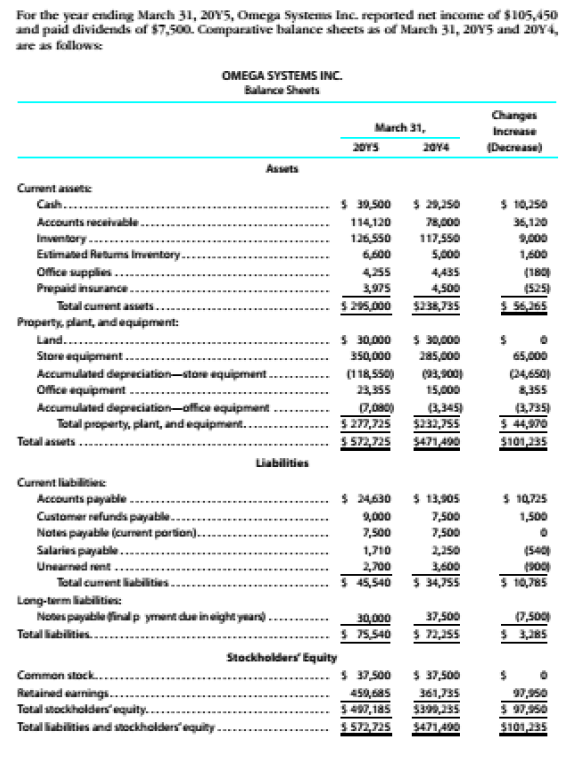

For the year ending March 31, 20Y5, Omega Systems Inc. reported net income of $105,450 and paid dividends of $7,500. Comparative balance sheets as of March 31, 20Y5 and 20Y4, are as follows: OMEGA SYSTEMS INC. Balance Sheets Changes Increase March 31, 20YS 20Y4 (Decrease) Assets Current assets Cash.. $ 30,500 $ 29,250 $ 10,250 Accounts receivable 114,120 126,550 6,600 78,000 117,550 5,000 36,120 Inventory .. Estimated Retums lInventory. 9,000 1,600 Ofice supplies.. Prepaid insurance. 4255 4,435 4,500 (180) 3,075 25000 s236,735 (525) 5 56,265 Tetal cument assets. Property, plant, and equipment: Land... 5 30,000 5 30,000 Store equipment.. 350,000 285,000 65,000 (24,650) 8,355 Accumulated depreciation-store equipment. (118,550) 23,355 (3,900) 15,000 Ofice equipment. Accumulated depreciation-office equipment Total property, plant, and equipment.. Total assets .. 0,080) 327,725 S 572,725 (3,345) $232,755 S471,490 (3,735) 3 4,970 S101,235 Liabilities Current liabilities $ 24630 $ 13,905 $ 10725 Accounts payable . Customer refunds payable. Notes payable (curment portion). Salaries payabile.. Unearned rent. Total cument liabilities. 9,000 7,500 7,500 1,500 7,500 1,710 2,250 (540 2,700 3,600 45,540 3 34,75s (300) S 10,785 Long-tarm liabilities: Notes payable final p yment due in eight yan). 30,000 37,500 S 75,540 3 72,55 (7,500 $ 3,185 Totaliabilities. Stockholders' Equity $ 37,500 $ 37,500 361,735 $390,135 5471,490 Commen stock. Retained earnings. Total stockholders equity. 450,685 5497, 185 5 572,725 97,950 $ 97,950 S101,135 Tetaliabilities and stockholders'equity

For the year ending March 31, 20Y5, Omega Systems Inc. reported net income of $105,450 and paid dividends of $7,500. Comparative balance sheets as of March 31, 20Y5 and 20Y4, are as follows: OMEGA SYSTEMS INC. Balance Sheets Changes Increase March 31, 20YS 20Y4 (Decrease) Assets Current assets Cash.. $ 30,500 $ 29,250 $ 10,250 Accounts receivable 114,120 126,550 6,600 78,000 117,550 5,000 36,120 Inventory .. Estimated Retums lInventory. 9,000 1,600 Ofice supplies.. Prepaid insurance. 4255 4,435 4,500 (180) 3,075 25000 s236,735 (525) 5 56,265 Tetal cument assets. Property, plant, and equipment: Land... 5 30,000 5 30,000 Store equipment.. 350,000 285,000 65,000 (24,650) 8,355 Accumulated depreciation-store equipment. (118,550) 23,355 (3,900) 15,000 Ofice equipment. Accumulated depreciation-office equipment Total property, plant, and equipment.. Total assets .. 0,080) 327,725 S 572,725 (3,345) $232,755 S471,490 (3,735) 3 4,970 S101,235 Liabilities Current liabilities $ 24630 $ 13,905 $ 10725 Accounts payable . Customer refunds payable. Notes payable (curment portion). Salaries payabile.. Unearned rent. Total cument liabilities. 9,000 7,500 7,500 1,500 7,500 1,710 2,250 (540 2,700 3,600 45,540 3 34,75s (300) S 10,785 Long-tarm liabilities: Notes payable final p yment due in eight yan). 30,000 37,500 S 75,540 3 72,55 (7,500 $ 3,185 Totaliabilities. Stockholders' Equity $ 37,500 $ 37,500 361,735 $390,135 5471,490 Commen stock. Retained earnings. Total stockholders equity. 450,685 5497, 185 5 572,725 97,950 $ 97,950 S101,135 Tetaliabilities and stockholders'equity

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 50E: Juroe Company provided the following income statement for last year: Juroes balance sheet as of...

Related questions

Question

100%

| Appendix statement of cash flows using indirect method for the year ending march 31-20y5-omega |

Transcribed Image Text:For the year ending March 31, 20Y5, Omega Systems Inc. reported net income of $105,450

and paid dividends of $7,500. Comparative balance sheets as of March 31, 20Y5 and 20Y4,

are as follows:

OMEGA SYSTEMS INC.

Balance Sheets

Changes

Increase

March 31,

20YS

20Y4

(Decrease)

Assets

Current assets

Cash..

$ 30,500 $ 29,250

$ 10,250

Accounts receivable

114,120

126,550

6,600

78,000

117,550

5,000

36,120

Inventory ..

Estimated Retums lInventory.

9,000

1,600

Ofice supplies..

Prepaid insurance.

4255

4,435

4,500

(180)

3,075

25000 s236,735

(525)

5 56,265

Tetal cument assets.

Property, plant, and equipment:

Land...

5 30,000 5 30,000

Store equipment..

350,000

285,000

65,000

(24,650)

8,355

Accumulated depreciation-store equipment.

(118,550)

23,355

(3,900)

15,000

Ofice equipment.

Accumulated depreciation-office equipment

Total property, plant, and equipment..

Total assets ..

0,080)

327,725

S 572,725

(3,345)

$232,755

S471,490

(3,735)

3 4,970

S101,235

Liabilities

Current liabilities

$ 24630 $ 13,905

$ 10725

Accounts payable .

Customer refunds payable.

Notes payable (curment portion).

Salaries payabile..

Unearned rent.

Total cument liabilities.

9,000

7,500

7,500

1,500

7,500

1,710

2,250

(540

2,700

3,600

45,540 3 34,75s

(300)

S 10,785

Long-tarm liabilities:

Notes payable final p yment due in eight yan).

30,000

37,500

S 75,540 3 72,55

(7,500

$ 3,185

Totaliabilities.

Stockholders' Equity

$ 37,500

$ 37,500

361,735

$390,135

5471,490

Commen stock.

Retained earnings.

Total stockholders equity.

450,685

5497, 185

5 572,725

97,950

$ 97,950

S101,135

Tetaliabilities and stockholders'equity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub