for Year 10 (federal income tax, FICA taxes, and unemployment taxes). Issued 5,000 additional shares of the $5 par value common stock for $8 per share. Issued 1,000 shares of $50 stated value, 5 percent cumulative preferred stock for $52 per share. Purchased $500 of supplies on account. Purchased 190 alarm systems at a cost of $310. Cash was paid for the purchase. After numerous attempts to collect from customers, wrote off $3,670 of uncollectible accounts receivable.

for Year 10 (federal income tax, FICA taxes, and unemployment taxes). Issued 5,000 additional shares of the $5 par value common stock for $8 per share. Issued 1,000 shares of $50 stated value, 5 percent cumulative preferred stock for $52 per share. Purchased $500 of supplies on account. Purchased 190 alarm systems at a cost of $310. Cash was paid for the purchase. After numerous attempts to collect from customers, wrote off $3,670 of uncollectible accounts receivable.

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter16: Financial Statements And Closing Entries For A Corporation

Section: Chapter Questions

Problem 5AP

Related questions

Question

During Year 11, Pacilio Security Services experienced the following transactions:

- Paid the sales tax payable from Year 10.

- Paid the balance of the payroll liabilities due for Year 10 (federal income tax, FICA taxes, and

unemployment taxes). - Issued 5,000 additional shares of the $5 par value common stock for $8 per share.

- Issued 1,000 shares of $50 stated value, 5 percent cumulative

preferred stock for $52 per share. - Purchased $500 of supplies on account.

- Purchased 190 alarm systems at a cost of $310. Cash was paid for the purchase.

- After numerous attempts to collect from customers, wrote off $3,670 of uncollectible

accounts receivable . - Sold 210 alarm systems for $600 each plus sales tax of 5 percent. All sales were on account.

- Record the cost of goods sold related to the sale from Event 8 using the FIFO method.

- Billed $125,000 of monitoring services for the year. Credit card sales amounted to $58,000, and the credit card company charged a 4 percent fee. The remaining $67,000 were sales on account. Sales tax is not charged on this service.

- Replenished the petty cash fund on June 30. The fund had $10 cash and receipts of $75 for yard mowing and $15 for office supplies expense.

- Collected the amount due from the credit card company.

- Paid the sales tax collected on $105,000 of the alarm sales.

- Collected $198,000 of accounts receivable during the year.

- Paid installers and other employees a total of $96,000 for salaries for the year. Assume the Social Security tax rate is 6 percent and the Medicare tax rate is 1.5 percent. Federal income taxes withheld amounted to $10,600. No employee exceeded $110,000 in total wages. The net salaries were paid in cash.

- On October 1, declared a dividend on the preferred stock and a $1 per share dividend on the common stock to be paid to shareholders of record on October 15, payable on November 1, Year 11.

- Paid $1,625 in warranty repairs during the year.

- On November 1, Year 11, paid the dividends that had been previously declared.

- Paid $18,500 of advertising expense during the year.

- Paid $6,100 of utilities expense for the year.

- Paid the payroll liabilities, both the amounts withheld from the salaries plus the employer share of Social Security tax and Medicare tax, on $88,000 of the salaries plus $9,200 of the federal income tax that was withheld.

- Paid the accounts payable.

- Paid bond interest and amortized the discount. The bond was issued in Year 10 and pays interest at 6 percent.

- Paid the annual installment of $14,238 on the amortized note. The interest rate for the note is 7 percent.

Adjustment

- There was $190 of supplies on hand at the end of the year.

- Recognized the uncollectible accounts expense for the year using the allowance method. Pacilio now estimates that 1 percent of sales on account will not be collected.

- Recognized

depreciation expense on the equipment, van, and building. The equipment, purchased in Year 8, has a five-year life and a $2,000 salvage value. The van has a four-year life and a $6,000 salvage value. The building has a 40-year life and a $10,000 salvage value. The company uses straight-line for the equipment and the building. The van is fully depreciated. - The alarm systems sold in transaction 8 were covered with a one-year warranty. Pacilio estimated that the warranty cost would be 2 percent of alarm sales.

- The unemployment tax on the three employees has not been paid. Record the accrued unemployment tax on the salaries for the year. The unemployment tax rate is 4.5 percent and gross wages for all three employees exceeded $7,000.

- Recognized the employer Social Security and Medicare payroll tax that has not been paid on $8,000 of salaries expense.

