For parts a)-d), evaluate the effect of each of the following events on the market for loanable funds. Explain the effects on savings, investment, and the (neutral) real interest rate. a) The government runs a government budget surplus instead of a deficit. b) The government decides to forgive some of the $66 billion in student loan debt. c) Chinese investors stop sending their funds to Australia, reducing net capital inflows. d) The nominal interest rate rises 1% in response to a 1% rise in the inflation rate.

For parts a)-d), evaluate the effect of each of the following events on the market for loanable funds. Explain the effects on savings, investment, and the (neutral) real interest rate. a) The government runs a government budget surplus instead of a deficit. b) The government decides to forgive some of the $66 billion in student loan debt. c) Chinese investors stop sending their funds to Australia, reducing net capital inflows. d) The nominal interest rate rises 1% in response to a 1% rise in the inflation rate.

Chapter1: Making Economics Decisions

Section: Chapter Questions

Problem 1QTC

Related questions

Question

Please help me with D, E,F

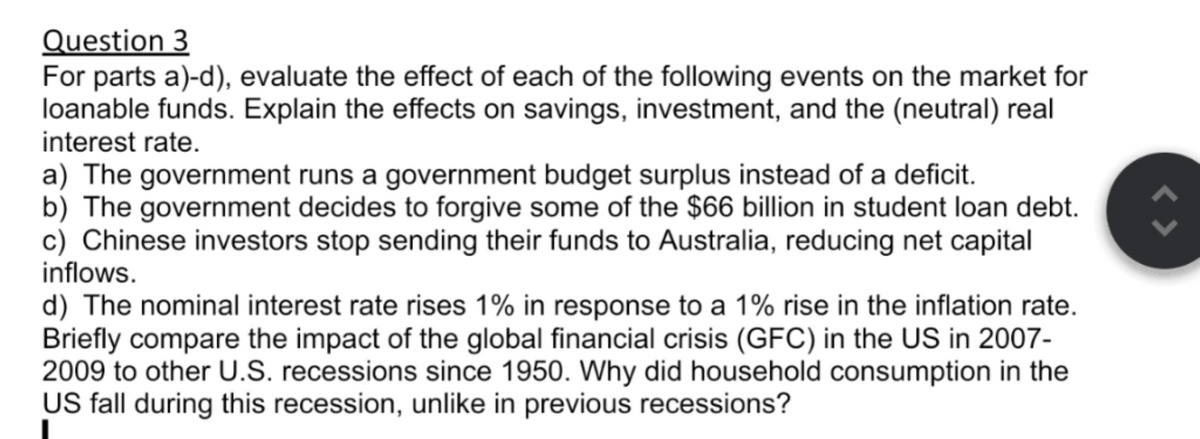

Transcribed Image Text:Question 3

For parts a)-d), evaluate the effect of each of the following events on the market for

loanable funds. Explain the effects on savings, investment, and the (neutral) real

interest rate.

a) The government runs a government budget surplus instead of a deficit.

b) The government decides to forgive some of the $66 billion in student loan debt.

c) Chinese investors stop sending their funds to Australia, reducing net capital

inflows.

d) The nominal interest rate rises 1% in response to a 1% rise in the inflation rate.

Briefly compare the impact of the global financial crisis (GFC) in the US in 2007-

2009 to other U.S. recessions since 1950. Why did household consumption in the

US fall during this recession, unlike in previous recessions?

ŵ

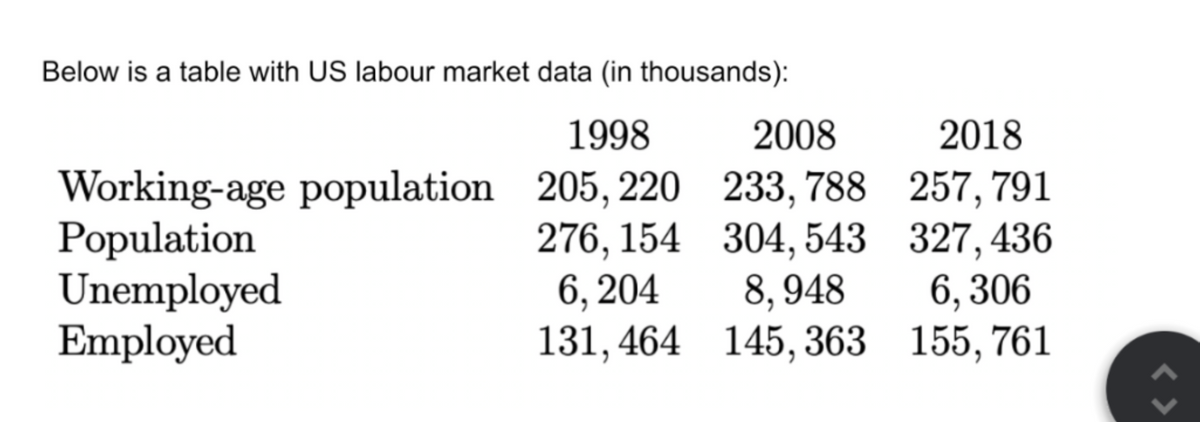

Transcribed Image Text:Below is a table with US labour market data (in thousands):

1998

Working-age population 205, 220

Population

276, 154

Unemployed

Employed

6, 204

131,464

2008

2018

233,788

257, 791

304,543

327, 436

8,948

6,306

145, 363 155, 761

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-…

Economics

ISBN:

9781259290619

Author:

Michael Baye, Jeff Prince

Publisher:

McGraw-Hill Education