For questions 24-25, use the following information; Posner Co. is a retail store operating in a state with a 7% retail sales tax. Posner made credit sales of $750,000 which are subject to 7% sales tax, 24. Total receivables were recorded for how much? 750,000 25. Sales Tax Payable is recorded for how much? 49. 665

For questions 24-25, use the following information; Posner Co. is a retail store operating in a state with a 7% retail sales tax. Posner made credit sales of $750,000 which are subject to 7% sales tax, 24. Total receivables were recorded for how much? 750,000 25. Sales Tax Payable is recorded for how much? 49. 665

Chapter24: Multistate Corporate Taxation

Section: Chapter Questions

Problem 40P

Related questions

Question

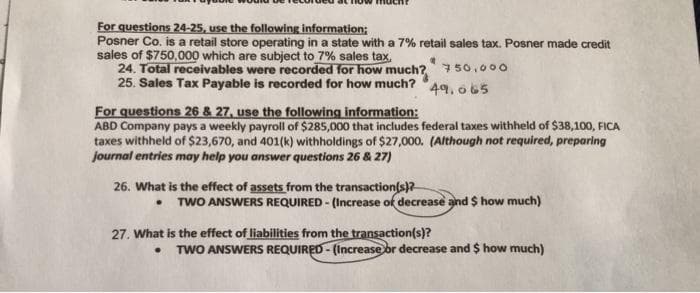

Transcribed Image Text:For questions 24-25, use the following information;

Posner Co. is a retail store operating in a state with a 7% retail sales tax. Posner made credit

sales of $750,000 which are subject to 7% sales tax,

24. Total receivables were recorded for how much? 750,o00

25. Sales Tax Payable is recorded for how much?

49. o65

For questions 26 & 27, use the following information:

ABD Company pays a weekly payroll of $285,000 that includes federal taxes withheld of $38,100, FICA

taxes withheld of $23,670, and 401(k) withholdings of $27,000. (Although not required, preparing

journal entries may help you answer questions 26 & 27)

26. What is the effect of assets from the transaction(s)?

• TWO ANSWERS REQUIRED - (Increase of decrease and $ how much)

27. What is the effect of liabilities from the transaction(s)?

TWO ANSWERS REQUIRED - (Increase or decrease and $ how much)

Expert Solution

Step 1

Hi! Thank you for the question, As per the honor code, we'll answer the first question since the exact one wasn't specified. Please submit a new question by specifying the one you'd like answered in the remaining questions.

The amount that is yet to be received from the customer on the sales made to them is referred to as accounts receivables.

Sales tax is the amount that is charged by the seller from the buyer as a percentage of sales on the price of goods and is collected at the time of sales.

Step 2

24: Total receivables:

Therefore, the total receivables are of $802,500.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub