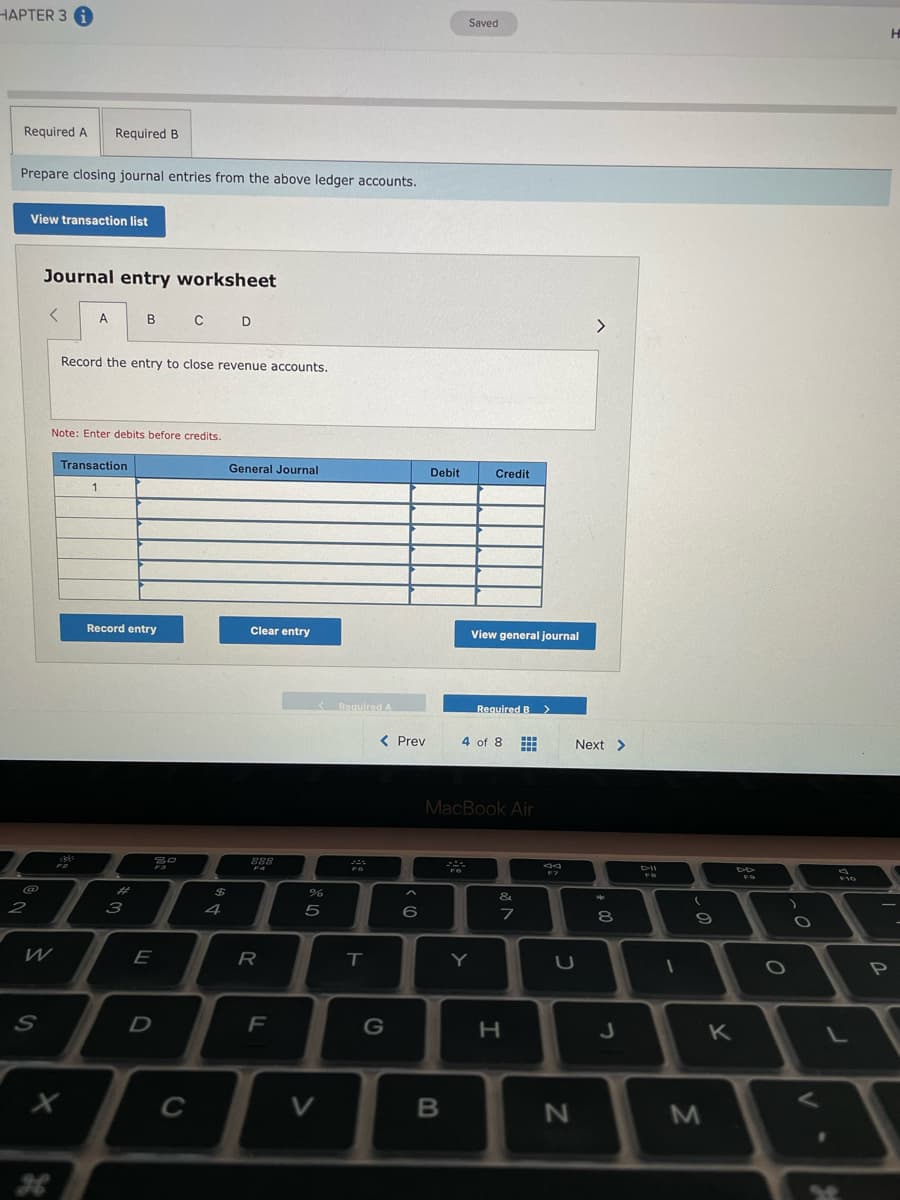

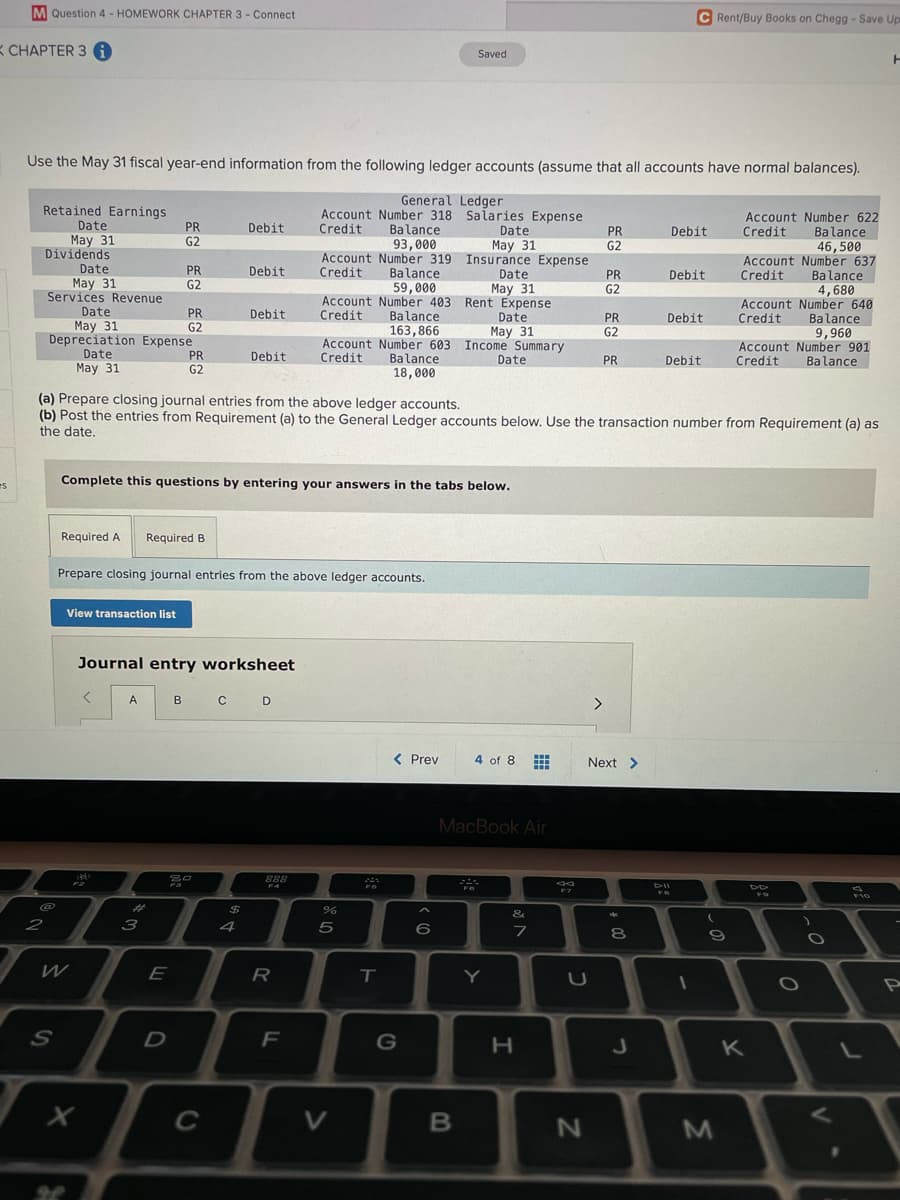

he May 31 fiscal year-end information from the following ledger accounts (assume that all accounts have norm General Ledger zained Earnings Date Account Number 318 Salaries Expense Credit Acco Cred PR G2 Debit Balance 93,000 Date PR G2 Account Number 319 Insurance Expense Debit Мay 31 widends Date May 31 PR G2 Acca Cred. Debit Credit Balance 59,000 Account Number 403 Rent Expense Balance Date May 31 PR G2 Debit May 31 rvices Revenue Date Acco Credi PR G2 epreciation Expense Debit Credit Date May 31 PR G2 Debit May 31 163,866 Account Number 603 Income Summary Аcco

Disclaimer:

“Since you have asked multiple question, we will solve the first question for you. If you want any specific question to be solved then please specify the question number or post only that question.”

Introduction:

The procedure of recording commercial transactions for first time in the books of accounts is known as journal entry. Adjusting entries, closing entries, and regular entries are examples of diary entries. Journal entries serve as the foundation for other accounting tasks such as ledger account order to prepare, trial balances, financial statements, and so on. A journal entry is the initial, methodical written record of all monetary business transactions. They are listed in chronological order, beginning with the date of the incident and ending with the date of the incident. Adjusting entries, closing entries, and regular entries are examples of diary entries.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps