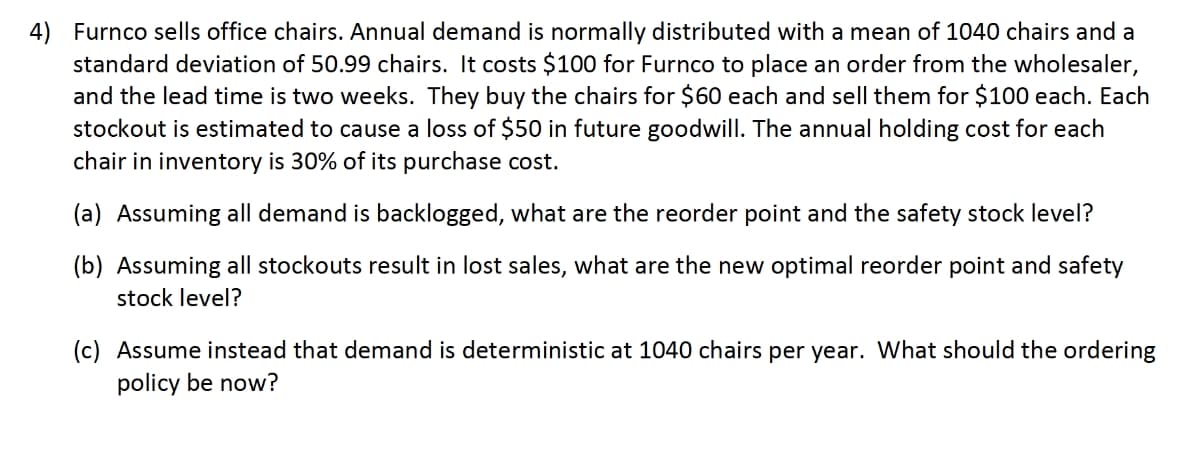

Furnco sells office chairs. Annual demand is normally distributed with a mean of 1040 chairs and a standard deviation of 50.99 chairs. It costs $100 for Furnco to place an order from the wholesaler, and the lead time is two weeks. They buy the chairs for $60 each and sell them for $100 each. Each stockout is estimated to cause a loss of $50 in future goodwill. The annual holding cost for each chair in inventory is 30% of its purchase cost. (a) Assuming all demand is backlogged, what are the reorder point and the safety stock level? (b) Assuming all stockouts result in lost sales, what are the new optimal reorder point and safety stock level? (c) Assume instead that demand is deterministic at 1040 chairs per year. What should the ordering policy be now?

Furnco sells office chairs. Annual demand is normally distributed with a mean of 1040 chairs and a standard deviation of 50.99 chairs. It costs $100 for Furnco to place an order from the wholesaler, and the lead time is two weeks. They buy the chairs for $60 each and sell them for $100 each. Each stockout is estimated to cause a loss of $50 in future goodwill. The annual holding cost for each chair in inventory is 30% of its purchase cost. (a) Assuming all demand is backlogged, what are the reorder point and the safety stock level? (b) Assuming all stockouts result in lost sales, what are the new optimal reorder point and safety stock level? (c) Assume instead that demand is deterministic at 1040 chairs per year. What should the ordering policy be now?

Chapter18: The Management Of Accounts Receivable And Inventories

Section: Chapter Questions

Problem 21P

Related questions

Question

I JUST NEED HELP WITH PART C!!!!!!

Transcribed Image Text:4) Furnco sells office chairs. Annual demand is normally distributed with a mean of 1040 chairs and a

standard deviation of 50.99 chairs. It costs $100 for Furnco to place an order from the wholesaler,

and the lead time is two weeks. They buy the chairs for $60 each and sell them for $100 each. Each

stockout is estimated to cause a loss of $50 in future goodwill. The annual holding cost for each

chair in inventory is 30% of its purchase cost.

(a) Assuming all demand is backlogged, what are the reorder point and the safety stock level?

(b) Assuming all stockouts result in lost sales, what are the new optimal reorder point and safety

stock level?

(c) Assume instead that demand is deterministic at 1040 chairs per year. What should the ordering

policy be now?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning