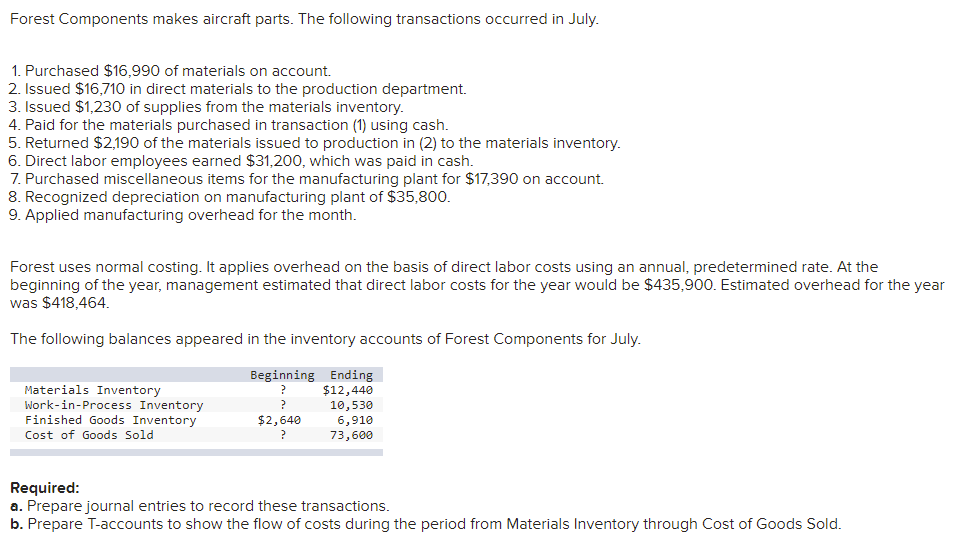

Forest Components makes aircraft parts. The following transactions occurred in July. 1. Purchased $16,990 of materials on account. 2. Issued $16,710 in direct materials to the production department. 3. Issued $1,230 of supplies from the materials inventory. 4. Paid for the materials purchased in transaction (1) using cash. 5. Returned $2,190 of the materials issued to production in (2) to the materials inventory. 6. Direct labor employees earned $31,200, which was paid in cash. 7. Purchased miscellaneous items for the manufacturing plant for $17,390 on account. 8. Recognized depreciation on manufacturing plant of $35,800. 9. Applied manufacturing overhead for the month. Forest uses normal costing. It applies overhead on the basis of direct labor costs using an annual, predetermined rate. At the beginning of the year, management estimated that direct labor costs for the year would be $435,900. Estimated overhead for the year was $418,464. The following balances appeared in the inventory accounts of Forest Components for July. Beginning Ending $12,440 Materials Inventory Work-in-Process Inventory Finished Goods Inventory Cost of Goods Sold 10,530 6,910 73,600 $2,640 Required: a. Prepare journal entries to record these transactions.

Forest Components makes aircraft parts. The following transactions occurred in July. 1. Purchased $16,990 of materials on account. 2. Issued $16,710 in direct materials to the production department. 3. Issued $1,230 of supplies from the materials inventory. 4. Paid for the materials purchased in transaction (1) using cash. 5. Returned $2,190 of the materials issued to production in (2) to the materials inventory. 6. Direct labor employees earned $31,200, which was paid in cash. 7. Purchased miscellaneous items for the manufacturing plant for $17,390 on account. 8. Recognized depreciation on manufacturing plant of $35,800. 9. Applied manufacturing overhead for the month. Forest uses normal costing. It applies overhead on the basis of direct labor costs using an annual, predetermined rate. At the beginning of the year, management estimated that direct labor costs for the year would be $435,900. Estimated overhead for the year was $418,464. The following balances appeared in the inventory accounts of Forest Components for July. Beginning Ending $12,440 Materials Inventory Work-in-Process Inventory Finished Goods Inventory Cost of Goods Sold 10,530 6,910 73,600 $2,640 Required: a. Prepare journal entries to record these transactions.

Chapter4: Job Order Costing

Section: Chapter Questions

Problem 12PA: The following data summarize the operations during the year. Prepare a journal entry for each...

Related questions

Question

Transcribed Image Text:Forest Components makes aircraft parts. The following transactions occurred in July.

1. Purchased $16,990 of materials on account.

2. Issued $16,710 in direct materials to the production department.

3. Issued $1,230 of supplies from the materials inventory.

4. Paid for the materials purchased in transaction (1) using cash.

5. Returned $2,190 of the materials issued to production in (2) to the materials inventory.

6. Direct labor employees earned $31,200, which was paid in cash.

7. Purchased miscellaneous items for the manufacturing plant for $17,390 on account.

8. Recognized depreciation on manufacturing plant of $35,800.

9. Applied manufacturing overhead for the month.

Forest uses normal costing. It applies overhead on the basis of direct labor costs using an annual, predetermined rate. At the

beginning of the year, management estimated that direct labor costs for the year would be $435,900. Estimated overhead for the year

was $418,464.

The following balances appeared in the inventory accounts of Forest Components for July.

Beginning Ending

$12,440

Materials Inventory

Work-in-Process Inventory

Finished Goods Inventory

?

10,530

6,910

73,600

$2,640

Cost of Goods Sold

Required:

a. Prepare journal entries to record these transactions.

b. Prepare T-accounts to show the flow of costs during the period from Materials Inventory through Cost of Goods Sold.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning