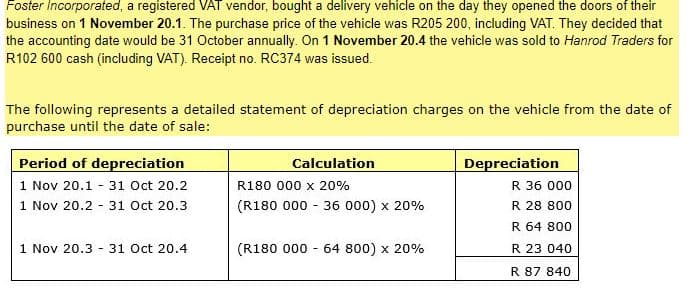

Foster incorporated, a registered VAI vendor, bought a delivery vehicle on the day they opened the doors business on 1 November 20.1. The purchase price of the vehicle was R205 200, including VAT. They decided that the accounting date would be 31 October annually. On 1 November 20.4 the vehicle was sold to Hanrod Traders for R102 600 cash (including VAT). Receipt no. RC374 was issued. The following represents a detailed statement of depreciation charges on the vehicle from the date of purchase until the date of sale: Period of depreciation 1 Nov 20.1 - 31 Oct 20.2 1 Nov 20.2 - 31 Oct 20.3 1 Nov 20.3 31 Oct 20.4 Calculation R180 000 x 20% (R180 000 - 36 000) x 20% (R180 000 - 64 800) x 20% Depreciation R 36 000 R 28 800 R 64 800 R 23 040 R 87 840

Foster incorporated, a registered VAI vendor, bought a delivery vehicle on the day they opened the doors business on 1 November 20.1. The purchase price of the vehicle was R205 200, including VAT. They decided that the accounting date would be 31 October annually. On 1 November 20.4 the vehicle was sold to Hanrod Traders for R102 600 cash (including VAT). Receipt no. RC374 was issued. The following represents a detailed statement of depreciation charges on the vehicle from the date of purchase until the date of sale: Period of depreciation 1 Nov 20.1 - 31 Oct 20.2 1 Nov 20.2 - 31 Oct 20.3 1 Nov 20.3 31 Oct 20.4 Calculation R180 000 x 20% (R180 000 - 36 000) x 20% (R180 000 - 64 800) x 20% Depreciation R 36 000 R 28 800 R 64 800 R 23 040 R 87 840

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 4EA: Window World extended credit to customer Nile Jenkins in the amount of $130,900 for his purchase of...

Related questions

Question

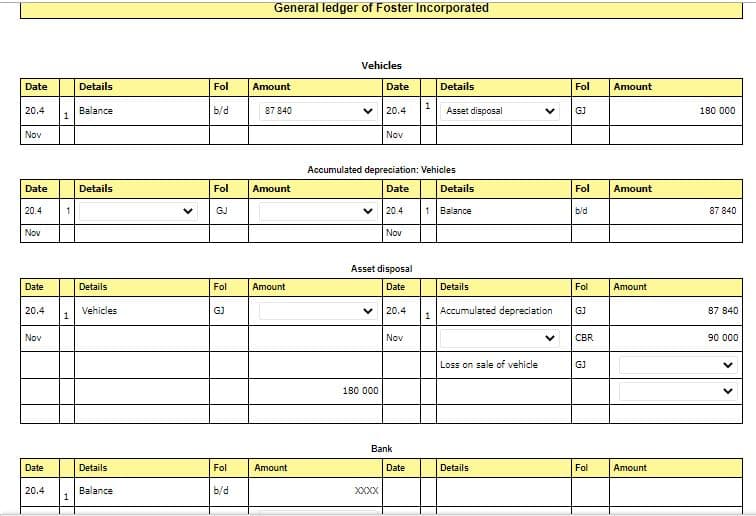

Use the information at the top of this screen (next to Instructions) to complete the general ledger of Foster Incorporated:

Transcribed Image Text:Foster Incorporated, a registered VAT vendor, bought a delivery vehicle on the day they opened the doors of their

business on 1 November 20.1. The purchase price of the vehicle was R205 200, including VAT. They decided that

the accounting date would be 31 October annually. On 1 November 20.4 the vehicle was sold to Hanrod Traders for

R102 600 cash (including VAT). Receipt no. RC374 was issued.

The following represents a detailed statement of depreciation charges on the vehicle from the date of

purchase until the date of sale:

Period of depreciation

1 Nov 20.1 - 31 Oct 20.2

1 Nov 20.2 - 31 Oct 20.3

1 Nov 20.3 31 Oct 20.4

Calculation

R180 000 x 20%

(R180 000 - 36 000) x 20%

(R180 000 64 800) x 20%

Depreciation

R 36 000

R 28 800

R 64 800

R 23 040

R 87 840

Transcribed Image Text:Date

20.4

Nov

Date

20.4

Nov

Date

20.4

Nov

Date

20.4

1

1

1

1

Details

Balance

Details

Details

Vehicles

Details

Balance

Fol

b/d

Fol

V GJ

Fol

GJ

Fol

b/d

General ledger of Foster Incorporated

Amount

87 840

Amount

Amount

Amount

Vehicles

V 20.4

Nov

Date

V

180 000

Accumulated depreciation: Vehicles

Date

Asset disposal

Date

20.4

XXXX

Nov

Nov

Bank

1

20.4 1 Balance

Date

Details

Asset disposal

1

Details

Details

Accumulated depreciation

Loss on sale of vehicle

Details

V GJ

Fol Amount

V

Fol

b/d

Fol

GJ

CBR

GJ

Fol

Amount

Amount

Amount

180 000

87 840

87 840

90 000

<

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT