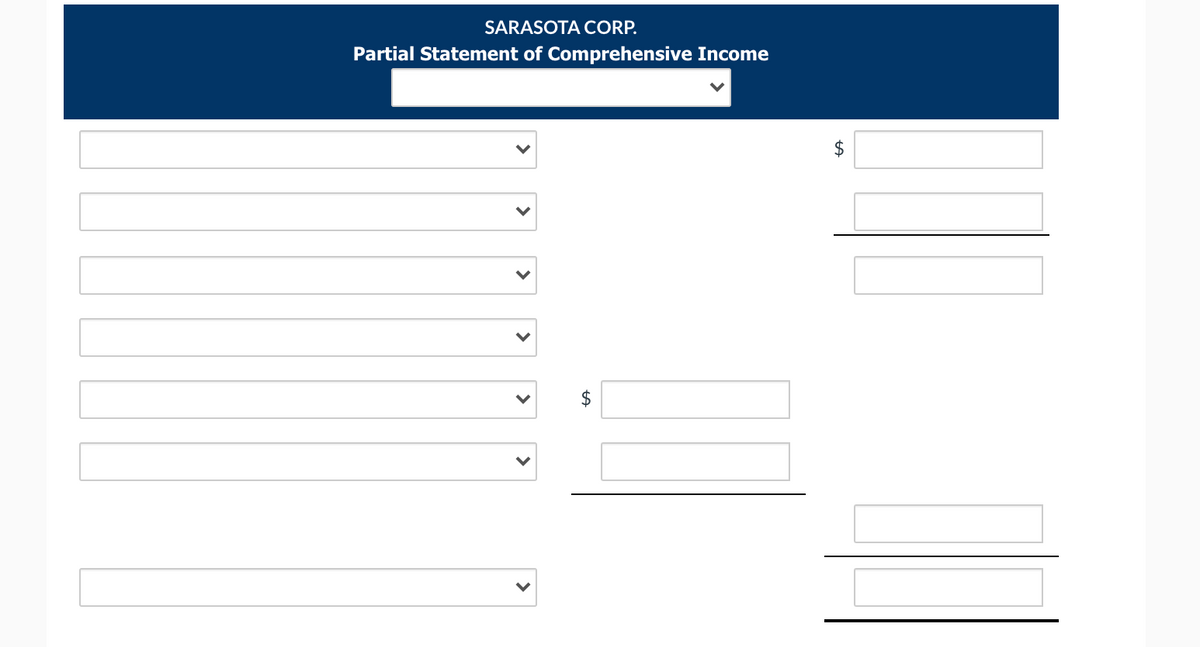

Transcribed Image Text:SARASOTA CORP.

Partial Statement of Comprehensive Income

2$

%24

>

>

>

>

>

>

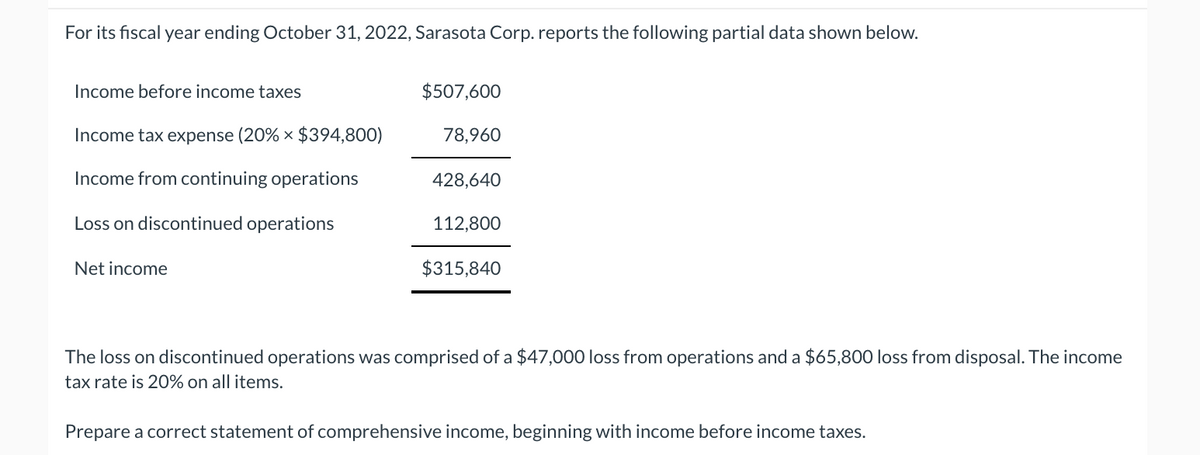

Transcribed Image Text:For its fiscal year ending October 31, 2022, Sarasota Corp. reports the following partial data shown below.

Income before income taxes

$507,600

Income tax expense (20% × $394,800)

78,960

Income from continuing operations

428,640

Loss on discontinued operations

112,800

Net income

$315,840

The loss on discontinued operations was comprised of a $47,000 loss from operations and a $65,800 loss from disposal. The income

tax rate is 20% on all items.

Prepare a correct statement of comprehensive income, beginning with income before income taxes.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning