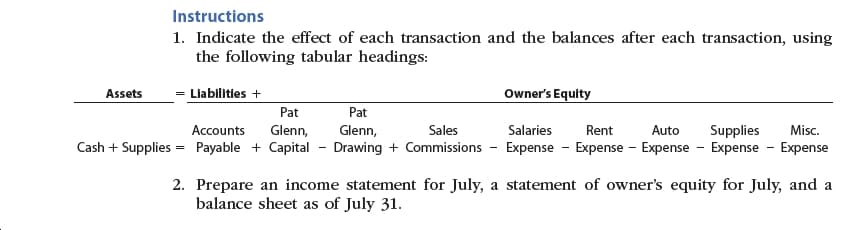

Instructions 1. Indicate the effect of each transaction and the balances after each transaction, using the following tabular headings: Owner's Equity Liabilities Assets Pat Pat Accounts Glenn, Glenn, Sales Salaries Rent Auto Supplies Misc. Cash Supplies Payable Capital - Drawing Commissions Expense Expense Expense Expense Expense 2. Prepare an income statement for July, a statement of owner's equity for July, and a balance sheet as of July 31

On July 1, 2019, Pat Glenn established Half Moon Realty. Pat completed the following transactions during the month of July:

a. Opened a business bank account with a deposit of $25,000 from personal funds.

b. Purchased office supplies on account, $1,850.

c. Paid creditor on account, $1,200.

d. Earned sales commissions, receiving cash, $41,500.

e. Paid rent on office and equipment for the month, $3,600.

f. Withdrew cash for personal use, $4,000.

g. Paid automobile expenses (including rental charge) for the month, $3,050, and miscellaneous expenses, $1,600.

h. Paid office salaries, $5,000.

i. Determined that the cost of supplies on hand was $950; therefore, the cost of supplies used was $900.

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images