furnit r equi

Q: State whether the following statements are true or false and justify your answer in each case: a)…

A: Here discuss about the details of the rights of the investor who made investment in the investee…

Q: During the current year, Adrienne Company purchased a second hand machine at a price of P5,000,000.…

A: Capitalized cost is the one which is computed over a certain period of time, starting from the…

Q: Abbott placed into service a flexible manufacturing cell costing $850,000 early this year for…

A: Taxable income is the amount on which the tax is to be paid. It is the amount after considering all…

Q: Lane Industries is considering three independent projects, each of which requires a $2.8 million…

A: IRR or internal rate of return is an important tool that is used in capital budgeting to determine…

Q: uch child tax credit can Bob and Carol claim for their two children in 2021 a. $2,000 b. $5,950 c.…

A: The question is related to taxation.

Q: On November 1, 2020, Cheng Company (a U.S.-based company) forecasts the purchase of goods from a…

A: The Yuan is selling at discount in forward market <spot rate. The forward contract include a…

Q: Determine the net present value of the film as of the beginning of 2018 if the desired rate of…

A: Net Present Value NPV is a measure of Capital Budgeting which is used to determine the net cash at…

Q: A company reports the following amounts at the end of the year: Total sales revenue = $560.000;…

A: Formula: Net revenues = Sales revenue - Sales discount - Sales returns - Sales allowances

Q: Ignore any calculations from prior questions. Information pertaining to Radakovich Corporation's…

A: Selling Price=Cost+Markup

Q: In the case of the adoption of a child who is not a US citizen or resident of the United States, the…

A: It is standardized by the Internal Revenue Service, and credit for eligible adoption expenditures is…

Q: Petitte Corporation has provided the following data from its activity-based costing system: annual…

A: The costs of producing a product are referred to as product cost. Direct labour, direct materials,…

Q: With this information, how many units and at what cost are in inventory to start February? How many…

A: Introduction Inventory valuation using Last In First Out (LIFO) method assumes that the inventory…

Q: Thornton, Inc. estimates manufacturing overhead costs for the Year 3 accounting period as follows.…

A: Predetermined Overhead rate= Budgeted overheads/budgeted machine hours Calculation of budgeted…

Q: Company had ary 1, Vilma c n method of P pany had esti er 31, 2020 wi y had fixed as f P2,000,000 c

A: The total amount of expense that should be reported in the interim income statement ended on 30…

Q: Assume you are the department B manager for Marley's Manufacturing. Marley's operates under a…

A: Introduction:- The following formula used to calculate operating income/Loss percentage as follows:-…

Q: The total resources of YVONNE Company is Php 20 million. Of this amount, 40% is in the form of…

A: Return on equity means the amount of money earned by the shareholders by investing in the equity of…

Q: QUESTION 1 Uber lec purchased a car for $43100. The car has a salvage value of $2000 and is…

A: Assets consists of all type of resources being held by the business. These may be current assets or…

Q: When a more than fifty percent (50%) Partner sells his entire interest in a Partnership to an…

A: Implementation of Tax Cuts and Jobs Act, 2017 had brought a change with respect to the termination…

Q: allaloo Collaborators, Inc. has been considering several capital investment proposals for the year…

A: The Internal Revenue Service describes depreciation as an tax deduction that companies can use to…

Q: can you answer #4 Return on assets and #5 Shamrock Corporation was formed 5 years ago through a…

A: Since, you have specifically asked for part 4 and 5, so we are solving same for you. Return on…

Q: Activity-Based Costing (ABC) 6. Jose Company specializes in the production of two types of products,…

A: Calculation of overhead cost Particulars A-1 B-3 Set up cost 40000 (140000 x 100/350)…

Q: Rodriguez, Inc., is preparing its direct labor budget for 2020 from the following production budget…

A: Direct labor is the direct expense. It is amount of wage paid to the labor which is directly…

Q: Indirect expenses for the period follow. $ 45,000 25,000 10,000 $ 80,000 Rent Advertising Insurance…

A: During prior periods, the overhead was allocated on the basis of area in square feet occupied by…

Q: Which of the following is a basic limitation associated with ratio analysis

A: Ratio Analysis is very helpful in analyzing the balance sheet and income statement items and…

Q: The most common funds used by private colleges and universities include all of the following except.…

A: A funds has been defined as" a sum of money or other resources segregated for the purpose of…

Q: Which of the following statements best describes the process of tax planning? Oa. Tax planning is…

A: Given : a. Tax planning is the calculation of a taxpayer's marginal rate of tax.b. Tax planning is…

Q: What total amount of expenses should be reported in the income statement for the 2nd quarter of…

A: Expenses means the amount spent on running the business. It will be shown in income statement and…

Q: Transactions: a. Deposited Php120,000 in a bank account in the name of the business. b. Bought…

A: The accounting equation states that assets equal to sum of liabilities and equity of the…

Q: Neely Systems Corporation manufactures and sells various high-tech office automation products. Two…

A: Solution: Spare capacity of Computer chip division = 10000 - 6000 = 4000 chips Variable cost per…

Q: Babak Industries is a division of a major corporation. Last year the division had total sales of…

A: Formula: Division's turnover = ( Sales revenue / Average operating Assets ) x 100

Q: Financial Ratios 2018 2019 2020 2021 Sales Growth Rate .97% .952% 1.13% EBIT Margin .81% 8.4% 8.4%…

A: In the accounting cycle, the last stage is the "analysis and interpretation" of the…

Q: The controller of Ferrence Company estimates the amount of materials handling overhead cost that…

A: The process of recognizing, aggregating, and assigning costs to cost items is known as cost…

Q: 1. Honest Corporation carried a provision of P1,500,000 in the draft financial statements for the…

A: As per IAS 10, Events after the reporting period, An event is said to be adjusting event if, that…

Q: Consider the following information pertaining to OldWest's inventory: Product Quantity Cost Net…

A: Lets understand the basics. As per IAS "2" inventory needs to be valued at lower of cost or net…

Q: On Jan. 1, 2021, Sleepy Company entered into a direct financing lease. A third party guaranteed the…

A: A lessor is essentially someone who grants a lease to someone else. As such, a lessor is the owner…

Q: d. Inappropriate Assignment of Labor Costs to Inventory A company having difficulty meeting profit…

A: Analytical procedures are the methods used by the auditors to find out the plausible differences…

Q: Total $ 260,400 159,600 Per Unit $ 31.00 19.00 Sales (8,400 units) Variable expenses Contribution…

A: Formula: Net income = Revenues - Expenses.

Q: Current assets amount to PHP30,000 while noncurrent assets are PHP50,000. Sales amount to…

A: The asset turnover ratio compares the value of a company's assets to the value of its sales or…

Q: b. Excess Payments to Employees Increasing the rate above that approved or paying employees for more…

A: Labor Productivity is important for the success of a business, it is calculated or measured as the…

Q: On De 500,00

A: The expense recognition is based on the concept of accrual accounting. Property taxes paid for the…

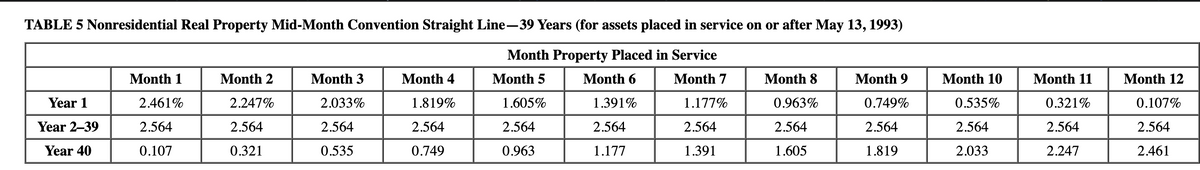

Q: cimum amount of depreciation that the company can claim in 2021 (Year 2) for the building? u cannot…

A: Answer 1) Option (e) is correct - $ 18,000. As per Internal revenue service , the useful life of the…

Q: Cost of Merchandise Inventory and Cost of Merchandise Sold Inventory Method Merchandise Inventory…

A: Answer 1. Cost flow statement under FIFO method FIFO Cost of goods available for sale Cost…

Q: A division of Midland Oil & Gas has a taxable income (TI) of $8.7 million for a tax year. If the…

A: Taxable Income: $8,500,000 State tax rate: 6% Before tax rate of return: 22% Equivalent after tax…

Q: eriodic Inventory Using FIFO, LIFO, and Weighted Average Cost Methods The units of an item…

A: LIFO method - Last in first out. It assumes that last inventory are sold first FIFO - First on…

Q: Which of the following discount rates will produce the smallest present value? Click here to view…

A: Present Value = Future Cash flow/(1+r)n Where r is the discount rate and n is the number of future…

Q: DATE TRANSACTIONS 20x1 Sept. 2 Purchased ski boots for $7,600 plus a freight charge of $310 from…

A: Journal entries shows the recording of transactions during an accounting year and every transaction…

Q: Exercise 14-22 (LO. 3) Juliana purchased land three years ago for $50,000. She made a gift of the…

A: In the case of capital gain or loss arising from gifted property or inheritance, the cost of the…

Q: Alyeski Tours operates day tours of coastal glaciers in Alaska on its tour boat the Blue Glacier.…

A: The flexible budget is prepared to record the data for flexible budget based on actual units or…

Q: On November 1, 2021, Agar-Agar Corporation had a division that met the criteria for discontinuance…

A: Reportable Income: Payments made to or on behalf of a person that must be "reported" to the…

Q: Sales Revenue $5,000 Inventory, January 1, 2015 $1,600 Purchases $1,200 Interest Revenue $250 Loss…

A: Single-step income statement A single-step income statement summarises a company's revenue and…

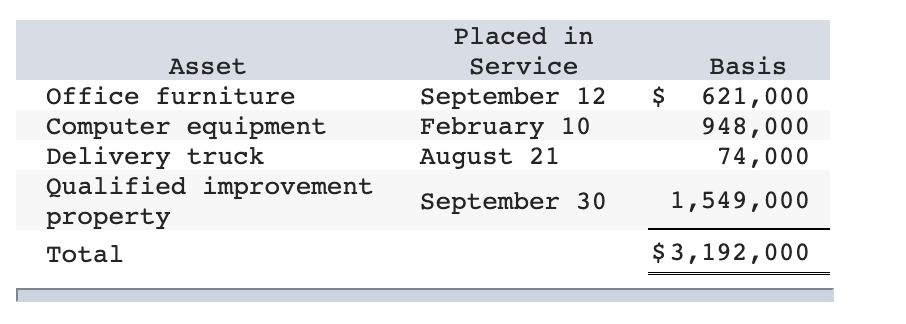

Chaz Corporation has taxable income in 2020 of $396,000 for purposes of computing the §179 expense and acquired the following assets during the year:

What is the maximum total

Step by step

Solved in 2 steps

- See image. Choices: a. P780,000 b. P720,000 c. P1,440,000 d. P560,000question 6tables and question attached in ss's belwo aoi52 h2i5h 25 thanks for help l42 64p2oCompany_A Company_B Industry_Index0.05072904 0.12515871 0.066853460.01486974 0.04931926 0.01986469-0.06178058 -0.09797119 -0.06618699-0.00553426 -0.00350203 -0.002453480.05051436 0.09901787 0.049130690.00314946 0.03793538 0.014420130.02414459 0.06546216 0.03510414-0.00859679 -0.01240826 -0.01093989-0.04991867 -0.07997777 -0.05958256-0.01880513 -0.03070676 -0.011357020.03244373 0.06944611 0.037463590.03989886 0.06959868 0.03820101-0.00227524 0.00535924 0.003629850.08699012 0.17364902 0.08813692-0.02364987 -0.06779889 -0.022791970.02096745 0.06365353 0.026876440.01348849 0.04595448 0.01708248-0.04434861 -0.06926109 -0.04669314-0.07177356 -0.22266492 -0.099407190.09142303 0.19338777 0.092811680.00082669 0.02676372 0.00774505-0.01214213 -0.02179503 -0.01130655-0.04803256 -0.07637749 -0.052557480.00487633 0.04582172 0.01566317

- Number 1 is Product A = 2.81 and Product B = 2.85 Number 2 is Product A = 23,733 and Product B = 29,104 Number 3 is Product A = 22.8 and Product B = 22.3 Number 5 is Product A = 15.5 and Product B = 15.1 Number 6 is NPT = B, PI = A, PP = A, IRR = A, SRR = A I need help with Number 4 and 6B Thank youD1 Retention: 50%, D7 Retention: %20, D30 Retention: 8% Interstitial Impressions per DAU: 4, Rewarded Impressions per DAU: 2 Interstitials eCPM: $30, Rewarded eCPM: $50 1) What is day 7 ARPU? 2) How would you estimate d30 ARPU?