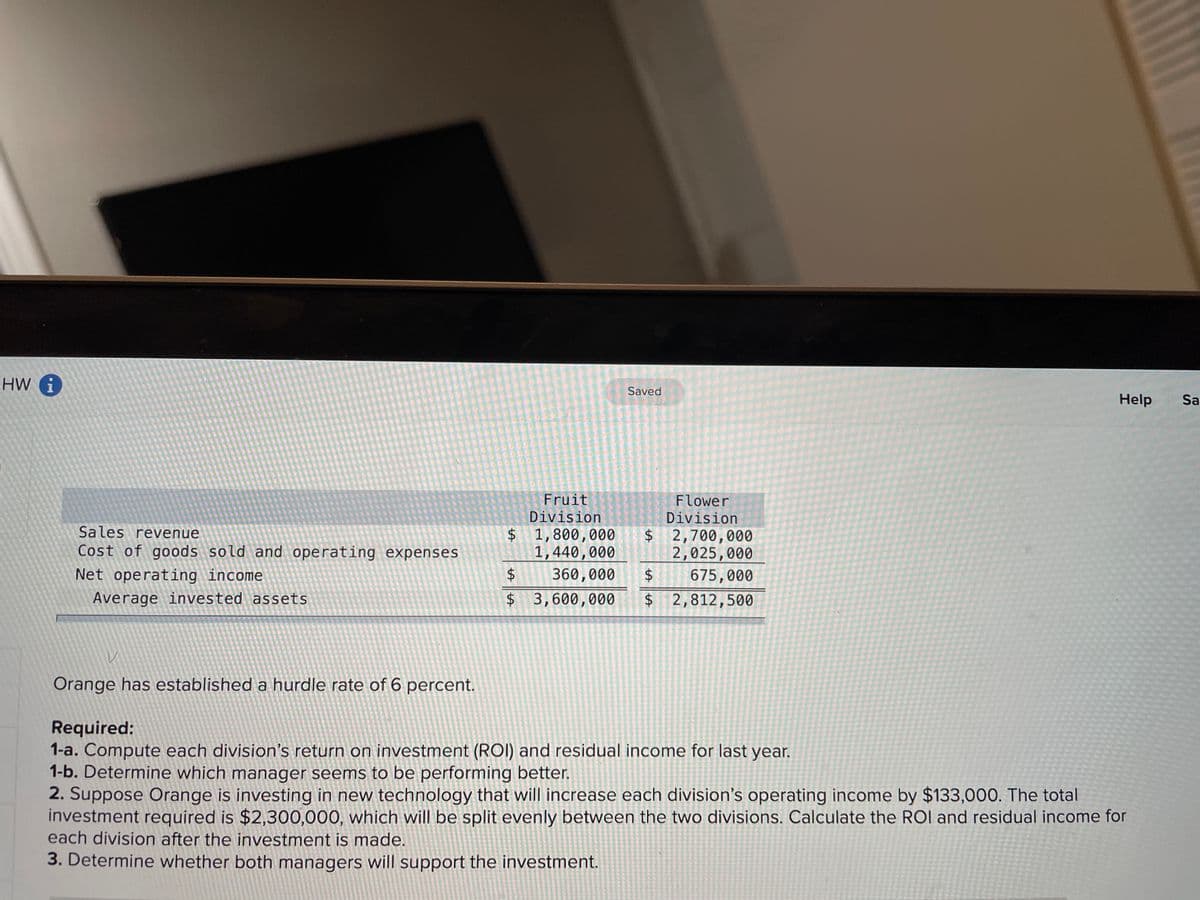

Fruit Division 24 Flower Division Sales revenue Cost of goods sold and operating expenses Net operating income 1,800,000 1,440,000 2$ $2,700,000 2,025,000 360,000 675,000 Average invested assets 24 3,600,000 $ 2,812,500 Orange has established a hurdle rate of 6 percent. Required: 1-a. Compute each division's return on investment (ROI) and residual income for last year. 1-b. Determine which manager seems to be performing better. 2. Suppose Orange is investing in new technology that will increase each division's operating income by $133,000. The total investment required is $2,300,000, which will be split evenly between the two divisions. Calculate the ROI and residual income for each division after the investment is made. 3. Determine whether both managers will support the investment.

Fruit Division 24 Flower Division Sales revenue Cost of goods sold and operating expenses Net operating income 1,800,000 1,440,000 2$ $2,700,000 2,025,000 360,000 675,000 Average invested assets 24 3,600,000 $ 2,812,500 Orange has established a hurdle rate of 6 percent. Required: 1-a. Compute each division's return on investment (ROI) and residual income for last year. 1-b. Determine which manager seems to be performing better. 2. Suppose Orange is investing in new technology that will increase each division's operating income by $133,000. The total investment required is $2,300,000, which will be split evenly between the two divisions. Calculate the ROI and residual income for each division after the investment is made. 3. Determine whether both managers will support the investment.

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter26: Capital Budgeting (capbud)

Section: Chapter Questions

Problem 5R

Related questions

Question

Transcribed Image Text:HW O

Saved

Help

Sa

Fruit

Division

$ 1,800,000

1,440,000

24

Flower

Division

$ 2,700,000

2,025,000

675,000

Sales revenue

Cost of goods sold and operating expenses

Net operating income

360,000

24

Average invested assets

$ 3,600,000

2$

$ 2,812,500

Orange has established a hurdle rate of 6 percent.

Required:

1-a. Compute each division's return on investment (ROI) and residual income for last year.

1-b. Determine which manager seems to be performing better.

2. Suppose Orange is investing in new technology that will increase each division's operating income by $133,000. The total

investment required is $2,300,000, which will be split evenly between the two divisions. Calculate the ROl and residual income for

each division after the investment is made.

3. Determine whether both managers will support the investment.

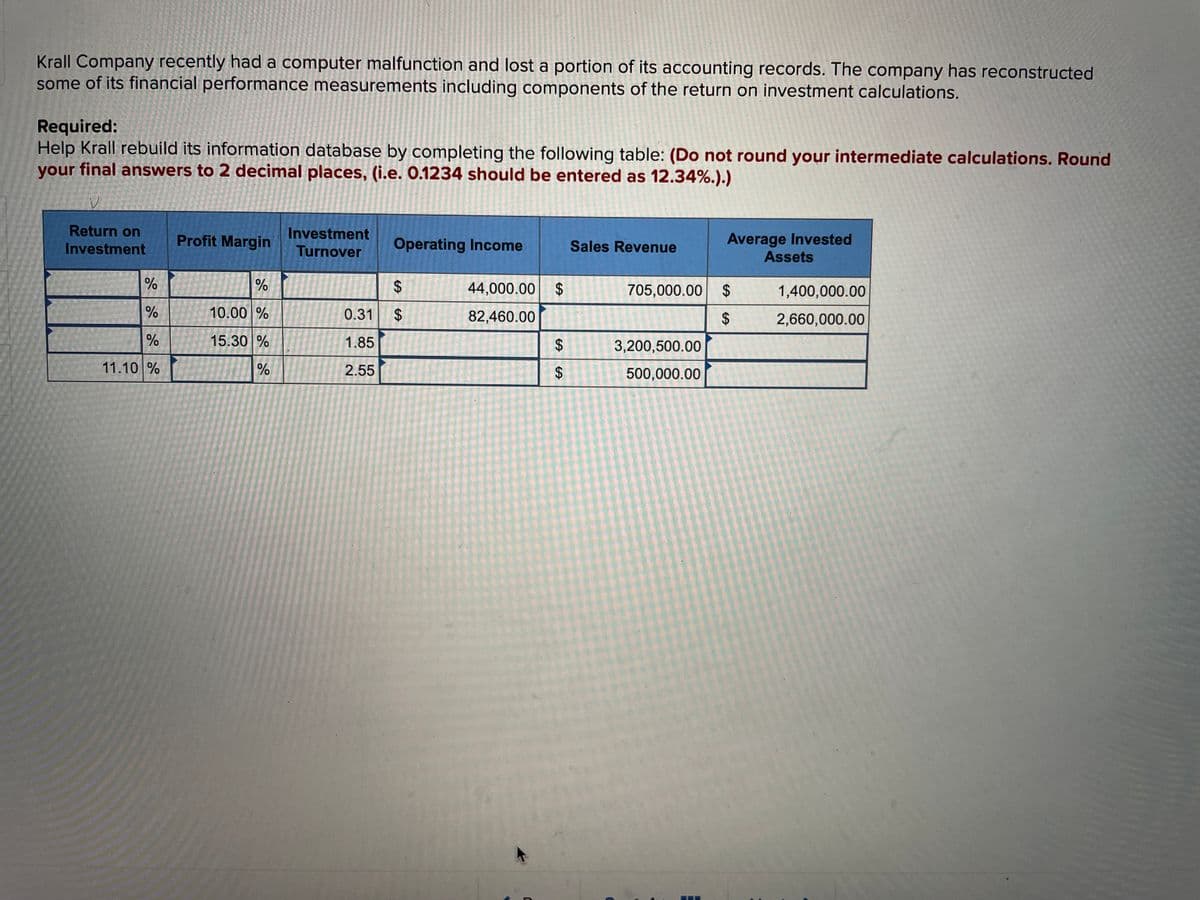

Transcribed Image Text:Krall Company recently had a computer malfunction and lost a portion of its accounting records. The company has reconstructed

some of its financial performance measurements including components of the return on investment calculations.

Required:

Help Krall rebuild its information database by completing the following table: (Do not round your intermediate calculations. Round

your final answers to 2 decimal places, (i.e. 0.1234 should be entered as 12.34%.).)

Return on

Investment

Profit Margin

Operating Income

Average Invested

Assets

Investment

Turnover

Sales Revenue

44,000.00 $

705,000.00 $

1,400,000.00

10.00 %

0.31

82,460.00

2,660,000.00

15.30 %

1.85

3,200,500.00

11.10 %

2.55

500,000.00

%24

%24

%24

%24

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning