Depletion Entries Alaska Mining Co. acquired mineral rights for $26,838,000. The mineral deposit is estimated at 149,100,000 tons. During the current year, 22,350,000 tons were mined and sold. a. Determine the amount of depletion expense for the current year. Round the depletion rate to two decimals places. b. Journalize the adjusting entry on December 31 to recognize the depletion expense.

Depletion Entries Alaska Mining Co. acquired mineral rights for $26,838,000. The mineral deposit is estimated at 149,100,000 tons. During the current year, 22,350,000 tons were mined and sold. a. Determine the amount of depletion expense for the current year. Round the depletion rate to two decimals places. b. Journalize the adjusting entry on December 31 to recognize the depletion expense.

Chapter4: The Adjustment Process

Section: Chapter Questions

Problem 7PA: Using the following information: A. make the December 31 adjusting journal entry for depreciation B....

Related questions

Question

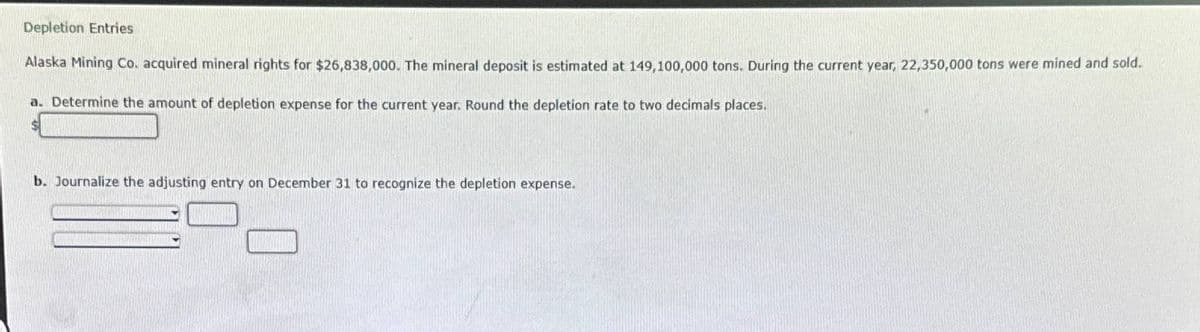

Transcribed Image Text:Depletion Entries

Alaska Mining Co. acquired mineral rights for $26,838,000. The mineral deposit is estimated at 149,100,000 tons. During the current year, 22,350,000 tons were mined and sold.

a. Determine the amount of depletion expense for the current year. Round the depletion rate to two decimals places.

b. Journalize the adjusting entry on December 31 to recognize the depletion expense.

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College