For the part B, on opportunity cost, should the 200k be added to (0.06*200k) again in addtion to all other forgone altenative? Kindly explain.

For the part B, on opportunity cost, should the 200k be added to (0.06*200k) again in addtion to all other forgone altenative? Kindly explain.

Principles of Economics 2e

2nd Edition

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:Steven A. Greenlaw; David Shapiro

ChapterA: The Use Of Mathematics In Principles Of Economics

Section: Chapter Questions

Problem 3RQ: Exercise A3 What dome slices of a pie chart represent?

Related questions

Question

For the part B, on

Transcribed Image Text:合日

Document1

Q. Search in Document

Home

Insert

Draw

Design

Layout

References

Mailings

Review

View

+ Share a

A. A-

E -E - E , E E

Times New R... -

AaBbCcDc AaBbCcDdEe AaBb( AabbCcDdEe

AaBbCcDdEe

AaBbCcDdEe

AgBbCcDdEe

AgBbCcDdEe

Paste

в

I

U - abe X, x2

Normal

Heading 1

Subtle Emph..

Emphasis

Styles

Pane

No Spacing

Heading 2

Title

Subtitle

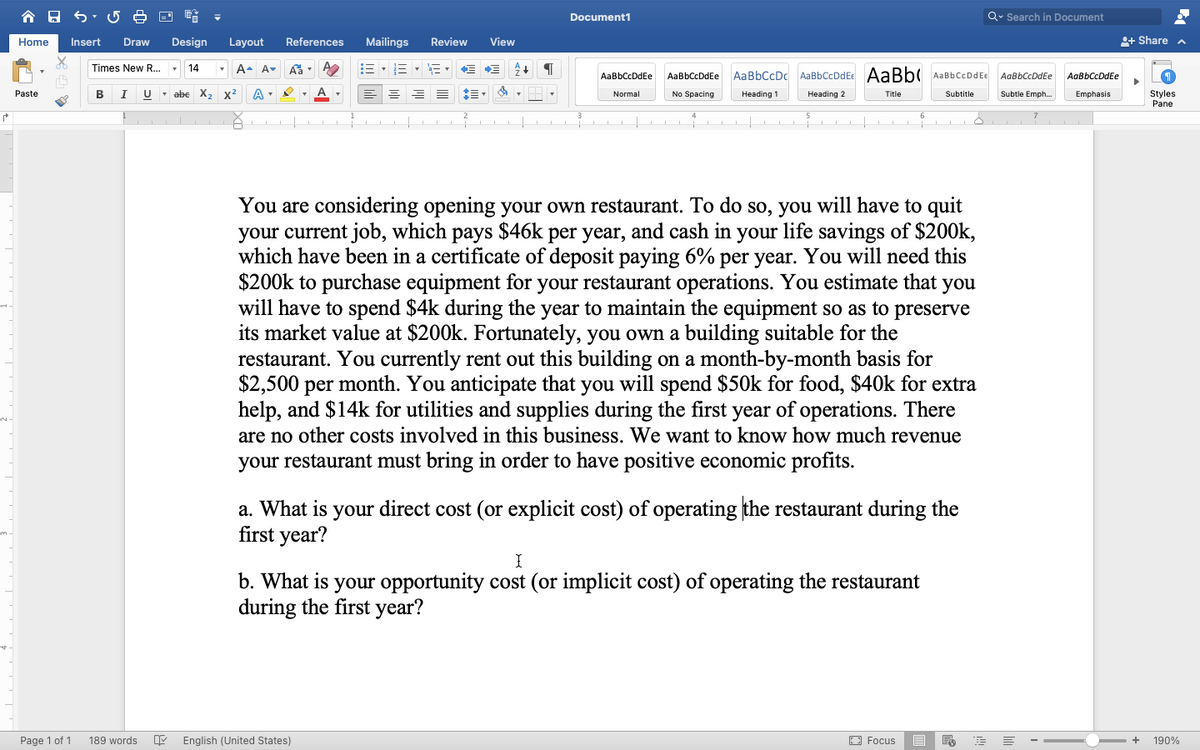

You are considering opening your own restaurant. To do so, you will have to quit

your current job, which pays $46k per year, and cash in your life savings of $200k,

which have been in a certificate of deposit paying 6% per year. You will need this

$200k to purchase equipment for your restaurant operations. You estimate that you

will have to spend $4k during the year to maintain the equipment so as to preserve

its market value at $200k. Fortunately, you own a building suitable for the

restaurant. You currently rent out this building on a month-by-month basis for

$2,500 per month. You anticipate that you will spend $50k for food, $40k for extra

help, and $14k for utilities and supplies during the first year of operations. There

are no other costs involved in this business. We want to know how much revenue

your restaurant must bring in order to have positive economic profits.

a. What is your direct cost (or explicit cost) of operating the restaurant during the

first year?

b. What is your opportunity cost (or implicit cost) of operating the restaurant

during the first year?

Page 1 of 1

189 words

English (United States)

O Focus

190%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax