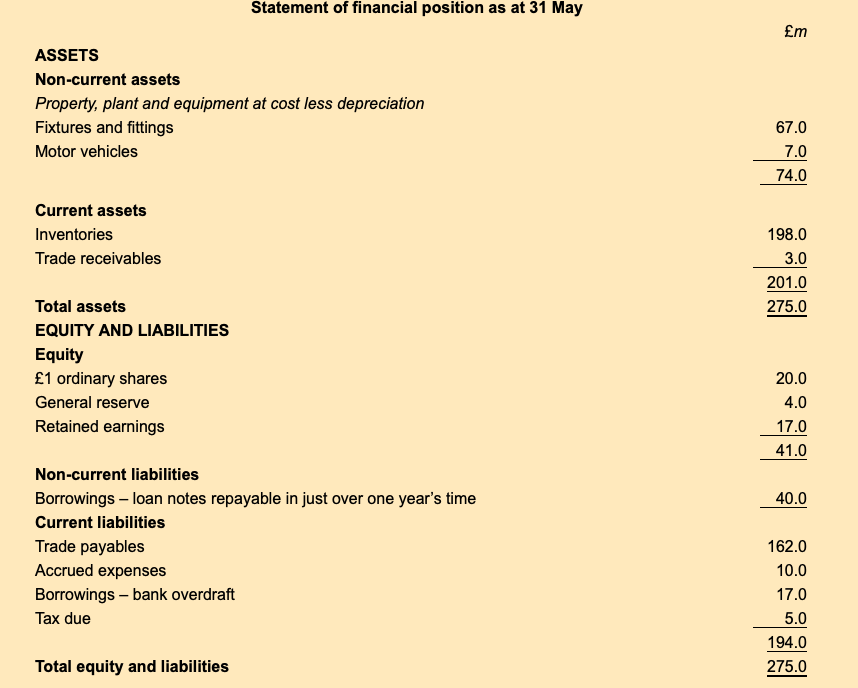

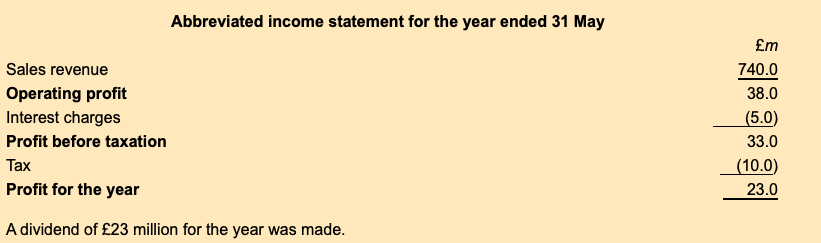

Gainsborough Fashions Ltd operates a chain of fashion shops. In recent months the business has been under pressure from its suppliers to reduce the average credit period taken from three months to one month. As a result, the directors have approached the bank to ask for an increase in the existing overdraft for one year to be able to comply with the suppliers’ demands. The most recent financial statements of the business are as follows: Notes: 1The loan notes are secured by personal guarantees from the directors. 2The current overdraft bears an interest rate of 12 per cent a year. Required: (a)Identify and discuss the major factors that a bank would take into account before deciding whether or not to grant an increase in the overdraft of a business. (b)State whether, in your opinion, the bank should grant the required increase in the overdraft for Gainsborough Fashions Ltd. You should provide reasoned arguments and supporting calculations where necessary.

Gainsborough Fashions Ltd operates a chain of fashion shops. In recent months the business has been under pressure from its suppliers to reduce the average credit period taken from three months to one month. As a result, the directors have approached the bank to ask for an increase in the existing overdraft for one year to be able to comply with the suppliers’ demands. The most recent financial statements of the business are as follows:

Notes:

-

1The loan notes are secured by personal guarantees from the directors.

-

2The current overdraft bears an interest rate of 12 per cent a year.

Required:

-

(a)Identify and discuss the major factors that a bank would take into account before deciding whether or not to grant an increase in the overdraft of a business.

-

(b)State whether, in your opinion, the bank should grant the required increase in the overdraft for Gainsborough Fashions Ltd. You should provide reasoned arguments and supporting calculations where necessary.

Step by step

Solved in 3 steps with 2 images