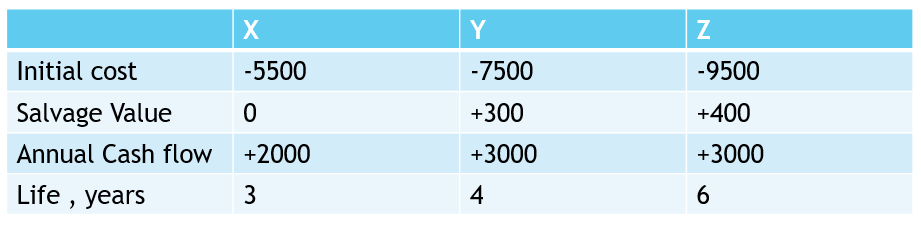

For the three mutually exclusive alternatives below, use a MARR of 15% per year to select the best alternative using (a.) rate of return analysis and (b.) Aw analysis on the actual cash flow estimates with MARR=15%

Q: Find the following values for a single cash flow: The future value of $600 invested at 9 percent for…

A: Present value method is used to evaluate the different level of investment projects. With the help…

Q: For the net cash flow series, find the external rate of return (EROR) using the MIRR method with an…

A: The given problem can be solved using MIRR function in excel.

Q: please solve the question in detail and without using excel sheets or equations rather use…

A: The modified internal rate of return (MIRR) assumes that positive cash flows are reinvested at the…

Q: Compute the Payback Period, Discounted Payback Period, Net Present Value, Internal Rate of Return,…

A: Capital projects are those that are spread across several years and requires a significant initial…

Q: d. You are given two investment alternatives to analyse. The cash flows from these two instruments…

A: The present value of the annuity factor is used when there is an equal series of cash flows and the…

Q: Yıl Nakit akışı 0 -1000 TL 1 +300 TL 3 +300 TL 4 +300 TL 5 +300 TL

A: Internal Rate of Return is the rate at which NPV of the Investment is zero. It is compared with MARR…

Q: ssume that the amount of initial investment is $350,000 and the scheduled receipts are $250,000 in…

A: Net Present Value is the difference between the present value of cash inflows and cash outflows.

Q: The present worth in year 10 of a decreasing geometric gradient series was calculated using…

A: a

Q: The equations below show the discounted or present value of cash flows either one year or twenty…

A: Percentage change in the present value of $100 in 1 year when the interest rate changes from 5% to…

Q: A company is investigating two production options of the manufactured switches that have the…

A: Net present worth is the present value of inflows less present value of outflows. Present value of…

Q: Wells Inc., has identified an investment project with the following cash flows. Year…

A: The future value calculation is an important tool of financial management. In future value…

Q: ou are given three investment alternatives to analyze. The cash flows from these three investments…

A: Let CFn = Cashflow in year n Discount rate (r) = 13%

Q: The following cash flow diagram represents an investment of Php 400 and revenue of x at the end of…

A: In order to have net present worth to be zero, Present value of end of year cash flows = Initial…

Q: Calculate the future equivalent at the end of 2012, at 25% per year, of the following series of cash…

A: Interest rate (r) = 25% Cashflow in year 2008 (CF1) = $1000 CF2 = $1000 - $100 = $900 CF3 = $1000 -…

Q: Wainright Co. has identified an investment project with the following cash flows. Year Cash…

A: Working note:

Q: Consider the following three cash flow series: Determine the values of X and Y so that you are…

A: Computation of present worth of cash flow B is as…

Q: a. What are the project’s annual net cash inflows? b. What is the present value of the project’s…

A: Since you have asked a question with multiple sub parts , we will solve first three subparts for…

Q: A project with the following cash flows received each year and with a required return of 8%. Initial…

A: Using Excel

Q: Assuming a 1-year, money market account investment at 4.97 percent (APY), a 2.96% inflation rate, a…

A: Answer 1: Information Provided: APY = 4.97% Inflation rate = 2.96% Marginal tax = 28% Balance =…

Q: What is the profitability index for an investment with the following cash flows given a 20 percent…

A: The Profitability Index(PI) is one of the capital budgeting techniques that take into consideration…

Q: The cash flows for 2 mutually exclusive alternatives are shown below. Determine which should be…

A: Given: Item Description Vendor A Vendor B Initial Cost ($200,000) ($550,000) Annual…

Q: The incremental cash flows for alternatives P and Q are shown. Determine which should be selected…

A: Internal rate of return method: Internal rate of return method is one of the capital investment…

Q: You are evaluating two mutually exclusive projects: Project A and Project B. Both Project A and…

A: project A B IRR 35.00% 30.00% CROSS OVER RATE 20.00%

Q: The cash flows for two alternatives X and Y are shown in the table displayed here. Year: 0 1 2 3…

A: Year Cash Flow - A Cash Flow - B 0 -3000 -5000 1 900 1400 2 900 1400 3 900 1400 4 900…

Q: Consider the following cash flow profile and assume MARR is 10%/year. EOY NCF -$80 1 $22 2 $22 3 $22…

A: The question is based on the concept of calculation of External rate of return (ERR). ERR is a…

Q: For the nonconventional net cash flow series shown, the ex return per year using the MIRR method,…

A: The MIRR is the modified rate of internal rate which assumes that reinvestment is different from the…

Q: For the cash flow shown below. Find the external rate of return (EROR) using rate of return approach…

A: Cash Flow Statement is a part of the Financial Statement of a company. It literally means a…

Q: Use the ERR method with ∈=8% per year to solve for a unique rate of return for the following…

A: Descartes’ rule of sign is used to determine the maximum number of real numbers (positive) solutions…

Q: With an initial cost of $100,000, a WACC of 15%, and subsequent cash flows for years 1, 2, 3 of…

A: Payback Period = Years before full recovery + (unrecovered cost at the start of the year/ cashflow…

Q: McCann Co. has identified an investment project with the following cash flows. Year Cash Flow…

A: a. If the discount rate is 10 percent, what is the present value of these cash flows? Discount rate…

Q: An investment has the following cash flow profile. For each value of MARR below, what is the minimum…

A: Investment is attractive only when IRR is equal to or greater than MARR. Hence, we need to find…

Q: For the net cash flow series, find the external rate of return (EROR) using the MIRR method with an…

A: Formula used for calculating EROR using MIRR is:

Q: According to Descartes' rule of signs, how many possible i values are there for the cash flows…

A: Information provided: Year Cashflows 0 -9000 1 4100 2 -2000 3 -7000 4 12000 5 700…

Q: The Potential for Multiple IRRs A proposed investment has the following projected after-taxcash…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: Wells, Inc., has identified an investment project with the following cash flows. Year…

A: Information Provided: Cash flow Year 1 = 970 Cash flow Year 2 = 1200 Cash flow Year 3 = 1420 Cash…

Q: Three mutually exclusive investment alternatives are being considered. The estimated cash flows for…

A: Note: This question has multiple subparts. The first three have been answered below.

Q: You have found an investment opportunity that will provide annual cash flows of $1,234 for 5 years…

A: Here, Cost is $6789 Annual Cash Flows is $1234 Time Period is 5 years Required Return is 12%

Q: For the cash flows shown, determine: (a) the number of possible i* values (b) the i* value displayed…

A: Calculation of the possible i* values, IRR and external rate of return using MIRR is shown below:…

Q: Fox Co. has identified an investment project with the following cash flows. Year 1 Cash Flow $1,330…

A: Present value can be defined as the current value of an amount of money or a series of cash inflows…

Q: Project A has the following estimated cash flows and present values: Year…

A: Sensitivity analysis: Sensitivity analysis allows managers to make changes to any one of the factors…

Q: Assuming a 1-year, money market account investment at 2.51 percent (APY), a 1.1% inflation rate, a…

A: After tax rate of return will be calculated to get the exact return a person earn from investment…

Q: Consider the following cash flow profile, and assume MARR is 11 percent/year. ΕΟΥ NCF $-115 $19 2…

A: a) According to Descartes' rule of signs, there are as many IRRs as there are sign changes in the…

Q: Compute the time needed for payback for the following example assuming the investment required an…

A: The payback period is the time required by the company to recover its initial investment, it doesn't…

Q: Compare the alternatives shown below on the basis of their capitalized costs. Use i=14% per year.…

A:

Q: or the nonconventional net cash flow series shown, the external rate of return per year using the…

A: ERROR is the external rate of return, MIRR is the modified internal rate of return, b is the…

For the three mutually exclusive alternatives below, use a MARR of 15% per year to select the best alternative using (a.)

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Determine the ERR (External rate of return) of the cash flows if external rate (e) is given as %19. Year Cash Flow 0 -3000 1 2000 2 4000 3 -1000 4 3000 5 4000 6 -5000 7 9000 Select one: a. 0.2988 b. 0.2638 c. 0.2565 d. 0.3073 e. 0.2783 f. 0.3491The following information is available for a potential investment for Panda Company: Initial investment $105000 Net annual cash inflow 20000 Net present value 42150 Salvage value 10000 Useful life 10 yrs. The potential investment’s profitability index is A. 2.49. B. 3.44. C. 5.25. D. 1.40.Assuming today is 1st January 2021. Date Cash flows (Rs.) 01-Jan-21 (900,000 ) 31-Dec-21 0 31-Dec-22 240,000 31-Dec-23 320,000 31-Dec-24 490,000 31-Dec-25 250,000 31-Dec-26 345,000 Cost of Capital = 8% Required: Net Present Value (NPV) Payback period (Simple and discounted) Internal Rate of Return (IRR) Solve At Excel.

- Vista Limited intends purchasing a new machine and has a choice between the following two machines:Equipment AEquipment BInitial costR220 000R240 000Expected useful life5 years5 yearsScrap valueNilNilExpected net cash inflows:RREnd of:Year 155 00070 000Year 260 00070 000Year 362 00070 000Year 460 00070 000Year 570 00070 000The company estimates that its cost of capital is 12%. Required:2.1 Calculate the Payback Period of both equipment. (Answers must be expressed in years, months and days). 2.2 Calculate the Accounting Rate of Return (on initial investment) for both equipment A and B. (Answers must be expressed to 2 decimal places). 2.3 Calculate the Net Present Value of each equipment. (Round off amounts to the nearest Rand.) 2.4 Calculate the Internal Rate of Return of Equipment B.ind the IRR for the following cash flows assuming a WACC of 10%. YR CF 0 -15,000 1 6,000 2 4,000 3 2,000 4 3,000 5 2,000The project's NPV? WACC: 10.00% Year 0 1 2 3 Cash flows -$1,000 $450 $460 $470

- Payback Machine X Cumulative cash flow Machine Y Cumulative cash flow Investment 1,000,000 1,000,000 (1,000,000) (1,000,000) Year 1 $500,000 (500,000) $200,000 (800,000) Year 2 $500,000 0 $300,000 (500,000) Year 3 $300,000 $500,000 0 Year 4 $100,000 $500,000 Payback 2 years 3 years ARR Machine X ARR = Average Profit Average investment Therefore: Depreciation (1000, 000-200,000) /4 = 200000 = 200,000X 4 = 800,000 Profits before depreciation 1400,000 Less depreciation (800,000) Accounting Profit 600,000 Average profits 600,000/4yrs =150,000 Average investment = (initial investment + residual value)/2 = (1,000,000 + 200,000)/2 = 600,000 (Average profit/ average investment) X 100 = (150,000/600,000) X 100 = 25% Machine Y…How do you calculate the NPV and IRR Project 1 Year Cashflows Discount Rate 10% 0 $ (750,000.00) 1 $ 250,000.00 2 $ 300,000.00 3 $ 350,000.00 4 $ 200,000.00 5 $ 100,000.00 Project 2 Year Cashflows Discount Rate 10% 0 $ (1,000,000.00) 1 $ 200,000.00 2 $ 300,000.00 3 $ 400,000.00 4 $ 500,000.00 5 $ 700,000.00The project's IRR? Year 0 1 2 3 4 5 Cash flows -$8,750 $2,000 $2,025 $2,050 $2,075 $2,100

- Vista Limited intends purchasing a new machine and has a choice between the following two machines:Equipment AEquipment BInitial costR220 000R240 000Expected useful life5 years5 yearsScrap valueNilNilExpected net cash inflows:RREnd of:Year 155 00070 000Year 260 00070 000Year 362 00070 000Year 460 00070 000Year 570 00070 000The company estimates that its cost of capital is 12%. Calculate the Internal Rate of Return of Equipment B.The following project has cash flows as follows: Year Project A 0 -$705,000 1 $225,000 2 $421,500 3 $275,000 What is the IRR?For the cash flows shown, the correct equation for FW2 using the ROIC method at the reinvestment rate of 20% per year is:a. [10,000(1+ i'' ) + 6000](1.20) - 8000b. [10,000(1.20) + 6000(1+i'' )](1.20) - 8000c. [10,000(1.20) + 6000](1.20) - 8000d. [10,000(1.20) + 6000](1+ i'' ) - 8000