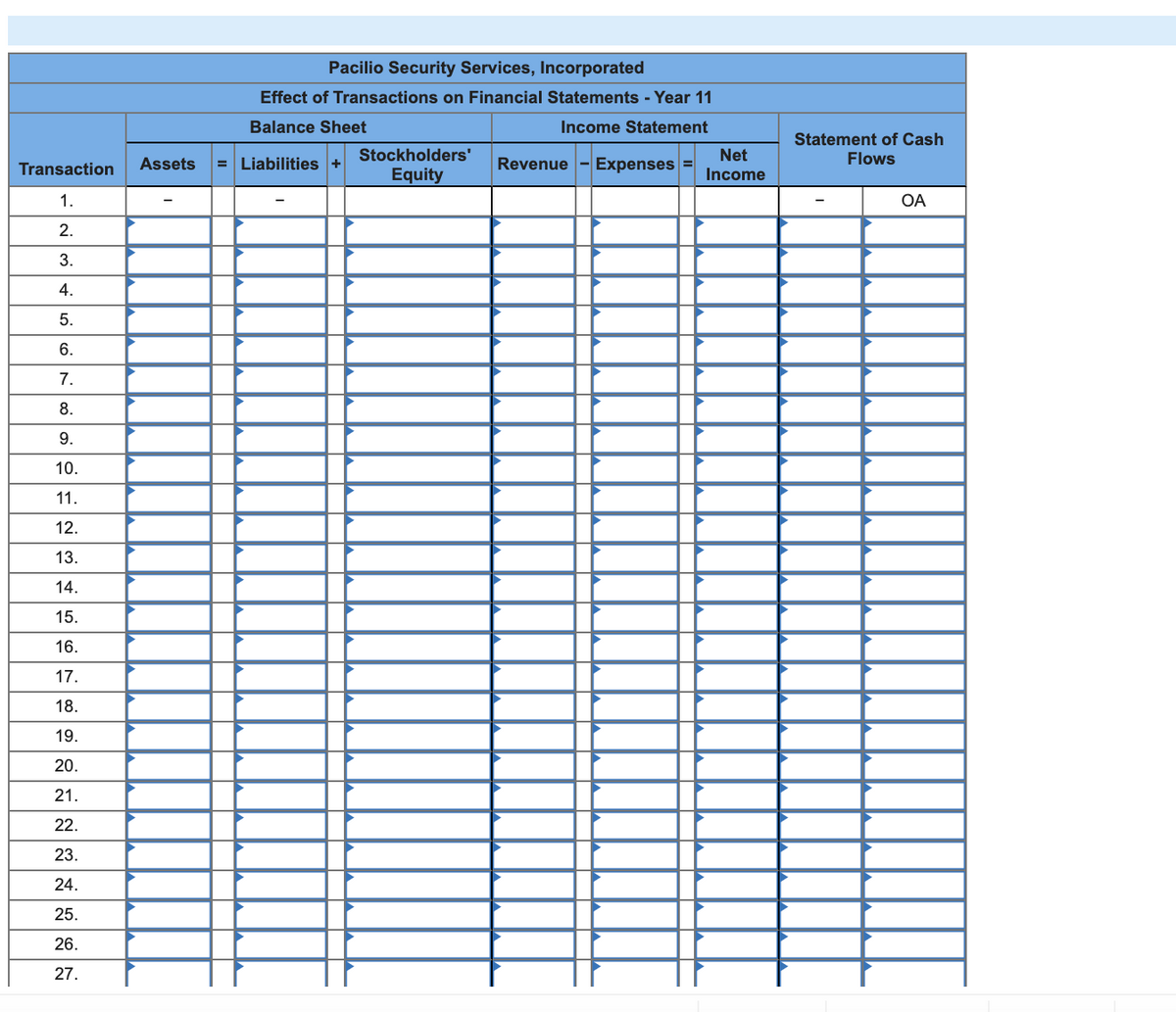

Transcribed Image Text:Pacilio Security Services, Incorporated

Effect of Transactions on Financial Statements - Year 11

Balance Sheet

Income Statement

Statement of Cash

Assets

Liabilities

Stockholders'

Revenue

Expenses =

Net

Flows

Transaction

Equity

Income

1.

OA

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

21.

22.

23.

24.

25.

26.

27.

