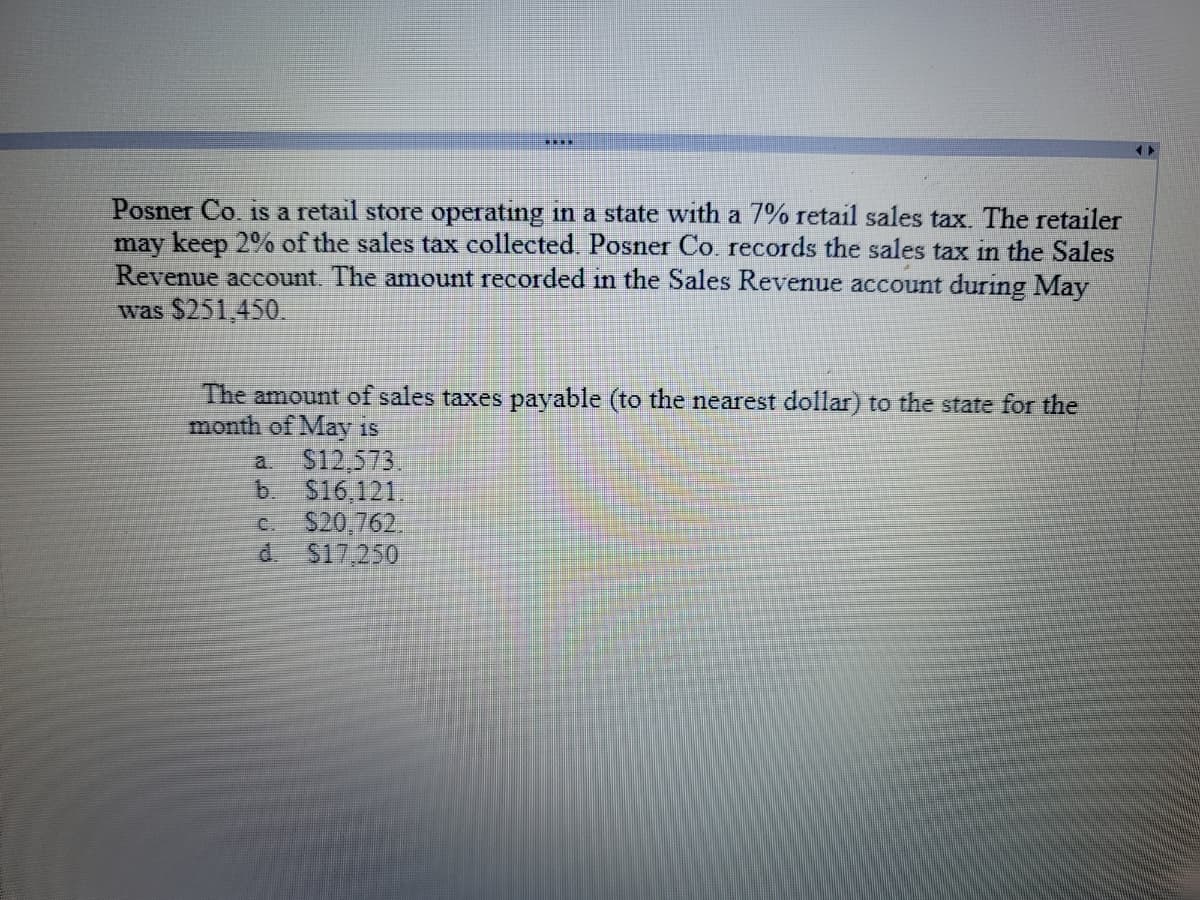

Posner Co. is a retail store operating in a state with a 7% retail sales tax. The retailer may keep 2% of the sales tax collected. Posner Co. records the sales tax in the Sales Revenue account. The amount recorded in the Sales Revenue account during May was $251,450. The amount of sales taxes payable (to the nearest dollar) to the state for the month of May is a. $12,573. b. $16,121. S20,762. d. C. $17,250

Posner Co. is a retail store operating in a state with a 7% retail sales tax. The retailer may keep 2% of the sales tax collected. Posner Co. records the sales tax in the Sales Revenue account. The amount recorded in the Sales Revenue account during May was $251,450. The amount of sales taxes payable (to the nearest dollar) to the state for the month of May is a. $12,573. b. $16,121. S20,762. d. C. $17,250

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter9: Current Liabilities And Contingent Obligations

Section: Chapter Questions

Problem 6RE: Smith Company is required to charge customers an 8% sales tax on all goods it sells. At the time of...

Related questions

Question

Transcribed Image Text:Posner Co. is a retail store operating in a state with a 7% retail sales tax. The retailer

may keep 2% of the sales tax collected. Posner Co. records the sales tax in the Sales

Revenue account. The amount recorded in the Sales Revenue account during May

was $251,450.

The amount of sales taxes payable (to the nearest dollar) to the state for the

month of May is

S12,573.

b. S16.121.

S20,762,

d.

a.

C.

S17,250

Expert Solution

Step 1

Sales tax is a form of taxation imposed on the sale of goods and services. The tax is imposed by the government of any country (or state), and is collected at the point of sale.

The sales tax is deducted from net sales revenue before making an entry in the Sales Revenue account

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College