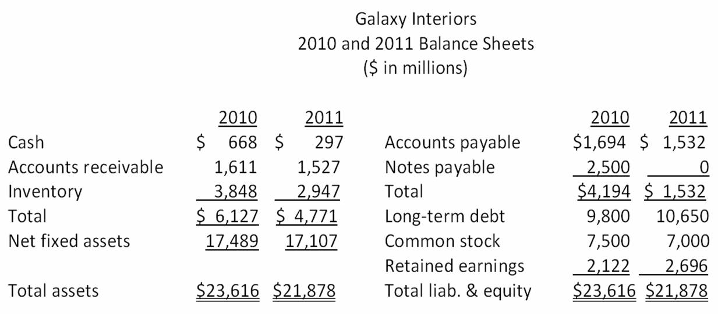

Galaxy Interiors 2010 and 2011 Balance Sheets ($ in millions) 2010 2011 2010 2011 Cash $ 668 $ 297 Accounts payable $1,694 $ 1,532 Accounts receivable 1,611 1,527 Notes payable 2,500 0 Inventory 3,848 2,947 Total $4,194 $1,532 Total $ 6,127 Net fixed assets $4,771 17,489 17,107 Total assets $23,616 $21,878 Long-term debt Common stock Retained earnings Total liab. & equity 2,122 $23,616 $21,878 9,800 10,650 7,500 7,000 2,696

Q: Background and Information Mohamad, owner of an residential furnished apartment's in Dubai,…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: The price of an Australian Savings Bond (ASB) with no expiration date is originally $1,000 and has a…

A: The objective of this question is to calculate the interest rate yield to a new buyer of the…

Q: please answer both questions fully.

A: Evaluating Silicon Wafer Milling Machines:Techron I:Annual Depreciation = (Cost - Salvage Value) /…

Q: Which statements is INCORRECT? Treasury bonds (T-bond) have maturities up to 30 years A coupon…

A: Treasury bonds (T-bond) have maturities up to 30 years: This statement is correct. Treasury bonds…

Q: Project L requires an initial outlay at t=0 of $60,000, its expected cash inflows are $11,000 per…

A: Step 1: Find the Present Value (PV) of Cash Inflows1.1. Identify the cash flows: In this case, we…

Q: 22. Portfolio Expected Return You have $250,000 to invest in a stock portfolio. Your choices are…

A: Step 1: Step 2: Step 3: Step 4:

Q: If we consider the effect of taxes, then the degree of operating leverage can be written as:…

A: Let's break down each part in more detail.a. **Calculating the Degree of Operating Leverage (DOL) at…

Q: Suppose that Gyp Sum Industries currently has the balance sheet shown. below, and that sales for the…

A: Step 1:A balance sheet is a type of financial statement that shows a company's assets, liabilities,…

Q: Corporate Finance In Reddit’s IPO, shares were issued at $34, and increased 48% that day, closing at…

A: The objective of the question is to understand whether the founders of Reddit would be upset at the…

Q: Bhupatbhai

A: Let's thoroughly review the Net Advantage of Leasing (NAL) calculation, incorporating all the…

Q: None

A: Answer image:a. b. c.Option c. on average, the investment strategy in part a) is less risky but…

Q: None

A: The objective of the question is to estimate the total value of the company and the value of its…

Q: Company Express S. A. asks you to construct cash flows for following three (3) investment projects,…

A: Certainly! Let's break down the calculation of cash flows for Project 1 in detail, step by step. 1.…

Q: None

A: (b) Minimum Acceptable Rate of Return (10%)Comparison:After-Tax Cost of Money (4.8%) < Minimum…

Q: Total income of R17 100,50

A: To clarify, it sounds like you might want some kind of calculation or explanation related to the…

Q: Calculate the cash flows for this question

A: Certainly! Let's break down the provided data and its implications into six detailed paragraphs. 1.…

Q: At the beginning of the year, a firm had current assets of $121,306 and current liabilities of…

A: Step 1: The calculation of Change in net working capital AB1Current assets at the beginning $…

Q: Could you check these answers and help me with the IRR?

A: Your answers for the NPV are correct:NPV with mitigation: $416.60 millionNPV without mitigation:…

Q: Emma holds a $7,500 portfolio that consists of four stocks. Her investment in each stock, as well as…

A: The objective of the question is to determine the stock that contributes the least market risk and…

Q: Equipment has a book value of $4, 300 at the end of a project, but it can be sold for $5,400. What…

A: To calculate the cash flow for capital budgeting purposes at the end of the project, you need to…

Q: Suppose the continuously compounding interest rate r is constant. Given S(0), find the price of the…

A: Continuously Compounding Interest Rate (r): This is the interest rate at which an investment grows…

Q: Bhupatbhai

A: Approach to solving the question:Here is how I arrived with the calculations above.1. Calculating…

Q: This quiz: 10 point(s) possible This question: 1 point(s) possible Submit quiz (Discounted payback…

A: To compute the discounted payback period, you need to follow these steps: 1. **Determine the…

Q: 1. GBP/CAD ханшлалын ВАЅ=? Bid Ask USD/MNT 2811.002901.00 MNT/KRW 0.40 0.42 GBP/KRW 1508.571509.84…

A: The correct answer is D. 7.89%.To arrive at this answer, we need to first calculate the bid and ask…

Q: Consider the case of Blue Hamster Manufacturing Inc.: Last Tuesday, Blue Hamster Manufacturing Inc.…

A: Permit me to elaborate on how Project Lambda's initial investment was determined.The following…

Q: Six years ago the Templeton Company issued 25-year bonds with a 15% annual coupon rate at their…

A: Step 1:PV-1000 FV1090(1000*109%)PMT150(1000*15%)NPER6 YTC16.00% Rate (6.150,-1000,1090) Step 2:III)…

Q: a. What is the relative tax advantage of corporate debt if the corporate tax rate is TC=0.22, the…

A: Step 1: The formula for this is: Relative Tax Advantage = (1 - Tp) / (1 - Tpe) * (1 - Tp) where Tc…

Q: Consider the following information on two stocks: P(State) Stock A Stock B Boom 20% 30% 20% Normal…

A: Certainly! Let's break down the steps to calculate the standard deviation of the portfolio:1.…

Q: Consider the following information on two stocks: P(State) Stock A Stock B Boom 20% 30% 20% Normal…

A: To calculate the weight of Asset A (Stock A) in the portfolio, we followed these steps:1. Total…

Q: please answer these two

A: Qn 1: LED vs Incandescent Bulb - Break-Even CostHere's the corrected approach to find the break-even…

Q: None

A: A. To find the unlevered beta of the benchmark company, we can use the formula for unlevered beta:…

Q: SLM, Inc., with sales of $800, has the following balance sheet: SLM, Incorporated Balance Sheet…

A: A. Determine the balance sheet entries for sales of 1400 using the percent of sales forecasting…

Q: Corporate Finance You begin working at an investment bank with a group of analysts, and you are all…

A: Using a 40% Growth Rate for Amazon's DCF Model: A Critical Assessment There are drawbacks to the…

Q: Corporate Finance Company A and Company B’s revenues and variable expenses (e.g. COGS) are…

A: References Pinto, J. E. (2020). Equity asset valuation. John Wiley & Sons.

Q: Please answer question 3 as accurate as possible this is my third time submitting this question

A: Here's a detailed calculation for better understanding. The calculation for the new dividend per…

Q: has come out with an even better product. As a result, the firm projects an ROE of 20%, and it will…

A: Part 2: Explanation:Step 1: Calculate the growth rate (g):\[ g = ROE \times Plowback ratio = 20%…

Q: A firm has the following monthly pattern of sales: January $ 200 February 300 March 600…

A: Part 2:Explanation:Step 1: Calculate variable disbursements (wages):- January: $200 * 60% = $120-…

Q: Madison Manufacturing is considering a new machine that costs $350,000 and would reduce pre-tax…

A: To better understand the computations, let's go over each step in greater detail: First, figure out…

Q: Based on the following information, what is the expected return? State of Economy Recession Normal…

A:

Q: A bond with a coupon rate of 9 percent sells at a yield to maturity of 11 percent. If the bond…

A: ### Bond Price Calculation The bond's price is determined by discounting all future cash flows…

Q: Dog Up! Franks is looking at a new sausage system with an installed cost of $695,000. The asset…

A: Step 1: Determine the Cash Flows for each year. For year 0, the cash flows are the installation…

Q: Item 9 You work for a nuclear research laboratory that is contemplating leasing a diagnostic…

A: Step 1: Calculate the present value of the lease payments.Present value of lease payments =…

Q: You are attempting to value a put option with an exercise price of $108 and one year to expiration.…

A: Step 1:Calculate the option value at expiration based upon your assumption of a 50% chance of…

Q: Nikul

A: The objective of the question is to calculate the expected return and the standard deviation of the…

Q: None

A: Approach to solving the question: For better clarity of the solution, I have provided the…

Q: Q: Three years ago the USD/RUB exchange rate was 77.37 and today the exchange rate now sits at…

A: The objective of the question is to understand the changes in the exchange rate between the Russian…

Q: Baghiben

A: Step 1:Bond duration is a metric that reveals how much a bond's price may move in response to…

Q: None

A: Double-checking the calculations:There seems to be a mistake in the answer choices. Our calculation…

Q: What is the total amount you will pay if you do not pay the loan within the term and meet all the…

A: Step 1:Given: Loan amount = $5400Period of loan = 72 monthsFinal loan amount = $6965.35Interest is…

Q: Reconsider the determination of the hedge ratio in the two-state model where we showed that…

A: a.Solution:Upper state (uS0) = 135Down State (dS0) = 115Difference = 20Exercise priceHedge…

What is the cash flow from assets in 2011?

Question 10Answer

$2,247

$3,915

$1,732

$2,961

Step by step

Solved in 2 steps

- Orbit Limited : Statement of Financial Position as at 31 December 2022 2021 Non-current Assets R11 810 000 R7 560 000 Property, Plant, Equipment R10 025 000 R6 250 000 Investments R1 785 000 R1 310 000 Current Assets R4 190 000 R4 690 000 Inventories R 1 875 000 R2 350 000 Account Receivable R1 925 000 R2 200 000 Cash R390 000 R140 000 Toatal Assets R16 000 000 R12 250 000 Equities & Liabilities Equity ? ? Oridanary share capital R5 480 000 R3 680 000 Retained earnings ? ? Non-current Liabilities R4 500 000 R3 800 000 Loan (20% p.a) R4 500 000 R3 800 000 Current Liabilities R2 300 000 R1 500 000 Accounts payable? R2 300 000 R1 500 000 Calculate the increase in the retained earnings over the two-year period.Use the below information to answer the following questions: 20202021Sales$11,573$12,936Depreciation 1661 1736Cost of goods sold 3979 4707Other Expenses 846 924Interest Expense 776 926Cash 6067 6466Accounts Receivables 8034 9427Short-term Notes Payable 1171 1147Long-term debt 20,320 24,696Net fixed assets 50,888 54,273Accounts Payable 4384 4644Tax rate 26% 34%Inventory 14,283 15,288Payout ratio 33% 30% A. Create the Balance Sheets for 2020 & 2021.Use the below information to answer the following questions: 20202021Sales$11,573$12,936Depreciation 1661 1736Cost of goods sold 3979 4707Other Expenses 846 924Interest Expense 776 926Cash 6067 6466Accounts Receivables 8034 9427Short-term Notes Payable 1171 1147Long-term debt 20,320 24,696Net fixed assets 50,888 54,273Accounts Payable 4384 4644Tax rate 26% 34%Inventory 14,283 15,288Payout ratio 33% 30% A. Create the Income Statements for 2020 and 2021 (including dividends paid and retained earnings).

- BnB Construction Inc.Balance Sheet (Millions of Dollars) Assets 2021 Est 2020 2019 Liabilities 2021 Est 2020 2019 Cash and Cash Equivalents 15 10 15 Accounts payable 115 60 30 Short-Term Investments 10 0 65 Overdrafts 115 110 60 Accounts Receivable 420 375 315 Accruals 260 140 130 Inventories 700 615 415 Total Current Liabilities 490 310 220 Total Current Assets 1145 1000 810 Long -Term Bonds and New Loan 1300 754 580 Net Plant and Equipment 1884 1190 870 Total Debt 1790 1064 800 Preferred Stock 40 40 40 Common Stock 130 130 130 Retained Earnings 1069 956 710 Total Common Equity 1199 1086 840 Total Assets 3029 2190 1680 Total Liabilities and Equity 3,029 2,190 1,680 Included is the Income Statement. Requirements: 1. Calculate the EPS, DPS, and BVPS, and Cash…Description FY10 FY11 FY12 FY13 FY14 Financial Statements GBP m GBP m GBP m GBP m GBP m Income Statements Revenue 4,390 3,624 3,717 8,167 11,366 Profit before interest & taxes (EBIT) 844 700 704 933 1,579 Net Interest Payable (80) (54) (98) (163) (188) Taxation (186) (195) (208) (349) (579) Miniorities (94) (99) (105) (125) (167) Profit for the year 484 352 293 296 645 Balance Sheet Fixed Assets 3,510 3,667 4,758 10,431 11,483…SME Balance Sheet 2021 2020 Assets (in millions) Cash 85.960 56.460 Receivables 89.560 80.670 Inventories 55.750 41.260 Other Current Assets 9.950 6.760 Total Current Assets 241.220 185.150 Net Property, Plant, and Equipment 78.970 68.930 Goodwill and Other Intangible Assets 103.110 104.360 Other Non-Current Assets 6.900 4.200 Total Assets 430.200 362.640 Total Liabilities and Shareholders' Equity Payables 83.240 57.48 Current Debt 2.700 2.64 Total Current Liabilities 85.940 60.120 Long-Term Debt 122.000 119.62 Other Liabilities 21.880 22.58 Total Liabilities 229.820 202.320 Common Stock 200.380 160.32 Total Equity 200.38 160.32 Total Liabilities and Equity 430.200 362.640 INCOME STATEMENT 2021 Total Revenue (M) 488.10…

- SME Balance Sheet 2021 2020 Assets (in millions) Cash 85.960 56.460 Receivables 89.560 80.670 Inventories 55.750 41.260 Other Current Assets 9.950 6.760 Total Current Assets 241.220 185.150 Net Property, Plant, and Equipment 78.970 68.930 Goodwill and Other Intangible Assets 103.110 104.360 Other Non-Current Assets 6.900 4.200 Total Assets 430.200 362.640 Total Liabilities and Shareholders' Equity Payables 83.240 57.48 Current Debt 2.700 2.64 Total Current Liabilities 85.940 60.120 Long-Term Debt 122.000 119.62 Other Liabilities 21.880 22.58 Total Liabilities 229.820 202.320 Common Stock 200.380 160.32 Total Equity 200.38 160.32 Total Liabilities and Equity 430.200 362.640 INCOME STATEMENT 2021 Total Revenue (M) 488.10…SME Balance Sheet 2021 2020 Assets (in millions) Cash 85.960 56.460 Receivables 89.560 80.670 Inventories 55.750 41.260 Other Current Assets 9.950 6.760 Total Current Assets 241.220 185.150 Net Property, Plant, and Equipment 78.970 68.930 Goodwill and Other Intangible Assets 103.110 104.360 Other Non-Current Assets 6.900 4.200 Total Assets 430.200 362.640 Total Liabilities and Shareholders' Equity Payables 83.240 57.48 Current Debt 2.700 2.64 Total Current Liabilities 85.940 60.120 Long-Term Debt 122.000 119.62 Other Liabilities 21.880 22.58 Total Liabilities 229.820 202.320 Common Stock 200.380 160.32 Total Equity 200.38 160.32 Total Liabilities and Equity 430.200 362.640 INCOME STATEMENT 2021 Total Revenue (M) 488.10…SME Balance Sheet 2021 2020 Assets (in millions) Cash 85.960 56.460 Receivables 89.560 80.670 Inventories 55.750 41.260 Other Current Assets 9.950 6.760 Total Current Assets 241.220 185.150 Net Property, Plant, and Equipment 78.970 68.930 Goodwill and Other Intangible Assets 103.110 104.360 Other Non-Current Assets 6.900 4.200 Total Assets 430.200 362.640 Total Liabilities and Shareholders' Equity Payables 83.240 57.48 Current Debt 2.700 2.64 Total Current Liabilities 85.940 60.120 Long-Term Debt 122.000 119.62 Other Liabilities 21.880 22.58 Total Liabilities 229.820 202.320 Common Stock 200.380 160.32 Total Equity 200.38 160.32 Total Liabilities and Equity 430.200 362.640 INCOME STATEMENT 2021 Total Revenue (M) 488.10…

- SME Balance Sheet 2021 2020 Assets (in millions) Cash 85.960 56.460 Receivables 89.560 80.670 Inventories 55.750 41.260 Other Current Assets 9.950 6.760 Total Current Assets 241.220 185.150 Net Property, Plant, and Equipment 78.970 68.930 Goodwill and Other Intangible Assets 103.110 104.360 Other Non-Current Assets 6.900 4.200 Total Assets 430.200 362.640 Total Liabilities and Shareholders' Equity Payables 83.240 57.48 Current Debt 2.700 2.64 Total Current Liabilities 85.940 60.120 Long-Term Debt 122.000 119.62 Other Liabilities 21.880 22.58 Total Liabilities 229.820 202.320 Common Stock 200.380 160.32 Total Equity 200.38 160.32 Total Liabilities and Equity 430.200 362.640 INCOME STATEMENT 2021 Total Revenue (M) 488.10…SME Balance Sheet 2021 2020 Assets (in millions) Cash 85.960 56.460 Receivables 89.560 80.670 Inventories 55.750 41.260 Other Current Assets 9.950 6.760 Total Current Assets 241.220 185.150 Net Property, Plant, and Equipment 78.970 68.930 Goodwill and Other Intangible Assets 103.110 104.360 Other Non-Current Assets 6.900 4.200 Total Assets 430.200 362.640 Total Liabilities and Shareholders' Equity Payables 83.240 57.48 Current Debt 2.700 2.64 Total Current Liabilities 85.940 60.120 Long-Term Debt 122.000 119.62 Other Liabilities 21.880 22.58 Total Liabilities 229.820 202.320 Common Stock 200.380 160.32 Total Equity 200.38 160.32 Total Liabilities and Equity 430.200 362.640 INCOME STATEMENT 2021 Total Revenue (M) 488.10…SME Balance Sheet 2021 2020 Assets (in millions) Cash 85.960 56.460 Receivables 89.560 80.670 Inventories 55.750 41.260 Other Current Assets 9.950 6.760 Total Current Assets 241.220 185.150 Net Property, Plant, and Equipment 78.970 68.930 Goodwill and Other Intangible Assets 103.110 104.360 Other Non-Current Assets 6.900 4.200 Total Assets 430.200 362.640 Total Liabilities and Shareholders' Equity Payables 83.240 57.48 Current Debt 2.700 2.64 Total Current Liabilities 85.940 60.120 Long-Term Debt 122.000 119.62 Other Liabilities 21.880 22.58 Total Liabilities 229.820 202.320 Common Stock 200.380 160.32 Total Equity 200.38 160.32 Total Liabilities and Equity 430.200 362.640 INCOME STATEMENT 2021 Total Revenue (M) 488.10…