g. An increase in the Deferred Tax Liability account on the statement of financial position is recorded by a Income Tax Expense account. (debit, credit) to the

g. An increase in the Deferred Tax Liability account on the statement of financial position is recorded by a Income Tax Expense account. (debit, credit) to the

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter3: Taxes On The Financial Statements

Section: Chapter Questions

Problem 4BCRQ

Related questions

Question

Complete the following statements by filling in the blanks. Please make sure to indicate the subparts when you are answering.

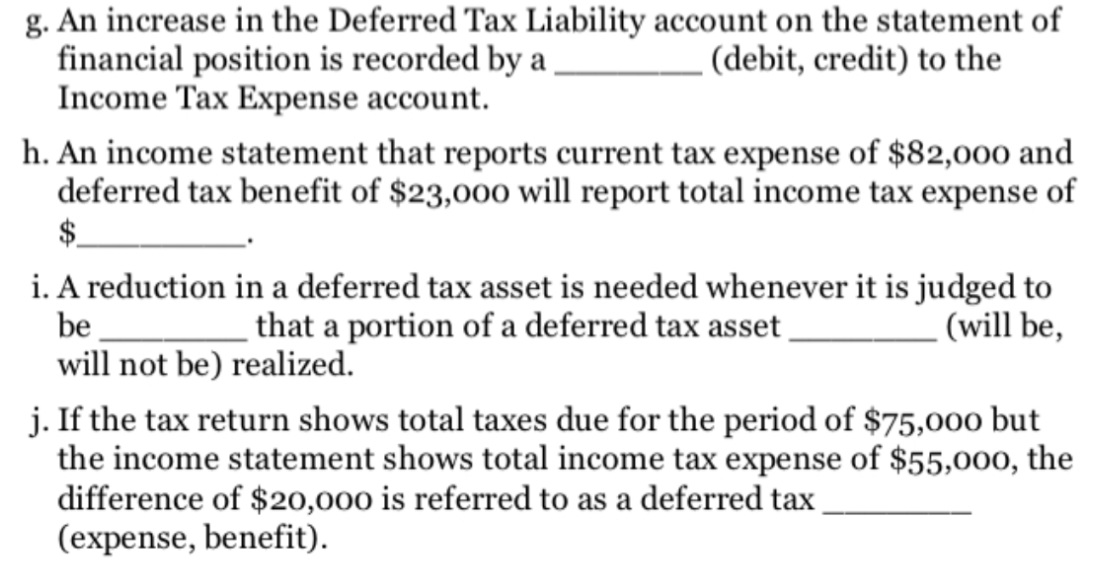

Transcribed Image Text:g. An increase in the Deferred Tax Liability account on the statement of

financial position is recorded by a

Income Tax Expense account.

(debit, credit) to the

h. An income statement that reports current tax expense of $82,000 and

deferred tax benefit of $23,000 will report total income tax expense of

$

i. A reduction in a deferred tax asset is needed whenever it is judged to

that a portion of a deferred tax asset .

be

(will be,

will not be) realized.

j. If the tax return shows total taxes due for the period of $75,000 but

the income statement shows total income tax expense of $55,000, the

difference of $20,000 is referred to as a deferred tax

(expense, benefit).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning