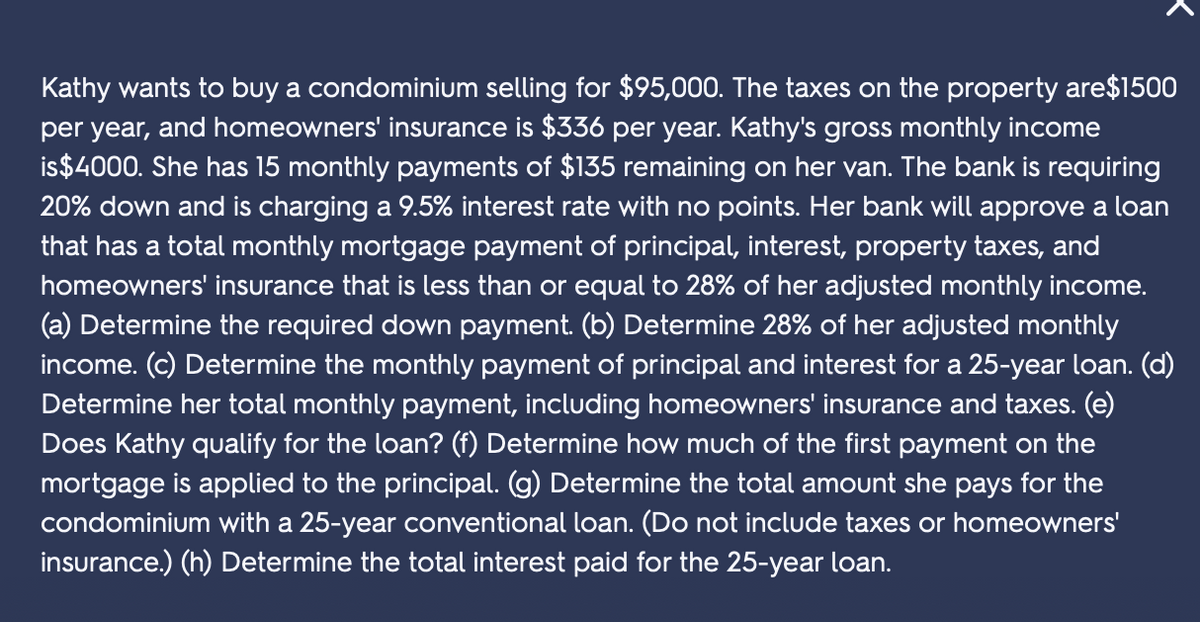

Kathy wants to buy a condominium selling for $95,000. The taxes on the property are$1500 per year, and homeowners' insurance is $336 per year. Kathy's gross monthly income is$4000. She has 15 monthly payments of $135 remaining on her van. The bank is requiring 20% down and is charging a 9.5% interest rate with no points. Her bank will approve a loan that has a total monthly mortgage payment of principal, interest, property taxes, and homeowners' insurance that is less than or equal to 28% of her adjusted monthly income. (a) Determine the required down payment. (b) Determine 28% of her adjusted monthly income. (c) Determine the monthly payment of principal and interest for a 25-year loan. (d) Determine her total monthly payment, including homeowners' insurance and taxes. (e) Does Kathy qualify for the loan? (f) Determine how much of the first payment on the mortgage is applied to the principal. (g) Determine the total amount she pays for the condominium with a 25-year conventional loan. (Do not include taxes or homeowners' insurance.) (h) Determine the total interest paid for the 25-year loan.

Kathy wants to buy a condominium selling for $95,000. The taxes on the property are$1500 per year, and homeowners' insurance is $336 per year. Kathy's gross monthly income is$4000. She has 15 monthly payments of $135 remaining on her van. The bank is requiring 20% down and is charging a 9.5% interest rate with no points. Her bank will approve a loan that has a total monthly mortgage payment of principal, interest, property taxes, and homeowners' insurance that is less than or equal to 28% of her adjusted monthly income. (a) Determine the required down payment. (b) Determine 28% of her adjusted monthly income. (c) Determine the monthly payment of principal and interest for a 25-year loan. (d) Determine her total monthly payment, including homeowners' insurance and taxes. (e) Does Kathy qualify for the loan? (f) Determine how much of the first payment on the mortgage is applied to the principal. (g) Determine the total amount she pays for the condominium with a 25-year conventional loan. (Do not include taxes or homeowners' insurance.) (h) Determine the total interest paid for the 25-year loan.

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter13: Investing In Mutual Funds, Etfs, And Real Estate

Section: Chapter Questions

Problem 9FPE

Related questions

Question

Transcribed Image Text:Kathy wants to buy a condominium selling for $95,000. The taxes on the property are$1500

per year, and homeowners' insurance is $336 per year. Kathy's gross monthly income

is$4000. She has 15 monthly payments of $135 remaining on her van. The bank is requiring

20% down and is charging a 9.5% interest rate with no points. Her bank will approve a loan

that has a total monthly mortgage payment of principal, interest, property taxes, and

homeowners' insurance that is less than or equal to 28% of her adjusted monthly income.

(a) Determine the required down payment. (b) Determine 28% of her adjusted monthly

income. (c) Determine the monthly payment of principal and interest for a 25-year loan. (d)

Determine her total monthly payment, including homeowners' insurance and taxes. (e)

Does Kathy qualify for the loan? (f) Determine how much of the first payment on the

mortgage is applied to the principal. (g) Determine the total amount she pays for the

condominium with a 25-year conventional loan. (Do not include taxes or homeowners'

insurance.) (h) Determine the total interest paid for the 25-year loan.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning