Q: Given the data and hints, Project Zeta's initial investment is and its NPV is (rounded to the…

A: Net Present Value: It is computed by reducing the initial investment from the sum of present-worth…

Q: Which investment(s) should you choose, considering all the above criteria, if the cost of capital is…

A: NPV: It is the present worth of the cashflows including the initial cost of investment. IRR: It…

Q: a. Assuming that the desired rate of return is 6%, determine the net present value for the proposal.…

A: Net present value method: Net present value method id the method which is used to compare the…

Q: If the present value of future cash flows is $4,200 for an investment that requires an outlay of…

A: NPV = present value of cash inflows - the present value of cash outflows given that, present…

Q: Below is the schedule of cash flows for Investment PEK and Investment PVG. Using the NPV, and IRR…

A: Hi There, thanks for posting the question. But as per Q&A guidelines, we must answer the first…

Q: Net Present Value Method The following data are accumulated by Paxton Company in evaluating the…

A: a. Compute present value of net cash flow, amount to be invested and net present value for the…

Q: ould it sell for in order to yield a 7.5% nominal return on the investment? O $522,150 O $542,487…

A: Bonds are the debt obligations of a business on which it requires to pay regular interest to the…

Q: An investor has to decide how much he will be willing to pay for an investment that generates the…

A: The present value of future cash flows will be helpful in finding out the total investment which is…

Q: An investor is faced with the problem of choosing among 2 investment opportunities that have the…

A: Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question…

Q: Alternatives X and Y have rates of return of 10% and 18%, respectively. What is known about the rate…

A: It is not true that the highest rate of return always give a better investment result. The problem…

Q: Below is the schedule of cash flows for Investment PEK and Investment PVG. 1. Using the NPV, and IRR…

A: Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question…

Q: An investment has the following possible returns: Return: 13%; Probability: 40% Return: 8%;…

A: The expected return is the minimum required rate of return which an investor required from the…

Q: Using the equation for the capital asset pricing model, calculate the (A) Find beta when required…

A: This Question has two parts. In part A we need to calculate Beta and In part B we need to calculate…

Q: Compute the (a) net present value, (b) internal rate of return (IRR), (c) modified internal rate of…

A: Hello. Since your question has multiple sub-parts, we will solve first three sub-parts for you. If…

Q: An investor owns a portfolio of assets that willl generate a cash flow of $445 with prob. 0.25,…

A: Benefit function: b(x) = x^0.5 Let the lowest acceptable price = P

Q: A company has an opportunity to invest money. Two investment alternatives are considered with…

A: You have posted a multi-part question, so as per Bartleby policy only the first three parts are…

Q: Consider two investments with the following sequences of cash flows: (a) Compute the i* for each…

A: IRR is the rate at which NPV of the project is equal to zero or PV of cash inflows is equal to PV of…

Q: Requirements: (a) What is the cash payback period for this proposal? (b) What is the annual rate of…

A: cash pay back period is the period by which the initial investment is recovered. so it 2 years +…

Q: Suppose your firm is considering investing in a project with the cash flows shown below, that the…

A: Required Return = 7% Year Cash Flow 0 -5300 1 1300 2 2500 3 1700 4 1700 5 1500 6…

Q: Darren is considering the following investments; Alphabet, PayZero and FNQ Res.: Probability of…

A: Expected return and standard deviation of stocks can be clauclated as below:

Q: a. Assuming that the desired rate of return is 20%, determine the net present value for the…

A: The net present value method is used to evaluate the investment projects. We can evaluate the…

Q: An investor owns a portfolio of assets that will generate a cash flow of $445 with prob. 0.25,…

A: A portfolio is a collection of financial investments that may include closed-end funds and exchange…

Q: Suppose the risk-free rate is 5%. The expected return and standard deviation of a risky asset are…

A: Expected return (Re) = 10% Risk free rate (Rf) = 5% Standard deviation (SD) = 20%

Q: consider the following two investments with the cashfow as shown. given the project are mutually…

A: Incremental cash flow refers to the net additional cash flows generated by accepting a new project…

Q: Darren is considering the following investments; Alphabet, PayZero and FNQ Res.: Probability of…

A: “Since you have posted a question with multiple sub-parts, we will solve first three subparts for…

Q: The Potential for Multiple IRRs A proposed investment has the following projected after-taxcash…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: Consider two assets with the following cash flow streams: Asset A generates $4 at t=1, $3 at…

A:

Q: Use the basic equation for the capital asset pricing model (CAPM) to find the required return for an…

A: Following is the answer to the question

Q: The internal rate of return equals the rate that yields a profitability index of 1 for an…

A: Internal rate of return is the rate at which the Present Value of Cash inflows is equal to the…

Q: ments, X and Y. If each investment is carried out, there are four pos outcomes. The present value of…

A: Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: a. What is the simple payback period for Alternative 1? b. What is the annual worth of Alternative…

A: As per policy we answer only 3 sub questions in a single question. Please repost the unanswered…

Q: Consider the following sets of investment projects: (a) Classify each project as either simple or…

A: Step 1: A project is a simple project when the type of cash flow does not change in the…

Q: a) What is the net present value of the proposed investment, assuming Daneche uses a 12% discount…

A: Net Present Value = Present Value of all Cash Inflows - Present Value of all Cash Outflows…

Q: Project A has the following estimated cash flows and present values: Year…

A: Sensitivity analysis: Sensitivity analysis allows managers to make changes to any one of the factors…

Q: For a project that has an initial cash outflow followed by cash inflows, the profitability index…

A: Profitability Index The Profitability Index (PI) is the ratio between the present value of cash…

Q: You are considering an investment into a new market and have two mutually exclusive and normal cash…

A: IRR is the rate of return when NPV is zero. The criteria to select a project is that the Net present…

Q: Best Industries is considering an investment project that has the following cash flows: Year 0………………

A: 1) IRR is calculated using excel IRR function 2) NPV = Present value of cashflow - Initial…

Q: Which of the following statements is CORRECT? Assume that the project being considered has normal…

A: Point 1 is not correct as IRR is not found using this method. Cash flows cannot be compounded at…

Q: A company has an opportunity to invest money. Two investment alternatives are considered with…

A: Hi There, thanks for posting the question. But as per Q&A guidelines, we must answer the first…

Q: Which TWO of the following statements are correct for a potential project with an investment…

A: Capital Budgeting techniques are used to know the profitability of the project. The NPV and the IRR…

Q: There are some cases in which the present worth (( PW )) of an investment is positive while its…

A: Investments are the methods adopted by individuals and corporations for the purpose of parking or…

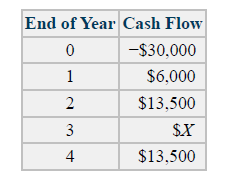

An investment has the following cash flow profile. For each value of MARR below, what is the minimum value of X such that the investment is attractive based on an

b. MARR is 15%/yr. c. MARR is 24%/yr. d. MARR is 8%/yr. e. MARR is 0%/yr.

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

- a. (1) Current year working capital. 1,090,000 Current position analysis The following data were taken from the balance sheet of Nilo Company at the end of two recent fiscal years: Current Year Previous Year Current assets: Cash 391,000 300,000 Marketable securities 515,000 354,000 Accounts and notes receivable (net) 634,000 426,000 Inventories 368,000 222,000 Prepaid expenses 182,000 138,000 Total current assets 2,090,000 1,440,000 Current liabilities: Accounts and notes payable (short-term) 725,000 600,000 Accrued liabilities 275,000 300,000 Total current liabilities 1,000,000 900,000 a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place. b. What conclusions can be drawn from these data as to the companys ability to meet its currently maturing debts?Year Net cashflows 0 -575,000 1 £125,000 2 £248,000 3 £176,000 4 £146,000CP 4 Year Cash Flow 0 -$200,000 1 50,000 2 100,000 3 150,000 4 40,000 5 25,000 Calculate Payback

- 2. 7 Days' cash on hand Financial statement data for years ending December 31 for Newton Company follow: Line Item Description 20Y9 20Y8 Cash (end of year) $25,500 $24,250 Short-term investments (end of year) 8,270 9,460 Operating expenses 60,135 63,780 Depreciation expense 13,225 11,400 Determine the days’ cash on hand for 20Y8 and 20Y9. Assume 365 days in a year. Round all calculations to one decimal place. Year Days’ Cash on Hand 20Y8: fill in the blank 1 of 2 days 20Y9: fill in the blank 2 of 2 days Feedback Area Feedback Days' Cash on Hand = (Cash and Short-Term Investments) ÷ [(Operating Expenses - Depreciation Expense) ÷ 365 days] to obtain the ratio.Find the capital beginning when, Additional Income = 150,000.00 Net Income = 120,000.00 Withdrawal = 138,000.00 Capital Ending =217,000.00The Balance Sheet Of Future Inc. for December 31,20Y3 and 20Y2 1 Dec. 31, 20Y3 Dec. 31, 20Y2 2 Assets 3 Cash $155,000.00 $150,000.00 4 Accounts receivable (net) 450,000.00 400,000.00 5 Inventories 770,000.00 750,000.00 6 Investments 0.00 100,000.00 7 Land 500,000.00 0.00 8 Equipment 1,400,000.00 1,200,000.00 9 Accumulated depreciation-equipment (600,000.00) (500,000.00) 10 Total assets $2,675,000.00 $2,100,000.00 11 Liabilities and Stockholders’ Equity 12 Accounts payable $340,000.00 $300,000.00 13 Accrued expenses payable 45,000.00 50,000.00 14 Dividends payable 30,000.00 25,000.00 15 Common stock, $4 par 700,000.00 600,000.00 16 Paid-in capital: Excess of issue price over par—common stock 200,000.00 175,000.00 17 Retained earnings 1,360,000.00 950,000.00 18 Total liabilities and…

- answer in 50 minutes The following information is available from the current period financial statements: Net income $126,307 Depreciation expense 23,648 Increase in accounts receivable 16,473 Decrease in accounts payable (19,595) The net cash flows from operating activities using the indirect method is a.$126,307 b.$113,887 c.$66,591 d.$186,023Question / Money 10,000,000, retained earnings 5,000,000, millions of financial reserves 4,000,000, financial loans, 250,000 and creditors 2,000,000, 1,000,000 payment notes, what is the amount of equity at the end of the yearCalculate the unknown amounts appearing in each column. A B C Beginning Assets $50,000 $45,000 $65,000 Liabilities $30,000 $10,000 $45,000 Ending Assets $54,000 $42,000 $48,000 Liabilities $20,000 ? $15,000 During Year Sales Revenue ? $42,000 $42,000 Expenses $13,000 $35,000 $25,000 Dividends $1,500 $1,000 ?

- Days' cash on hand Financial statement data for years ending December 31 for Newton Company follow: 20Y9 20Y8 Cash (end of year) $26,530 $23,121 Short-term investments (end of year) 8,300 9,450 Operating expenses 60,210 63,365 Depreciation expense 13,125 11,900 Determine the days’ cash on hand for 20Y8 and 20Y9. Assume 365 days in a year. Days’ Cash on Hand 20Y8: fill in the blank 1 days 20Y9: fill in the blank 2 daysRevenue R100 000, Debtors (opening R50 000, closing R110 000), Calculate Cash Receipts from Customers. Select one: a. R60 000 b. R40 000 c. R110 000 d. R100 000ABC DEF GHI JKL Operating cash flow $ 13,230,000 $ 13,625,000 $ 8,020,000 $ 12,588,000 Investing cash flow (2,629,000) (2,226,000) (5,359,000) (3,945,000) Financing cash flow (8,861,000) (13,477,000) (1,840,000) (8,584,000) Change in cash $ 1,740,000 $ (2,078,000) $ 821,000 $ 59,000 There are three parts to this problem. Use Excel to complete the following: a. Use the SUM function to calculate the “Change in Cash” for each company in the Student Work Area. b. Create a separate waterfall chart for each company showing the amount of cash flow by cash flow activity and the changes in cash flow. Include a descriptive chart title, axes labels, properly formatted axes, and a legend for each chart. c. What generalizations can you make about this industry’s cash flow based on the chart in part b? Describe in general how the companies obtained its…