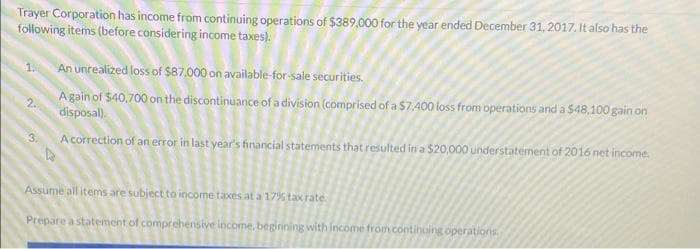

Trayer Corporation has income from continuing operations of $389,000 for the year ended December 31, 2017. It also has the following items (before considering income taxes). 1. An unrealized loss of $87,000 on available-for-sale securities. A gain of $40,700 on the discontinuance of a division (comprised of a $7.400 loss from operations and a $48,100 gain on disposal). A correction of an error in last year's financial statements that resulted in a $20,000 understatement of 2016 net income. Assume all items are subject to income taxes at a 17% tax rate Prepare a statement of comprehensive income, beginning with income from continuing operations

Trayer Corporation has income from continuing operations of $389,000 for the year ended December 31, 2017. It also has the following items (before considering income taxes). 1. An unrealized loss of $87,000 on available-for-sale securities. A gain of $40,700 on the discontinuance of a division (comprised of a $7.400 loss from operations and a $48,100 gain on disposal). A correction of an error in last year's financial statements that resulted in a $20,000 understatement of 2016 net income. Assume all items are subject to income taxes at a 17% tax rate Prepare a statement of comprehensive income, beginning with income from continuing operations

Chapter14: Property Transactions: Capital Gains And Losses, § 1231, And Recapture Provisions

Section: Chapter Questions

Problem 68P

Related questions

Question

Please Solve In 15mins

Transcribed Image Text:FLINT CORPORATION

Partial Statement of Comprehensive Income

Transcribed Image Text:Trayer Corporation has income from continuing operations of $389,000 for the year ended December 31, 2017. It also has the

following items (before considering income taxes).

1.

An unrealized loss of $87,000 on available-for-sale securities.

2.

A gain of $40,700 on the discontinuance of a division (comprised of a $7.400 loss from operations and a $48,100 gain on

disposal).

3.

A correction of an error in last year's financial statements that resulted in a $20,000 understatement of 2016 net income.

Assume all items are subject to income taxes at a 17% tax rate.

Prepare a statement of comprehensive income, beginning with income from continuing operations.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning