For the past several years, Steffy Lopez has operated a part-time consulting business from his home. As of July 1, 2018, Steffy decided to move to rented quarters and to operate the business, which was to be known as Diamond Consulting, on a full-time basis. Diamond Consulting entered into the following transactions during July: Jul. 1 The following assets were received from Steffy Lopez in exchange for common stock: cash, $13,500; accounts receivable, $20,800; supplies, $3,200; and office equipment, $7,500. There were no liabilities received. 1 Paid two months’ rent on a lease rental contract, $4,800. 2 Paid the annual premiums on property and casualty insurance policies, $4,500. 4 Received cash from clients as an advance payment for services to be provided, and recorded it as unearned fees, $5,500. 5 Purchased additional office equipment on account from Office Station Co., $6,500. 6 Received cash from clients on account, $15,300. 10 Paid cash for a newspaper advertisement, $400. 12 Paid Office Station Co. for part of the debt incurred on July 5, $5,200. 12 Recorded services provided on account for the period July 1–12, $13,300. 14 Paid receptionist for two weeks’ salary, $1,750. Record the following transactions on Page 2 of the journal: Jul. 17 Recorded cash from cash clients for fees earned during the period July 1–17, $9,450. 18 Paid cash for supplies, $600. 20 Recorded services provided on account for the period July 13–20, $6,650. 24 Recorded cash from cash clients for fees earned for the period July 17–24, $4,000. 26 Received cash from clients on account, $12,000. 27 Paid receptionist for two weeks’ salary, $1,750. 29 Paid telephone bill for July, $325. 31 Paid electricity bill for July, $675. 31 Recorded cash from cash clients for fees earned for the period July 25–31, $5,200. 31 Recorded services provided on account for the remainder of July, $3,000. 31 Paid dividends, $12,500. Required: 1. Journalize each transaction in a two-column journal starting on Page 1, referring to the chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) 2. A. Post the journal to a ledger of four-column accounts. • Download the spreadsheet in the Ledger panel and save the Excel file to your computer. Use the spreadsheet to post the July transactions from the journal to a ledger of four-column accounts. Be sure to save your work in Excel as it will be used to complete the following steps in Part 1 of this problem as well as steps in Part 2 of this problem. Your input into the spreadsheet will not be included in your grade in CengageNOW on this problem. B. Add the appropriate posting reference to the journal in CengageNOW. 3. Prepare an unadjusted trial balance.

For the past several years, Steffy Lopez has operated a part-time consulting business from his home. As of July 1, 2018, Steffy decided to move to rented quarters and to operate the business, which was to be known as Diamond Consulting, on a full-time basis. Diamond Consulting entered into the following transactions during July: Jul. 1 The following assets were received from Steffy Lopez in exchange for common stock: cash, $13,500; accounts receivable, $20,800; supplies, $3,200; and office equipment, $7,500. There were no liabilities received. 1 Paid two months’ rent on a lease rental contract, $4,800. 2 Paid the annual premiums on property and casualty insurance policies, $4,500. 4 Received cash from clients as an advance payment for services to be provided, and recorded it as unearned fees, $5,500. 5 Purchased additional office equipment on account from Office Station Co., $6,500. 6 Received cash from clients on account, $15,300. 10 Paid cash for a newspaper advertisement, $400. 12 Paid Office Station Co. for part of the debt incurred on July 5, $5,200. 12 Recorded services provided on account for the period July 1–12, $13,300. 14 Paid receptionist for two weeks’ salary, $1,750. Record the following transactions on Page 2 of the journal: Jul. 17 Recorded cash from cash clients for fees earned during the period July 1–17, $9,450. 18 Paid cash for supplies, $600. 20 Recorded services provided on account for the period July 13–20, $6,650. 24 Recorded cash from cash clients for fees earned for the period July 17–24, $4,000. 26 Received cash from clients on account, $12,000. 27 Paid receptionist for two weeks’ salary, $1,750. 29 Paid telephone bill for July, $325. 31 Paid electricity bill for July, $675. 31 Recorded cash from cash clients for fees earned for the period July 25–31, $5,200. 31 Recorded services provided on account for the remainder of July, $3,000. 31 Paid dividends, $12,500. Required: 1. Journalize each transaction in a two-column journal starting on Page 1, referring to the chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) 2. A. Post the journal to a ledger of four-column accounts. • Download the spreadsheet in the Ledger panel and save the Excel file to your computer. Use the spreadsheet to post the July transactions from the journal to a ledger of four-column accounts. Be sure to save your work in Excel as it will be used to complete the following steps in Part 1 of this problem as well as steps in Part 2 of this problem. Your input into the spreadsheet will not be included in your grade in CengageNOW on this problem. B. Add the appropriate posting reference to the journal in CengageNOW. 3. Prepare an unadjusted trial balance.

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter6: Work Sheet And Adjusting Entries For A Service Business

Section: Chapter Questions

Problem 4AP

Related questions

Question

For the past several years, Steffy Lopez has operated a part-time consulting business from his home. As of July 1, 2018, Steffy decided to move to rented quarters and to operate the business, which was to be known as Diamond Consulting, on a full-time basis. Diamond Consulting entered into the following transactions during July:

| Jul. | 1 | The following assets were received from Steffy Lopez in exchange for common stock: cash, $13,500; |

| 1 | Paid two months’ rent on a lease rental contract, $4,800. | |

| 2 | Paid the annual premiums on property and casualty insurance policies, $4,500. | |

| 4 | Received cash from clients as an advance payment for services to be provided, and recorded it as unearned fees, $5,500. | |

| 5 | Purchased additional office equipment on account from Office Station Co., $6,500. | |

| 6 | Received cash from clients on account, $15,300. | |

| 10 | Paid cash for a newspaper advertisement, $400. | |

| 12 | Paid Office Station Co. for part of the debt incurred on July 5, $5,200. | |

| 12 | Recorded services provided on account for the period July 1–12, $13,300. | |

| 14 | Paid receptionist for two weeks’ salary, $1,750. |

Record the following transactions on Page 2 of the journal:

| Jul. | 17 | Recorded cash from cash clients for fees earned during the period July 1–17, $9,450. |

| 18 | Paid cash for supplies, $600. | |

| 20 | Recorded services provided on account for the period July 13–20, $6,650. | |

| 24 | Recorded cash from cash clients for fees earned for the period July 17–24, $4,000. | |

| 26 | Received cash from clients on account, $12,000. | |

| 27 | Paid receptionist for two weeks’ salary, $1,750. | |

| 29 | Paid telephone bill for July, $325. | |

| 31 | Paid electricity bill for July, $675. | |

| 31 | Recorded cash from cash clients for fees earned for the period July 25–31, $5,200. | |

| 31 | Recorded services provided on account for the remainder of July, $3,000. | |

| 31 | Paid dividends, $12,500. |

| Required: | |||||||||||||

| 1. | Journalize each transaction in a two-column journal starting on Page 1, referring to the chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) | ||||||||||||

| 2. |

|

||||||||||||

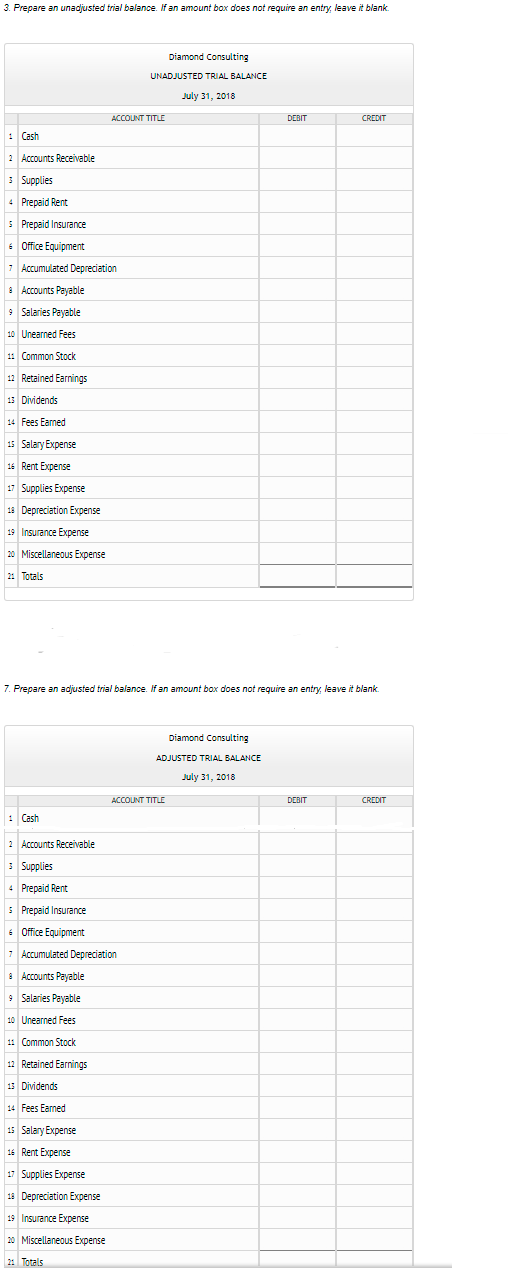

| 3. | Prepare an unadjusted |

||||||||||||

| 4. | At the end of July, the following adjustment data were assembled. Analyze and use these data to complete requirements (5) and (6).

|

||||||||||||

| 5. | (Optional) On your own paper or spreadsheet, enter the unadjusted trial balance on an end-of-period work sheet and complete the work sheet. Find a blank end-of-period work sheet in the Excel spreadsheet you previously downloaded. | ||||||||||||

| 6. |

|

||||||||||||

| 7. | Prepare an adjusted trial balance. If an amount box does not require an entry, leave it blank. |

CHART OF ACCOUNTSDiamond ConsultingGeneral Ledger

| ASSETS | |

| 11 | Cash |

| 12 | Accounts Receivable |

| 14 | Supplies |

| 15 | Prepaid Rent |

| 16 | Prepaid Insurance |

| 18 | Office Equipment |

| 19 |

| LIABILITIES | |

| 21 | Accounts Payable |

| 22 | Salaries Payable |

| 23 | Unearned Fees |

| EQUITY | |

| 31 | Common Stock |

| 32 | |

| 33 | Dividends |

| 34 | Income Summary |

| REVENUE | |

| 41 | Fees Earned |

| EXPENSES | |

| 51 | Salary Expense |

| 52 | Rent Expense |

| 53 | Supplies Expense |

| 54 | Depreciation Expense |

| 55 | Insurance Expense |

| 59 | Miscellaneous Expense |

Transcribed Image Text:1.

Jourmalize each transaction in a two-column jourmal starting on Page 1, refeming to the chart of accounts in selecting the accounts to be

debited and credited. (Do not insert the account numbers in the journal at this time.)

2. B. Add the appropriate posting reference to the joumal in CengageNOW.

6. A. Joumalize the adjusting entries on page 3 of the journal. Adjusting entries are recorded on July 31.

6. C. Add the appropriate posting reference to the adjusting entries in the journal in CengageNOW.

JOURNAL

ACCOUNTING EQUATION

DATE

DESCRIPTION

POST, REF.

DEBIT

CREDIT

ASSETS

LIABILITIES

EQUITY

2

4

7

10

11

12

13

14

15

16

17

18

19

20

21

22

23

JOURNAL

ACCOUNTING EQUATION

DATE

DESCRIPTION

POST. REF.

DEBIT

CREDIT

ASSETS

LIABILITICS

EQUITY

2

4

10

11

12

13

14

15

16

17

18

19

20

21

22

JOURNAL

ACCOUNTINO EQUATION

DATE

DESCRIPTION

POST. REF.

DEBIT

CREDIT

ASSETS

LIABILITIES

EQUITY

Adjusting Entries

2

4

10

11

12

13

Transcribed Image Text:3. Prepare an unadjusted trial balance. If an amount box does not require an entry, leave it blank

Diamond Consulting

UNADJUSTED TRIAL BALANCE

July 31, 2018

ACCOUNT TITLE

DEBIT

CREDIT

1 Cash

2 Accounts Receivable

3 Supplies

4 Prepaid Rent

5 Prepaid Insurance

E Office Equipment

7 Accumulated Depreciation

a Accounts Payable

9 Salaries Payable

10 Unearned Fees

11 Common Stock

12 Retained Earnings

13 Dividends

14 Fees Earned

15 Salary Expense

14 Rent Expense

17 Supplies Expense

18 Depreciation Expense

19 Insurance Expense

20 Miscellaneous Expense

21 Totals

7. Prepare an adjusted trial balance. If an amount box does not require an entry, leave it blank.

Diamond Consulting

ADJUSTED TRIAL BALANCE

July 31, 2018

ACCOUNT TITLE

DEBIT

CREDIT

1 Cash

2 Accounts Receivable

3 Supplies

4 Prepaid Rent

5 Prepaid Insurance

E Office Equipment

7 Accumulated Depreciation

a Accounts Payable

9 Salaries Payable

10 Unearned Fees

11 Common Stock

12 Retained Earnings

13 Dividends

14 Fees Earned

15 Salary Expense

16 Rent Expense

17 Supplies Expense

18 Depreciation Expense

19 Insurance Expense

20 Miscellaneous Expense

21 Totals

Expert Solution

Step 1 Introduction

Question is based on the concept of Final Accounts.

As per Bartleby guidelines we are allowed to answer only the first 3 questions. For the rest of the questions you have to repost the questions

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College