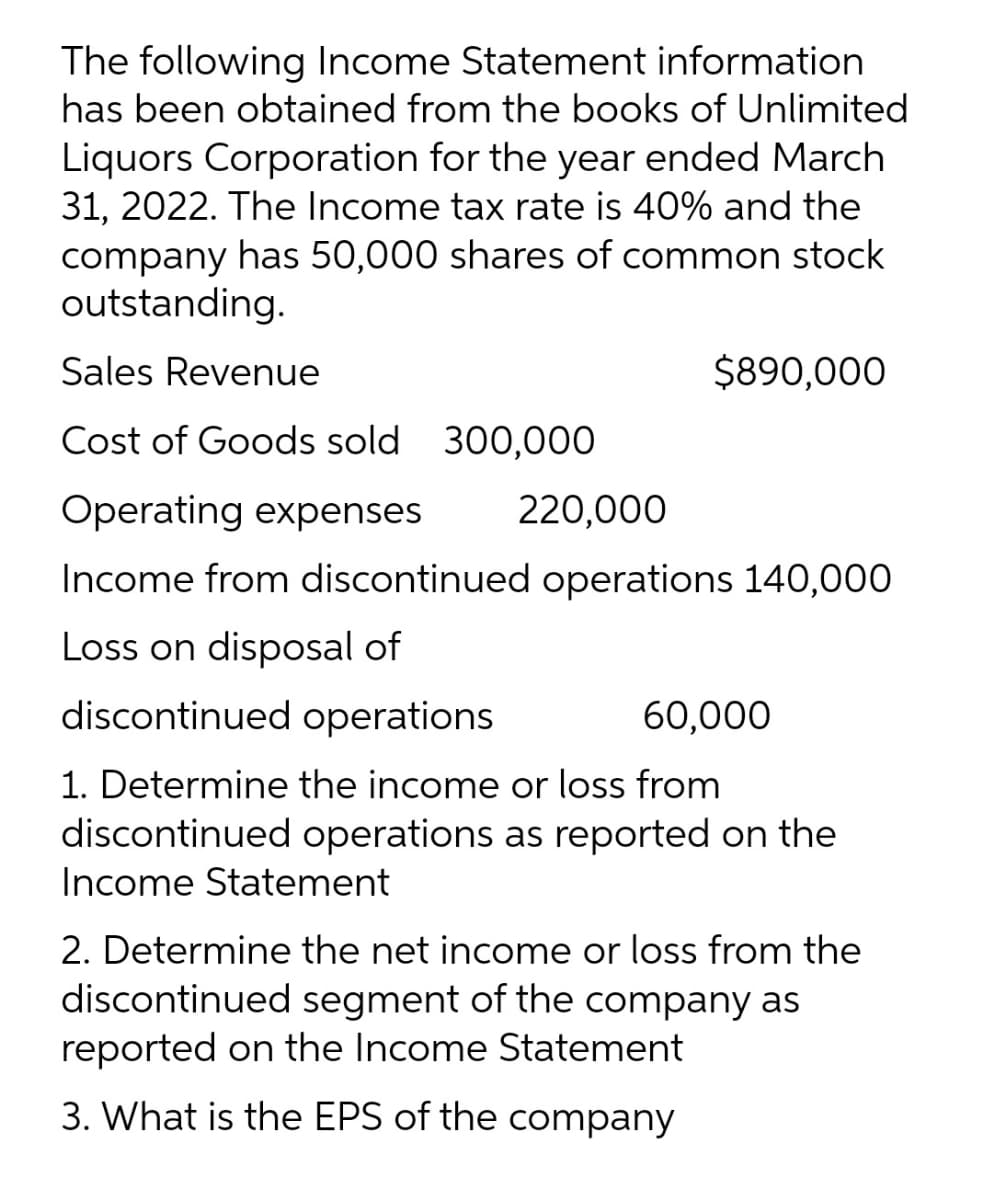

The following Income Statement information has been obtained from the books of Unlimited Liquors Corporation for the year ended March 31, 2022. The Income tax rate is 40% and the company has 50,000 shares of common stock outstanding. Sales Revenue $890,000 Cost of Goods sold 300,000 Operating expenses 220,000 Income from discontinued operations 140,000 Loss on disposal of discontinued operations 60,000 1. Determine the income or loss from discontinued operations as reported on the Income Statement 2. Determine the net income or loss from the discontinued segment of the company as reported on the Income Statement 3. What is the EPS of the company

The following Income Statement information has been obtained from the books of Unlimited Liquors Corporation for the year ended March 31, 2022. The Income tax rate is 40% and the company has 50,000 shares of common stock outstanding. Sales Revenue $890,000 Cost of Goods sold 300,000 Operating expenses 220,000 Income from discontinued operations 140,000 Loss on disposal of discontinued operations 60,000 1. Determine the income or loss from discontinued operations as reported on the Income Statement 2. Determine the net income or loss from the discontinued segment of the company as reported on the Income Statement 3. What is the EPS of the company

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 11P: Net Income and Comprehensive Income At the beginning of 2019, JR Companys shareholders equity was as...

Related questions

Question

100%

Transcribed Image Text:The following Income Statement information

has been obtained from the books of Unlimited

Liquors Corporation for the year ended March

31, 2022. The Income tax rate is 40% and the

company has 50,000 shares of common stock

outstanding.

Sales Revenue

$890,000

Cost of Goods sold 300,000

Operating expenses

220,000

Income from discontinued operations 140,000

Loss on disposal of

discontinued operations

60,000

1. Determine the income or loss from

discontinued operations as reported on the

Income Statement

2. Determine the net income or loss from the

discontinued segment of the company as

reported on the Income Statement

3. What is the EPS of the company

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning