For the year ending December 31, 2017, sales for Company Y were $62.91 billion. Beginning January 1, 2018 Company Y plans to invest 8.5% of their sales and each year and they expect their sales to increase by 5% each year over the next three years. Company Y invests into an account earning an APR of 2.0% compounded continuously. Assume a continuous income stream How much money will be in the investment account on December 31, 2020? Round your answer to three decimal places. 17.305 x billion dollars How much money did Company Y invest in the account between January 1, 2018 and December 31, 20207 Round your answer to three decimal places. 16.856 x billion dollars How much interest did Company Y earn on this investment between January 1, 2018 and December 31, 2020? Round your answer to three decimal places. If intermediate values are used, be sure to use the unrounded values to determine the answer 447 x billion dollars

For the year ending December 31, 2017, sales for Company Y were $62.91 billion. Beginning January 1, 2018 Company Y plans to invest 8.5% of their sales and each year and they expect their sales to increase by 5% each year over the next three years. Company Y invests into an account earning an APR of 2.0% compounded continuously. Assume a continuous income stream How much money will be in the investment account on December 31, 2020? Round your answer to three decimal places. 17.305 x billion dollars How much money did Company Y invest in the account between January 1, 2018 and December 31, 20207 Round your answer to three decimal places. 16.856 x billion dollars How much interest did Company Y earn on this investment between January 1, 2018 and December 31, 2020? Round your answer to three decimal places. If intermediate values are used, be sure to use the unrounded values to determine the answer 447 x billion dollars

Chapter16: Supply Chains And Working Capital Management

Section: Chapter Questions

Problem 11P

Related questions

Question

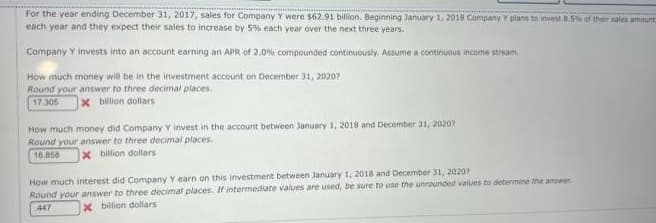

Transcribed Image Text:For the year ending December 31, 2017, sales for Company Y were $62.91 billion. Beginning January 1, 2018 Company Y plans to invest 8.5% of their sales amount

each year and they expect their sales to increase by 5% each year over the next three years.

Company Y invests into an account earning an APR of 2.0% compounded continuously. Assume a continuous income stream

How much money will be in the investment account on December 31, 2020?

Round your answer to three decimal places.

17.306 x billion dollars

How much money did Company Y invest in the account between January 1, 2018 and December 31, 20207

Round your answer to three decimal places.

16.858

x billion dollars

How much interest did Company Y earn on this investment between January 1, 2018 and December 31, 2020?

Round your answer to three decimal places. If intermediate values are used, be sure to use the unrounded values to determine the answer

447

x billion dollars

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning