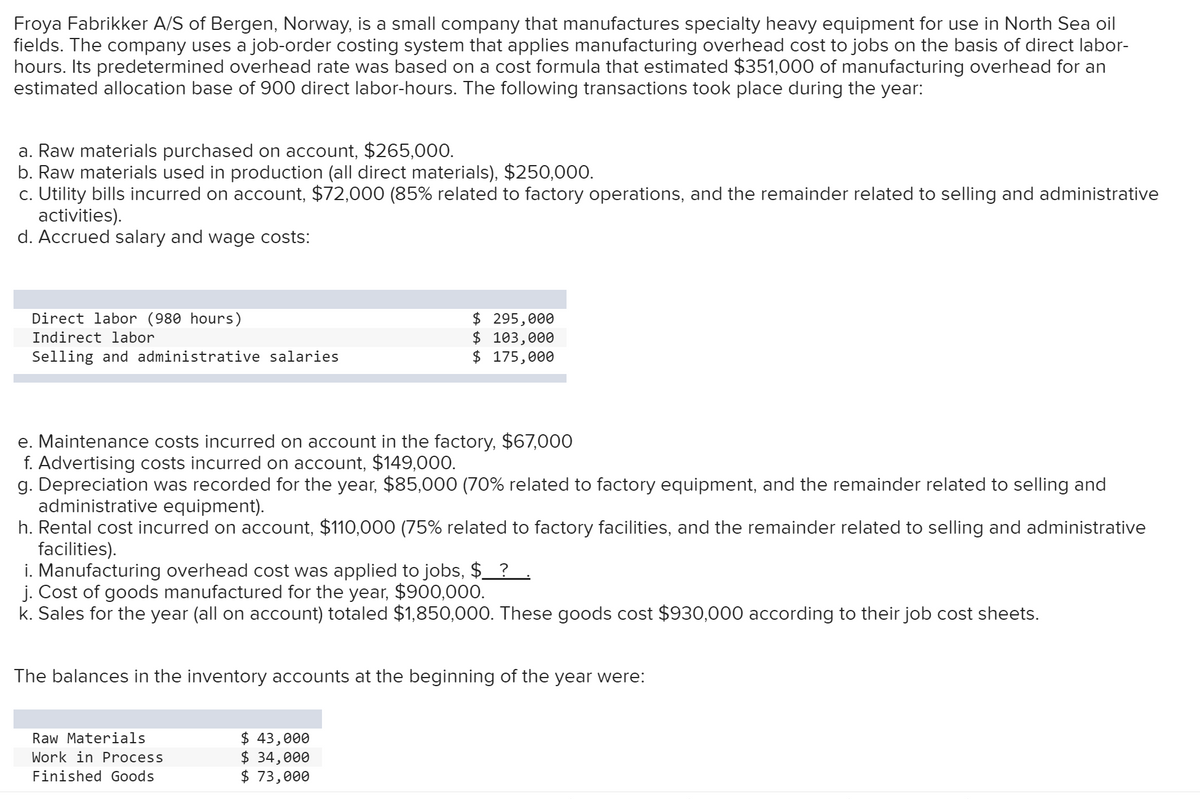

Froya Fabrikker A/S of Bergen, Norway, is a small company that manufactures specialty heavy equipment for use in North Sea oil fields. The company uses a job-order costing system that applies manufacturing overhead cost to jobs on the basis of direct labor- hours. Its predetermined overhead rate was based on a cost formula that estimated $351,000 of manufacturing overhead for an estimated allocation base of 900 direct labor-hours. The following transactions took place during the year: a. Raw materials purchased on account, $265,000. b. Raw materials used in production (all direct materials), $250,000. c. Utility bills incurred on account, $72,000 (85% related to factory operations, and the remainder related to selling and administrative activities). d. Accrued salary and wage costs: Direct labor (980 hours) Indirect labor $ 295,000 $ 103,000 $ 175,000 Selling and administrative salaries e. Maintenance costs incurred on account in the factory, $67,000 f. Advertising costs incurred on account, $149,000. g. Depreciation was recorded for the year, $85,000 (70% related to factory equipment, and the remainder related to selling and administrative equipment). h. Rental cost incurred on account, $110,000 (75% related to factory facilities, and the remainder related to selling and administrative facilities). i. Manufacturing overhead cost was applied to jobs, $_?. j. Cost of goods manufactured for the year, $900,000. k. Sales for the year (all on account) totaled $1,850,000. These goods cost $930,000 according to their job cost sheets. The balances in the inventory accounts at the beginning of the year were: $ 43,000 $ 34,000 $ 73,000 Raw Materials Work in Process Finished Goods

Froya Fabrikker A/S of Bergen, Norway, is a small company that manufactures specialty heavy equipment for use in North Sea oil fields. The company uses a job-order costing system that applies manufacturing overhead cost to jobs on the basis of direct labor- hours. Its predetermined overhead rate was based on a cost formula that estimated $351,000 of manufacturing overhead for an estimated allocation base of 900 direct labor-hours. The following transactions took place during the year: a. Raw materials purchased on account, $265,000. b. Raw materials used in production (all direct materials), $250,000. c. Utility bills incurred on account, $72,000 (85% related to factory operations, and the remainder related to selling and administrative activities). d. Accrued salary and wage costs: Direct labor (980 hours) Indirect labor $ 295,000 $ 103,000 $ 175,000 Selling and administrative salaries e. Maintenance costs incurred on account in the factory, $67,000 f. Advertising costs incurred on account, $149,000. g. Depreciation was recorded for the year, $85,000 (70% related to factory equipment, and the remainder related to selling and administrative equipment). h. Rental cost incurred on account, $110,000 (75% related to factory facilities, and the remainder related to selling and administrative facilities). i. Manufacturing overhead cost was applied to jobs, $_?. j. Cost of goods manufactured for the year, $900,000. k. Sales for the year (all on account) totaled $1,850,000. These goods cost $930,000 according to their job cost sheets. The balances in the inventory accounts at the beginning of the year were: $ 43,000 $ 34,000 $ 73,000 Raw Materials Work in Process Finished Goods

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter2: Accounting For Materials

Section: Chapter Questions

Problem 15E: Kenkel, Ltd. uses backflush costing to account for its manufacturing costs. The trigger points are...

Related questions

Question

Info in images

Transcribed Image Text:Froya Fabrikker A/S of Bergen, Norway, is a small company that manufactures specialty heavy equipment for use in North Sea oil

fields. The company uses a job-order costing system that applies manufacturing overhead cost to jobs on the basis of direct labor-

hours. Its predetermined overhead rate was based on a cost formula that estimated $351,000 of manufacturing overhead for an

estimated allocation base of 900 direct labor-hours. The following transactions took place during the year:

a. Raw materials purchased on account, $265,000.

b. Raw materials used in production (all direct materials), $250,000.

c. Utility bills incurred on account, $72,000 (85% related to factory operations, and the remainder related to selling and administrative

activities).

d. Accrued salary and wage costs:

Direct labor (980 hours)

$ 295,000

$ 103,000

$ 175,000

Indirect labor

Selling and administrative salaries

e. Maintenance costs incurred on account in the factory, $67,000

f. Advertising costs incurred on account, $149,000.

g. Depreciation was recorded for the year, $85,000 (70% related to factory equipment, and the remainder related to selling and

administrative equipment).

h. Rental cost incurred on account, $110,000 (75% related to factory facilities, and the remainder related to selling and administrative

facilities).

i. Manufacturing overhead cost was applied to jobs, $_ ?.

j. Cost of goods manufactured for the year, $900,000.

k. Sales for the year (all on account) totaled $1,850,000. These goods cost $930,000 according to their job cost sheets.

The balances in the inventory accounts at the beginning of the year were:

$ 43,000

$ 34,000

$ 73,000

Raw Materials

Work in Process

Finished Goods

Transcribed Image Text:Req 1

Req 2

Req 3

Req 4A

Req 4B

Req 5

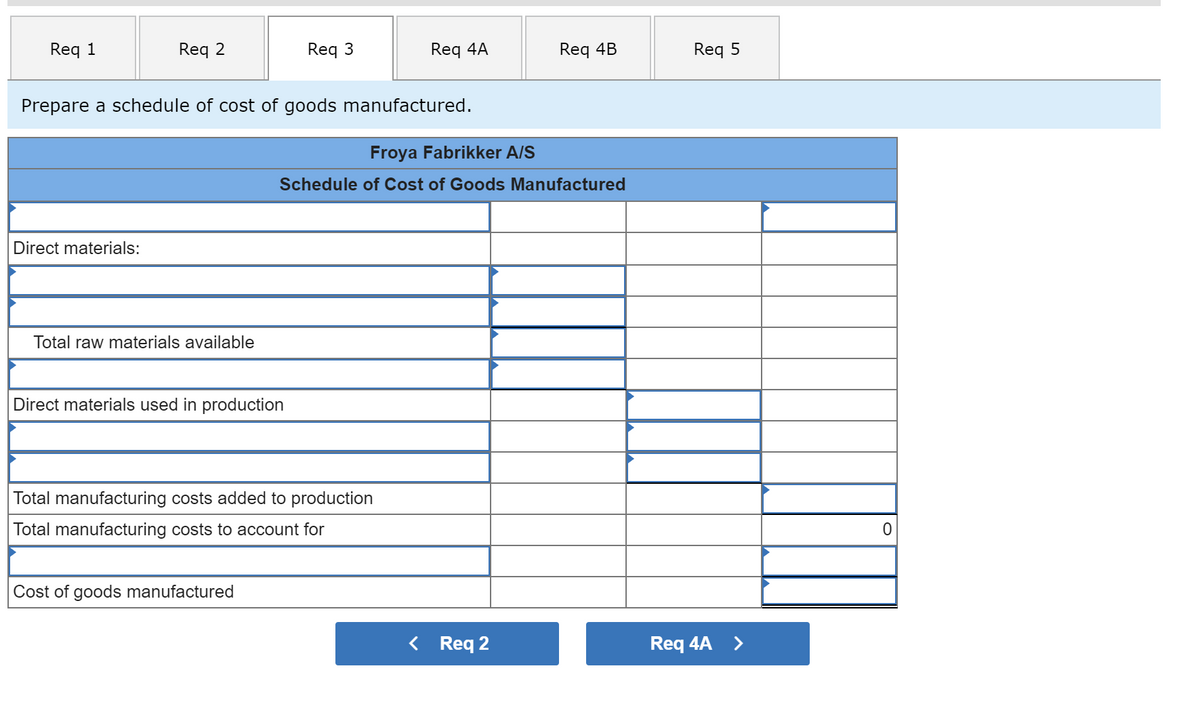

Prepare a schedule of cost of goods manufactured.

Froya Fabrikker A/S

Schedule of Cost of Goods Manufactured

Direct materials:

Total raw materials available

Direct materials used in production

Total manufacturing costs added to production

Total manufacturing costs to account for

Cost of goods manufactured

< Req 2

Req 4A >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,