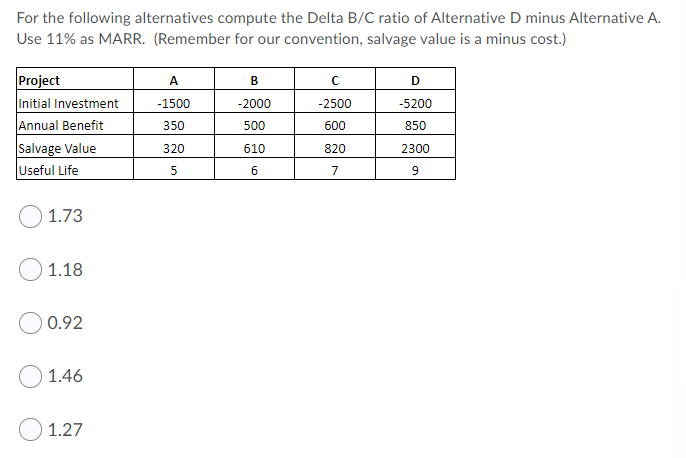

For the following alternatives compute the Delta B/C ratio of Alternative D minus Alternative A. Use 11% as MARR. (Remember for our convention, salvage value is a minus cost.) Project Initial Investment Annual Benefit Salvage Value Useful Life A B D -1500 -2000 -2500 -5200 350 500 600 850 320 610 820 2300 5 6 7 1.73 1.18

Q: The Matrixlandia Government wants to reduce the total amount of sulfur dioxide (SO,) emitted by the…

A: Environmental economics is a branch of economics concerned with the financial consequences of…

Q: If climate change impacts (e.g., increased heat waves, droughts, wildfires, etc.) decrease the…

A: The Solow Model is an external economic expansion model that examines variations in an economy's…

Q: What uniform series over periods (1,11) years is equivalent at 3% compounded annually to the…

A: First, we will find the present value of all the cashflows. Then, we can find the uniform series…

Q: Inflation Unemployment If the Phillip curve shows that unemployment is low and inflation is high in…

A: Philips curve is a curve that shows inverse relationship between unemployment and inflation. If…

Q: external forces that are driving changes in the global economy for transportation. b. A…

A: DISCLAIMER “Since you have asked multiple question, we will solve the first question for you. If…

Q: alleviation of poverty, explain which most worth the conventional and Islamic financing modes in…

A: Poverty has existed from the beginning of time, and it occupies a significant position on almost…

Q: #4 Use the IS-MP model to show what happens when the Federal Reserve raises the federal funds…

A: Disclaimer: Since you have posted multiple questions, I am providing you with the answer to the…

Q: Evaluate your marginal and total utility of consuming at an all you can eat pizza buffet. Explain…

A: The satisfaction that is being obtained by an individual after the consumption of goods or services…

Q: I need help with question 2. You guys have already answered number 1. Externalities and Tax…

A: Answer 2. An externality is a cost or benefit incurred or received by a producer that is not paid…

Q: What are Opportunity Costs? How is it different from Cost Benefits? (2 PAGES)

A: A producer's expenditure on factor and non-factor inputs for a specific amount of production of a…

Q: the demand function and total cost function for a product are 6P = 660 − 3Q, TC = 80 − 20Q2 + 600Q…

A: * SOLUTION :- (3) Given that, the demand function and total cost function for a product are 6P =…

Q: Given the demand functions, (iii) P = 45 (a) Write down the equations for TR. (b) Calculate…

A: The demand function shows the inverse relationship between price and quantity demanded. It means…

Q: #4 Use the IS-MP model to show what happens when the Federal Reserve raises the federal funds…

A: Dear student, you have asked multiple questions in a single post.To get the remaining questions…

Q: (2) Two competing firms are each planning to introduce a new product. Each will decide whether to…

A: The correct answer is given in the second step.

Q: What does it mean by "aggregate demand and aggregate supply" when pertaining to macroeconomic policy…

A: Demand is defined as the amount of goods and services consumed by individuals in an economy during a…

Q: Assuming the equilibrium unemployment rate is 5%, if actual output falls to 5 percentage points…

A:

Q: What are the disadvantages of petrol subsidies?

A: Subsidy is a defined as the form of Government help which is provided to lower down the price of…

Q: Use the orange points (square symbol) to plot the initial short-run industry supply curve when there…

A: We know that the supply curve is the same as the firm's marginal cost curve. In the competitive…

Q: 1.) During the early months of the pandemic in 2020 a.) the price elasticity of demand for some…

A: When talking about initial pandemic situation, it can be seen that there was a high fluctuations in…

Q: YN CN Next question Suppose that the production function is given by 0 5VR N. where Y is output Kis…

A: Given production function Y=0.5K*N δ=0.05s=0s=0.1s=0.2s=1

Q: Suppose Joe and Sarah each have a patent on their respective product: no other supplier can provide…

A: Given, Consumer Demand of Joe and Sarah :Qjoe=300-15Pjoe+10PsarahQsarah=300-15Psarah+10PjoeCosts…

Q: Q.Suppose the government gives $500 to anyone who is out of work. For each $1 earned, the benefit is…

A: The government gives to unemployed = $500 For $1 earned the benefit is reduced by 50 cents Job…

Q: Consider the following sensitivity analysis results: Single Factor being Changed Original Estimate…

A: Under a given set of assumptions, sensitivity analysis evaluates how different values of an…

Q: Using a graph for the loanable funds market of this economy, show what are the effect on the…

A: The market for loanable funds describes how borrowing happens in the market. The supply of loanable…

Q: For an interest rate of 8% per year compounded quarterly, determine the number of times interest…

A: Interest Rate is the rate of borrowing or lending of money from a lender or borrower respectively.…

Q: Explain trade gains graphically and also split trade gains into exchange gains and specialization…

A: Gains from trade are graphically represented by the Production Possibilities Frontier (PPF) curve.…

Q: Suppose I know the production function: Q = F(K,L) = F(5, 10) = 200. The the average product of…

A: Average product of labor is equal to total product per unit of labor.

Q: The table below represents how Marco feels about chocolate candy bars. a. Fill in the missing…

A: Utility means the level of satisfaction that is derived from the consumption of a good or service.

Q: True or False? Explain in 2-3 sentences. If both players use grim trigger strategies, they could…

A: If both players use grim trigger strategies, they could (depending on the value of 5) sustain…

Q: Alice and Bob are playing a repeated game in which a certain stage game is played twice in…

A: It is given that: Alice has 4 pure strategies and Bob has 3 pure strategies in the stage game

Q: QUESTION 2 Assume that a country is endowed with 30 units of oil reserve. (a) the marginal…

A: Marginal willingness to pay = demand curve equation : P = 13 - 0.55q MC of oil = 2 Discount rate =…

Q: GDP Counting Activity Consumption Expenditures (A) Gross Private Domestic Investment (B) Government…

A:

Q: 9) Describe and illustrate the difference between perfect competition and monopolistic competition…

A: There are different prevailing market forms in the economy. Perfect and monopolistic market forms…

Q: Discuss the social and economic implications of subsidising the transportation industry.

A: A good transportation system helps expand the goods market. It can also facilitate the…

Q: World population growth rate from the 6th billion to the 7th billion shows a(n)- O Increasing at a…

A: The "population growth rate" is the rate at which the number of people in a population increases…

Q: 5. Determine the capitalized cost of an expenditure of P 200,000 at time 0, P 25,000 in years 2…

A: Given: Cost at time 0=200,000 Interest rate=12%

Q: Consider a simple economy that produces only pens. The following table contains information on the…

A: Given; In 2018 Money supply= $200 Price of pen= $5.00 Quantity produced= 400 pens

Q: To eliminate losses in a perfectly competitive market, firms exit the industry. This exit results in…

A: Perfectly Competitive firm Graph:-

Q: The Penn Central Railroad has not paid local taxes since 1969, under federal bankruptcy court…

A: A liability is something an individual or organization owes, generally an amount of cash.…

Q: graduating highschool student decided to take a year off and work to save money for college. The…

A: * SOLUTION :-

Q: In economics, utility O A. and relative price are the same thing. B. always decreases as income…

A: Relative price of the good is the ratio of price of the good itself and price of other good.

Q: Characteristics of oligopoly An oligopolistic market structure is distinguished by several…

A: Oligopoly market is one of the forms of market where firms face difficulties in entry and exit.

Q: Activity 2: Taxes and Salary are related to one another when it come to purchasing power which…

A: The worth of a currency is stated in terms of the number of commodities or services that one unit of…

Q: In 2009, the price of Amazon's Kindle 2 was $359, while iSuppli estimated that its marginal cost…

A: Learner's index measures the market power of the firm that enables the firm to charge price greater…

Q: If there is a negative production externality affecting a market (where the firm mistakenly tries to…

A: In a market with negative production externality, it can be said that the production of the good…

Q: Explain the difference between Initial Margin and Maintenance margin in stock trading.

A: The stock market comprehensively alludes to the assortment of trades and different settings where…

Q: An economy is described by the following equations: C=150+0.5 YD I=150 G=200 T=? What is the value…

A: Aggregate expenditure (AE) in closed economy is the sum of consumption, investment, and government…

Q: Inflation Unemployment If the Phillip curve shows that unemployment is low and inflation is high in…

A: The Phillips curve is the downward sloping curve which represents the connection between the…

Q: Suppose a firm sells two goods, Good A and Good B. Use the following information to answer questions…

A: Given information Profit maximizing price of Good A = R200Profit maximizing price of Good B = R75MC…

Q: GDP measures both income and output Select one: O True O False

A: GDP measures the value of final goods and services that are produced with in the country in a given…

Step by step

Solved in 3 steps with 2 images

- Which statement is not true with respect to estimating the economic impacts of proposed engineering projects? (a) Order-of-magnitude estimates are used for high-level planning. (b) Order-of-magnitude estimates are the most accurate type at about –3 to 5%. (c) Increasing the accuracy of estimates requires added time and resources. (d) Estimators tend to underestimate the magnitude of costs and to overestimate benefits.build a modelAn industrial park is being planned for a tract of land near a river. To prevent flood damage to the industrial buildings that will be built on this low-lying land, an earthen embankment can be constructed. The height of the embankment will be determined by an economic analysis of the costs and benefits.The following data have been gathered (Tables 1 and 2). The embankment is expected to last 40 years and will require no maintenance.Whenever the flood water flows over the embarkment, a $310,000 in annual damages occur. The corporation uses an interest rate of 15% a) if they build the embarkment, what height should it have? Table 1 Table 2 Embankment Height Above Roadway (m) Initial Cost ($) Embankment Height Above Roadway (m) Avg Frequency That Flood Level Will Exceed heigh of embarkment 2.0 $ 100,000.00 2.0 Once in 3 years 2.5 $ 165,000.00 2.5 Once in 8 years 3.0 $ 300,000.00 3.0 Once in 25 years 3.5…If the capital budget limit is $120,000, the MARR is 10% per year, and all projects have a 10-year life, rank and select from the independent projects using the (a) PI measure, (b) IROR measure, and (c) PW at the MARR. (d) Are different projects selected using the three methods? First Net Income, IROR, PW at Project Cost, $ $ per Year % 10%, $ A −18,000 4,000 18.0 6,578 B −15,000 2,800 13.3 2,205 C −35,000 12,600 34.1 42,422 D −60,000 13,000 17.3 19,879 E −50,000 8,000 9.6 −843

- The California Forest Service is considering two locations for a new state park. Location Ewould require an investment of $3 million and $50,000 per year in maintenance. Location Wwould cost $7 million to construct, but the Forest Service would receive an additional $25,000per year in park use fees. The operating cost of location W will be $65,000 per year. The revenueto park concessionaires will be $500,000 per year at location E and $700,000 per year at locationW. The disbenefits associated with each location are $30,000 per year for location E and $40,000per year for location W. Use(a) The B/C method, and(b) The modified B/C method to determine which location, if either, should be selected, using aninterest rate of 12% per year. Assume that the park will be maintained indefinitely.Engineering economy - ENGR 3322 A new municipal refuse-collection truck can be purchased for $84,000. Its expected useful life is six years, at which time its market value will be zero. Annual receipts less expenses will be approximately $18,000 per year over the six-year study period. At MARR of 19%, calculate the benefit-cost ratio of the project a. 53 b. 63 c. 73 d. None of the choicesInitial Cost: ($300,000)The Study Period: 15 yearsSalvage (Market) Value of the Project: 12% of the initial costOperating Costs in the first year: ($7,500)Operating Costs increase by 5% per yearBenefits in the first year: $30,000 Benefit increase by 13% per yearMARR: 9% per year 1)Determine the NPW, AW, FW of the project. 2) Is the Project acceptable? WHY?

- An oil company plans to purchase a piece of vacant land at the corner of two busy streets for $50,000. On properties of this type, the company installs businesses of three different types. Each has an estimated useful life of 15 years. The salvage value for each is estimated to be the $50,000 land cost. Plan Cost (in addition to land cost) Type of business Net annual income A $ 83,000 Conventional gas station $ 26,500 B $ 195,000 Add automatic car wash $ 39,750 C $ 115,000 Add quick car wash $ 31,200 if the oil company expects a 10% rate of return on its investments, which plan (if any) should be selected? Use incremental analysis, before tax.Solve the Engineering Economics Problem: Project Feasibility Indicator Which alternative should be selected based on BCR? Assume i=7% and a study period of 10 years. Sensor A: First cost: Php 87,000 Annual M&O: Php 64,000 Annual Benefits: Php 160,000 Annual Disbenefits: --- Sensor B First cost: Php 38,000 Annual M&O: Php 49,000 Annual Benefits: Php 110,000 Annual Disbenefits: Php 26,000A municipality is investigating the maintenance and refurbishment of the main road through the town . They can either resurface the road every 10 years , or resurface every 15 years but with higher maintenance costs . The municipality uses a 5 % interest rate for their appraisals to include in their applications for the Municipal Infrastructure Grant ( MIG ) . The funding will be available such that construction can be completed by the end of the current financial year . They have determined the following data , but they need you to carry out an economic appraisal as the basis from which to advise them : 10 - year resurfacing cycle Resurfacing : R15 000 000 Maintenance schedule : Year 1-5 : zero Year 6 : R300 000 Year 7 : R600 000 Year 8-10 : R800 000 15 Year resurfacing cycle : Resurfacing : R15 000 000 Maintenance schedule : Year 1-5 : zero Year 6 : R300 000 Year 7 : R600 000 Year 8-10 : R800 000 Year 11-15 : R1 000 000

- The following estimates (in $1000 units) have been developed for a security system upgrade at Chicago’s O’Hare Airport. (a) Calculate the conventional B/C ratio at a discount rate of 10% per year. Is the project justified? (b) Determine the minimum first cost that is possible to render the project just economically unjustified. Item Cash Flow First cost, $ 13,000 AW of benefits, $ per year 3,800 FW of disbenefits, year 20, $ 6,750 M&O costs, $ per year 400 Life, years 20The city of Oakmont is interested in developing some lake front property into a sports park (picnic facilities, boat docks, swimming area, etc.). A consultant has estimated that the city would need to invest $3 million in this project. In return, the developed property would return $500,000 per year to the city through increased tax revenues and recreational benefits to the public. Whatwould the life of this project need to be in order to be cost-beneficial to the city? The interest rate on municipal bonds is 6% per year.Determine the FW of the following engineering project when the MARR is 15% per year. Is the project acceptable? (5.4) *A negative market value means that there is a net cost to dispose of an asset. Investment cost Expected lifeMarket (salvage) value* Annual receiptsAnnual expenses $10,000 5 years -$1,000 $8,000 $4,000