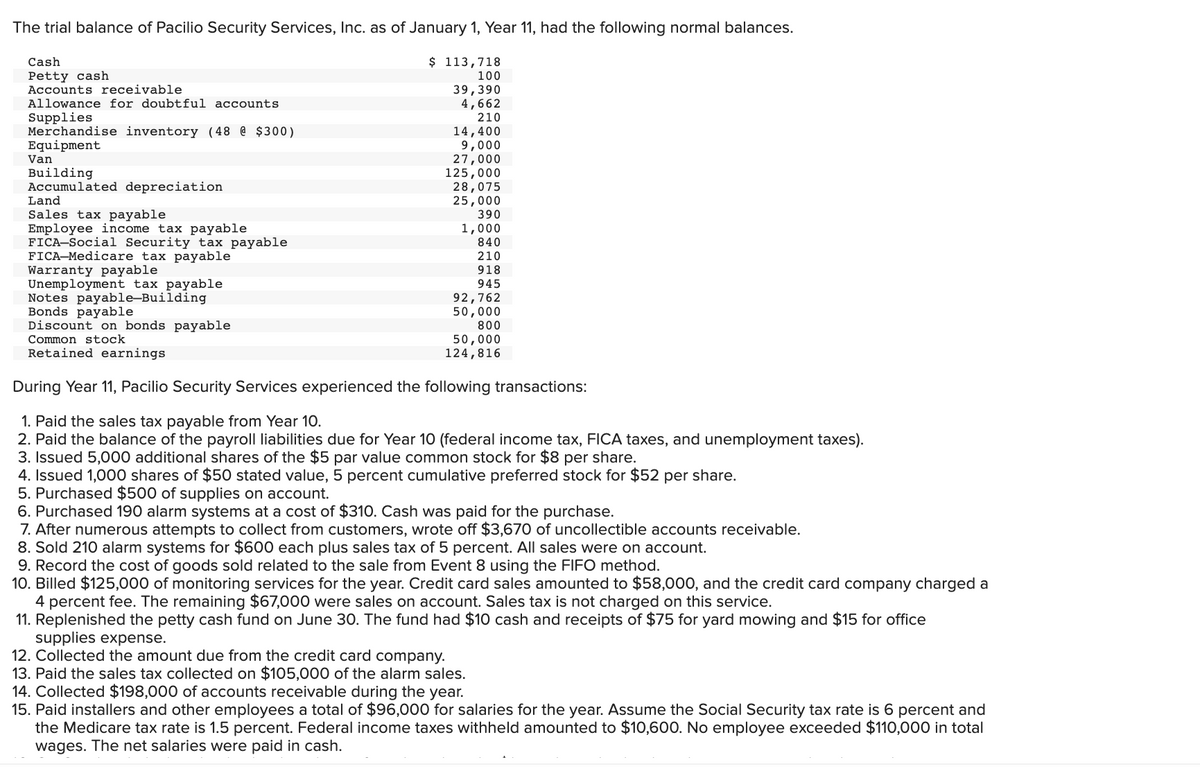

Transcribed Image Text:The trial balance of Pacilio Security Services, Inc. as of January 1, Year 11, had the following normal balances.

Cash

$ 113,718

Petty cash

Accounts receivable

100

39,390

4,662

210

Allowance for doubtful accounts

Supplies

Merchandise inventory (48 @ $300)

Equipment

Van

14,400

9,000

27,000

125,000

28,075

25,000

390

Building

Accumulated depreciation

Land

Sales tax payable

Employee income tax payable

FICA-Social Security tax payable

FICA-Medicare tax payable

Warranty payable

Unemployment tax payable

Notes payable-Building

Bonds payable

Discount on bonds payable

1,000

840

210

918

945

92,762

50,000

800

50,000

124,816

Common stock

Retained earnings

During Year 11, Pacilio Security Services experienced the following transactions:

1. Paid the sales tax payable from Year 1O.

2. Paid the balance of the payroll liabilities due for Year 10 (federal income tax, FICA taxes, and unemployment taxes).

3. Issued 5,000 additional shares of the $5 par value common stock for $8 per share.

4. Issued 1,000 shares of $50 stated value, 5 percent cumulative preferred stock for $52 per share.

5. Purchased $500 of supplies on account.

6. Purchased 190 alarm systems at a cost of $310. Cash was paid for the purchase.

7. After numerous attempts to collect from customers, wrote off $3,670 of uncollectible accounts receivable.

8. Sold 210 alarm systems for $600 each plus sales tax of 5 percent. All sales were on account.

9. Record the cost of goods sold related to the sale from Event 8 using the FIFO method.

10. Billed $125,000 of monitoring services for the year. Credit card sales amounted to $58,000, and the credit card company charged a

4 percent fee. The remaining $67,000 were sales on account. Sales tax is not charged on this service.

11. Replenished the petty cash fund on June 30. The fund had $10 cash and receipts of $75 for yard mowing and $15 for office

supplies expense.

12. Collected the amount due from the credit card company.

13. Paid the sales tax collected on $105,000 of the alarm sales.

14. Collected $198,000 of accounts receivable during the year.

15. Paid installers and other employees a total of $96,000 for salaries for the year. Assume the Social Security tax rate is 6 percent and

the Medicare tax rate is 1.5 percent. Federal income taxes withheld amounted to $10,600. No employee exceeded $110,000 in total

wages. The net salaries were paid in cash.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage