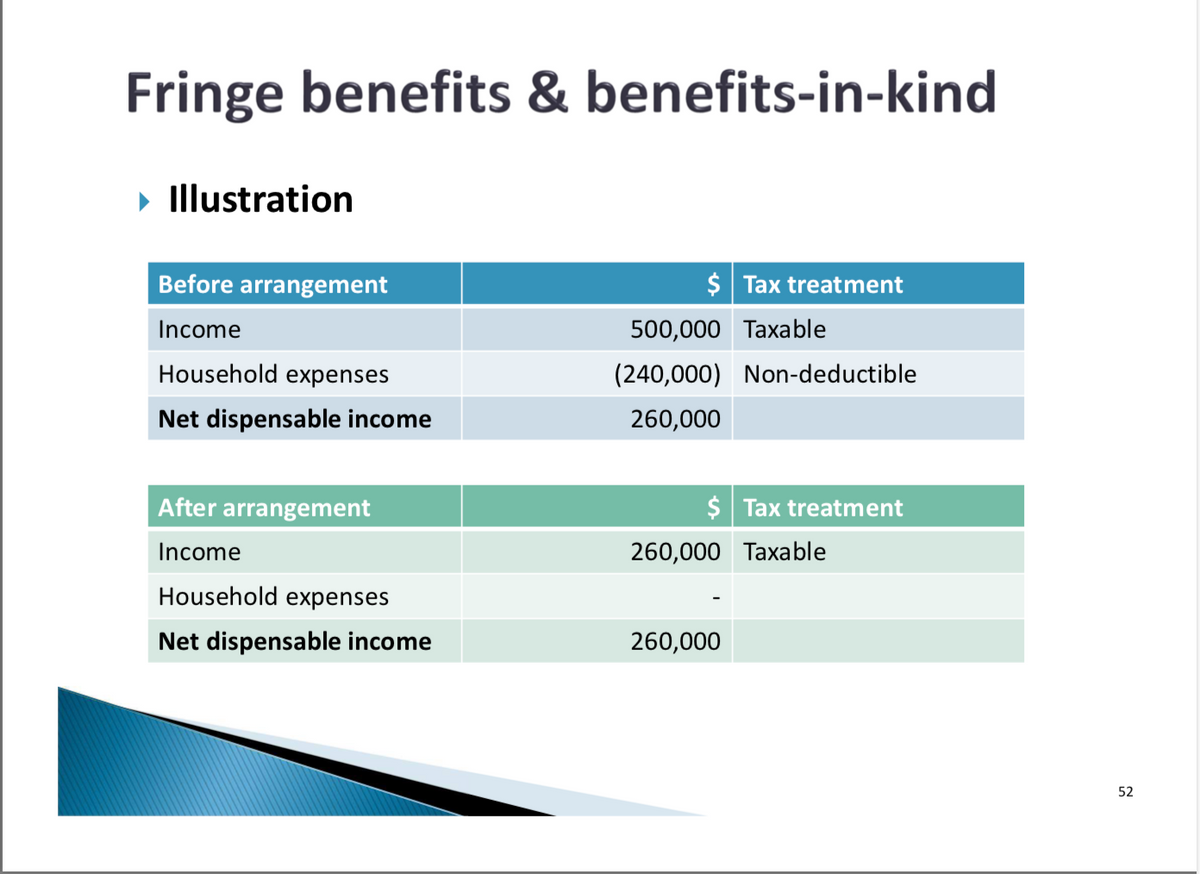

Fringe benefits & benefits-in-kind ▸ Household expenses ▸ All contracts of household expenses e.g. utilities, domestic helpers are entered into by the employer (i.e. liabilities are borne by the employer) ▸ For the same amount of dispensable income of an individual, salaries tax is saved with a reduced income and elimination of expenses. 51 Fringe benefits & benefits-in-kind ▸ Illustration Before arrangement Income Household expenses Net dispensable income $ Tax treatment 500,000 Taxable (240,000) Non-deductible 260,000 After arrangement Income Household expenses Net dispensable income $ Tax treatment 260,000 Taxable 260,000 52

Fringe benefits & benefits-in-kind ▸ Household expenses ▸ All contracts of household expenses e.g. utilities, domestic helpers are entered into by the employer (i.e. liabilities are borne by the employer) ▸ For the same amount of dispensable income of an individual, salaries tax is saved with a reduced income and elimination of expenses. 51 Fringe benefits & benefits-in-kind ▸ Illustration Before arrangement Income Household expenses Net dispensable income $ Tax treatment 500,000 Taxable (240,000) Non-deductible 260,000 After arrangement Income Household expenses Net dispensable income $ Tax treatment 260,000 Taxable 260,000 52

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter14: Planning For Retirement

Section: Chapter Questions

Problem 4FPE

Related questions

Question

Transcribed Image Text:Fringe benefits & benefits-in-kind

▸ Household expenses

▸ All contracts of household expenses e.g. utilities,

domestic helpers are entered into by the employer (i.e.

liabilities are borne by the employer)

▸ For the same amount of dispensable income of an

individual, salaries tax is saved with a reduced income

and elimination of expenses.

51

Transcribed Image Text:Fringe benefits & benefits-in-kind

▸ Illustration

Before arrangement

Income

Household expenses

Net dispensable income

$ Tax treatment

500,000 Taxable

(240,000) Non-deductible

260,000

After arrangement

Income

Household expenses

Net dispensable income

$ Tax treatment

260,000 Taxable

260,000

52

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning